PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698552

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698552

Europe Used Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

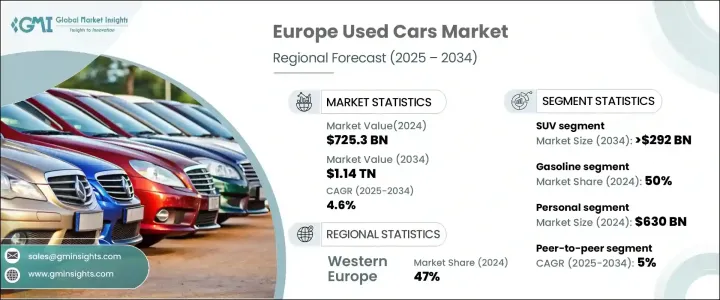

Europe Used Cars Market was valued at USD 725.3 billion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2034. Rising urbanization and increasing living costs have driven individuals and businesses toward cost-effective transportation solutions. Used cars offer affordability and value, making them attractive to budget-conscious consumers, first-time buyers, and small businesses. Expanding access to financing, including flexible loans and leasing options, has further facilitated market growth. The digital transformation of the industry has streamlined transactions, with online platforms providing detailed vehicle histories, pricing assessments, and financing tools, fostering transparency and trust among buyers and sellers.

The shift toward durable automotive manufacturing has enhanced consumer confidence in pre-owned vehicles. Advanced engineering, stringent quality control, and routine maintenance enable vehicles to maintain reliability over extended periods, increasing demand in the secondary market. Inflation, rising raw material costs, stringent emission regulations, and the growing popularity of hybrid and electric powertrains are further propelling the market. The affordability of used cars remains a key factor for price-sensitive consumers, reinforcing their appeal across Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $725.3 Billion |

| Forecast Value | $1.14 Trillion |

| CAGR | 4.6% |

In terms of vehicle type, SUVs accounted for more than 40% of the market in 2024 and are anticipated to surpass USD 292 billion by 2034. Their elevated driving position, spacious interiors, and adaptability to both urban and rural terrains continue to attract consumers. Improved fuel efficiency in modern SUVs, along with the introduction of hybrid and compact crossover models, has reduced previous concerns regarding fuel consumption and environmental impact. Compact SUVs, offering a balance between fuel efficiency and practicality, have gained popularity in European cities due to their maneuverability in tight urban spaces.

Based on end use, the market is segmented into personal and commercial, with the personal segment exceeding USD 630 billion in 2024. Rising living expenses and inflation have encouraged consumers to opt for used vehicles over new ones. Lower financing rates and flexible loan options have made personal vehicle ownership more accessible. While car-sharing and subscription models exist, the majority of consumers still prefer owning their vehicles for the flexibility and long-term financial benefits they offer.

Regarding fuel type, gasoline vehicles dominated the market with a 50% share in 2024. Stricter emission regulations have diminished the demand for diesel cars, particularly with the implementation of Low Emission Zones (LEZs) in urban areas. Gasoline vehicles remain preferable due to their lower maintenance costs and better performance in city driving conditions. Additionally, tax incentives and widespread availability contribute to their continued market dominance.

The market is divided by sales channels into peer-to-peer transactions, franchised dealerships, and independent dealers. Peer-to-peer sales are expected to expand at a CAGR of 5%, driven by the convenience of digital platforms that facilitate direct transactions without intermediaries. This method allows buyers to negotiate better deals while avoiding dealership-related expenses.

Western Europe leads the regional market, holding a 47% share in 2024. Strong domestic production, high vehicle turnover, and a well-established infrastructure for used car sales contribute to the region's dominance. The presence of a structured leasing system ensures a steady influx of well-maintained vehicles into the secondary market, supporting sustained industry growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trend

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising cost of new vehicles

- 3.6.1.2 Growing demand for affordable mobility

- 3.6.1.3 Digitalization and online used car platforms

- 3.6.1.4 Increasing vehicle durability and reliability

- 3.6.1.5 Shift towards electric and hybrid vehicles

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Lack of standardization and quality assurance

- 3.6.2.2 Rising competition from new car sales and leasing models

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hatchback

- 5.3 Sedan

- 5.4 SUV

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Hybrid

- 6.5 Electric

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Peer-to-peer

- 7.3 Franchised dealers

- 7.4 Independent dealers

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Western Europe

- 9.2.1 Germany

- 9.2.2 Austria

- 9.2.3 France

- 9.2.4 Switzerland

- 9.2.5 Belgium

- 9.2.6 Luxembourg

- 9.2.7 Netherlands

- 9.2.8 Portugal

- 9.2.9 Rest of Western Europe

- 9.3 Eastern Europe

- 9.3.1 Poland

- 9.3.2 Romania

- 9.3.3 Czechia

- 9.3.4 Slovenia

- 9.3.5 Hungary

- 9.3.6 Bulgaria

- 9.3.7 Slovakia

- 9.3.8 Croatia

- 9.3.9 Rest of Eastern Europe

- 9.4 Northern Europe

- 9.4.1 UK

- 9.4.2 Denmark

- 9.4.3 Sweden

- 9.4.4 Finland

- 9.4.5 Norway

- 9.4.6 Rest of Northern Europe

- 9.5 Southern Europe

- 9.5.1 Italy

- 9.5.2 Spain

- 9.5.3 Greece

- 9.5.4 Rest of Southern Europe

Chapter 10 Company Profiles

- 10.1 Alphartis Deutschland

- 10.2 AMAG Schweiz

- 10.3 Autotorino Italien

- 10.4 AVAG Holding Deutschland

- 10.5 Avemo Deutschland

- 10.6 Bernard Frankreich

- 10.7 Bertel O. Steen Norwegen

- 10.8 Bilia Schweden

- 10.9 BPM Frankreich

- 10.10 BymyCar Frankreich

- 10.11 Car Avenue Frankreich

- 10.12 Chopard Lallier Frankreich

- 10.13 D’Ieteren Auto Belgien

- 10.14 Eden Auto Frankreich

- 10.15 Emil Frey Schweiz

- 10.16 Fahrzeug-Werke Lueg Deutschland

- 10.17 Feser, Graf & Co. Deutschland

- 10.18 GCA Groupe Frankreich

- 10.19 Gottfried Schultz Deutschland

- 10.20 Gueudet Frankreich