PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699407

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699407

Die-Cast Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

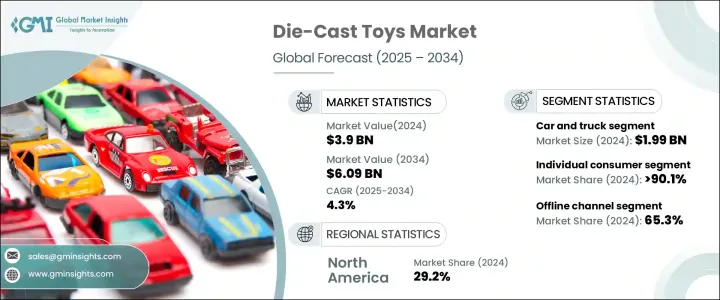

The Global Die-Cast Toys Market was valued at USD 3.9 billion in 2024 and is projected to grow at a CAGR of 4.3% between 2025 and 2034. The market is witnessing strong momentum, fueled by a combination of nostalgia, collector enthusiasm, and increasing interest from younger consumers. Die-cast toys, including model cars, aircraft, and action figures, are seeing a resurgence as collectors and enthusiasts seek high-quality, detailed replicas. Manufacturers are capitalizing on this trend by reintroducing classic models, launching limited-edition releases, and collaborating with entertainment franchises.

The emotional appeal of die-cast toys is one of the primary factors driving market growth. Many adult collectors are drawn to vintage and reissued models that evoke memories of their childhood. This has led to a surge in demand for retro-styled toys and special edition releases. In response, major die-cast toy brands are expanding their portfolios with intricate designs and limited-production runs to cater to both seasoned collectors and new buyers. Additionally, rising disposable incomes and the increasing popularity of themed merchandise from movies, TV shows, and video games have further strengthened the market's position.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.09 Billion |

| CAGR | 4.3% |

The market is primarily segmented by end-users, with individual consumers accounting for a dominant 90.1% share in 2024. These consumers include hobbyists, children, car enthusiasts, and collectors who drive the majority of sales through personal purchases. Collectors remain a crucial force in shaping market trends, with a strong preference for detailed, limited-edition models and vintage designs. Their demand influences new product launches and even dictates the reintroduction of older models, making them a key target audience for manufacturers.

Distribution channels for die-cast toys are divided into online and offline sales, with offline sales leading the segment, holding a 65.3% share in 2024. Physical stores, including toy shops and department stores, continue to be the preferred shopping destinations for many buyers, particularly collectors who value the opportunity to inspect craftsmanship and detailing before making a purchase. In-store displays and strategic product placements in high-traffic areas further boost impulse purchases, particularly among parents and children. While online sales are steadily increasing due to convenience and a wider selection, brick-and-mortar stores remain critical in fostering customer engagement and brand loyalty.

North America accounted for a significant 29.2% share of the Die-Cast Toy Market in 2024, generating USD 1.18 billion. The region has a well-established base of collectors and enthusiasts who actively seek exclusive and high-quality models. Market leaders are continuously innovating by expanding their product lines, forging partnerships with automobile manufacturers, and collaborating with entertainment franchises. These collaborations enhance brand visibility and attract a broader consumer base. As a result, the market continues to evolve, with brands focusing on precision, craftsmanship, and exclusivity to stay ahead in an increasingly competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing popularity of collectibles

- 3.10.1.2 Nostalgia and retro trends

- 3.10.1.3 Brand collaborations and licensing

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Rising cost of raw materials

- 3.10.2.2 Growing preference for digital and interactive toys

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Cars & trucks

- 5.2.1 Sports

- 5.2.2 Super

- 5.2.3 Road

- 5.2.4 Pickup trucks

- 5.2.5 Lorries

- 5.2.6 Other (Vintage, construction trucks etc.)

- 5.3 Motorcycles & bikes

- 5.3.1 Sports bikes

- 5.3.2 Chopper bikes

- 5.3.3 Dirt bikes

- 5.3.4 Cruiser Bikes

- 5.4 Airplanes

- 5.4.1 Commercial jets

- 5.4.2 Military aircraft

- 5.4.3 Helicopters

- 5.5 Trains

- 5.5.1 Locomotives

- 5.5.2 Passenger cars

- 5.5.3 Freight cars

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Metal

- 6.3 Aluminum

- 6.4 Plastic

- 6.5 Rubber

Chapter 7 Market Estimates & Forecast, By Power Source, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Battery power

- 7.3 Wind power

Chapter 8 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Scale, 2021 – 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 1:8-1:18

- 9.3 1:24-1: 1:43

- 9.4 1:43- 1:76

- 9.5 1:87- 3'

Chapter 10 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Individual consumers

- 10.3 Educational institutions

Chapter 11 Market Estimates & Forecast, By Control Method, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Manual

- 11.3 Remote

- 11.4 Interactive

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 Online Retail

- 12.2.1 E-commerce websites

- 12.2.2 Company website

- 12.3 Offline Retail

- 12.3.1 Toy stores

- 12.3.2 Department stores

- 12.3.3 Specialty stores

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.3.7 Nordics

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.4.6 Southeast Asia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 UAE

- 13.6.2 South Africa

- 13.6.3 Saudi Arabia

Chapter 14 Company Profiles

- 14.1 Bburago

- 14.2 Brekina Modelle

- 14.3 Diecast Models Wholesale

- 14.4 Dinky Toys

- 14.5 Greenlight Collectibles

- 14.6 Hasbro, Inc.

- 14.7 Hot Wheels

- 14.8 Jada Toys, Inc.

- 14.9 LEGO Group

- 14.10 Maisto International, Inc.

- 14.11 Matchbox

- 14.12 Mattel, Inc.

- 14.13 Tomica (TOMY Company, Ltd.)

- 14.14 Welly Diecast

- 14.15 Yat Ming