PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1929001

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1929001

Static Random-Access Memory (SRAM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

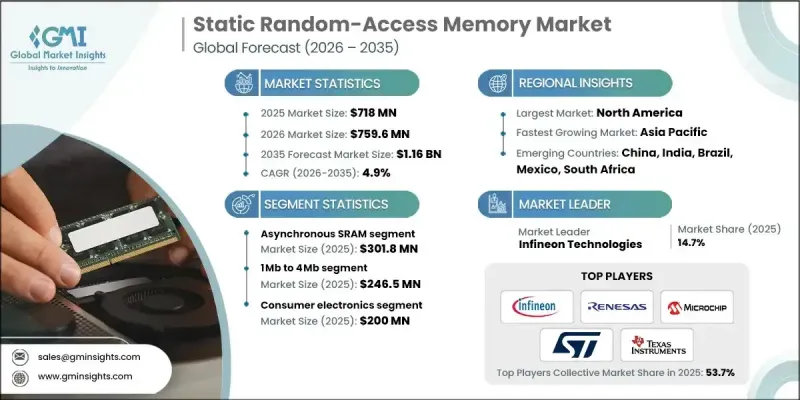

The Global Static Random-Access Memory Market was valued at USD 718 million in 2025 and is estimated to grow at a CAGR of 4.9% to reach USD 1.16 billion by 2035.

Market expansion is driven by rising demand for memory solutions that deliver high speed, minimal latency, and reliable performance across advanced electronic systems. Increasing integration of SRAM in next-generation semiconductor designs and the broadening scope of applications across computing, networking, and automotive electronics are reinforcing long-term growth. Ongoing improvements in semiconductor fabrication technologies are supporting higher density and improved efficiency in SRAM products. Growing investment in data-intensive digital infrastructure is also accelerating adoption, as SRAM plays a critical role in ensuring fast data access and processing. As modern applications continue to generate and process larger volumes of data, the importance of fast and stable on-chip memory is increasing. Static random-access memory is defined as a volatile semiconductor memory that retains stored data as long as power is supplied and enables faster access speeds compared to alternative memory types. These performance advantages are sustaining demand as system designers prioritize speed, reliability, and low power consumption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $718 Million |

| Forecast Value | $1.16 Billion |

| CAGR | 4.9% |

The asynchronous SRAM segment generated USD 301.8 million in 2025. This segment maintains a strong position due to its stable operation, simplified interface design, and compatibility with a wide range of electronic architectures. Its proven reliability and ease of integration continue to support widespread use across multiple system designs.

The above 16Mb SRAM segment is projected to grow at a CAGR of 6.3% and is expected to reach USD 194.7 million by 2035. Growth in this segment is being supported by increasing requirements for higher on-chip memory capacity to enable faster data handling and reduced dependence on external memory components.

North America Static Random-Access Memory (SRAM) Market accounted for 31.2% share in 2025. Regional growth is supported by strong semiconductor manufacturing capabilities, advanced technological infrastructure, and sustained investment in research and development activities focused on memory innovation.

Key companies operating in the Global Static Random-Access Memory Market include Samsung Electronics Co., Ltd., Texas Instruments, Renesas Electronics Corporation, Microchip Technology Inc., Infineon Technologies, NXP Semiconductors, STMicroelectronics NV, Toshiba Corporation, Winbond Electronics Corporation, Alliance Memory, Inc., GSI Technology Inc., ON Semiconductor, Integrated Silicon Solution Inc., and Analog Devices, Inc. Companies in the Static Random-Access Memory (SRAM) Market are strengthening their position through continuous innovation, capacity expansion, and technology optimization. Many players are investing in advanced process nodes to improve speed, reduce power consumption, and increase memory density. Expanding product portfolios to address diverse performance and capacity requirements is a key strategy. Firms are also focusing on long-term supply agreements with system manufacturers to secure consistent demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type Trends

- 2.2.3 Memory Size Trends

- 2.2.4 End Use Industry Trends

- 2.2.5 Regional Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of AI and Machine Learning Applications

- 3.2.1.2 Proliferation of Edge Computing and IoT Devices

- 3.2.1.3 Increasing Demand for High-Performance Cache Memory in Processors

- 3.2.1.4 Advancements in Semiconductor Technology and Node Scaling

- 3.2.1.5 Growth in Automotive and 5G Infrastructure Electronics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Manufacturing Costs and Scaling Limitations

- 3.2.2.2 Volatility in Semiconductor Supply Chain and Raw Material Availability

- 3.2.3 Market opportunities

- 3.2.3.1 Rising Adoption of SRAM in AI Accelerators and High-Performance Computing

- 3.2.3.2 Growing Integration of Embedded SRAM in Advanced SoC Designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging Business Models

- 3.11 Compliance Requirements

- 3.12 Sustainability Measures

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 1.1.1 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Asynchronous SRAM

- 5.3 Synchronous SRAM

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Memory Size, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Up to 1Mb

- 6.3 1Mb to 4Mb

- 6.4 4Mb to 16Mb

- 6.5 Above 16 Mb

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 Consumer electronics

- 7.4 Automotive

- 7.5 Aerospace & defense

- 7.6 Industrial

- 7.7 Healthcare

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alliance Memory, Inc.

- 9.2 Analog Devices, Inc.

- 9.3 GSI Technology Inc.

- 9.4 Infineon Technologies

- 9.5 Integrated Silicon Solution Inc. (ISSI)

- 9.6 Microchip Technology Inc.

- 9.7 NXP Semiconductors

- 9.8 ON Semiconductor

- 9.9 Renesas Electronics Corporation

- 9.10 Samsung Electronics Co., Ltd.

- 9.11 STMicroelectronics NV

- 9.12 Texas Instruments

- 9.13 Toshiba Corporation

- 9.14 Winbond Electronics Corporation