PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699381

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699381

High Frequency High Speed Copper Clad Laminate (CCL) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

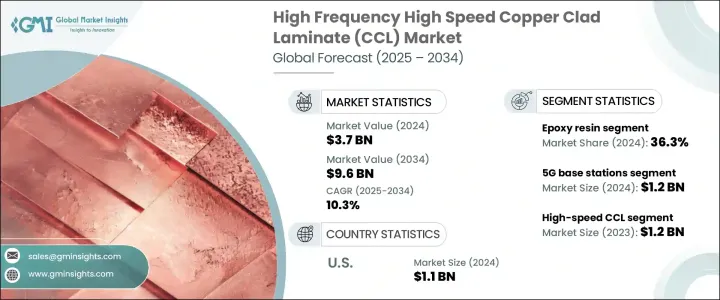

The Global High Frequency High Speed Copper Clad Laminate Market reached USD 3.7 billion in 2024 and is expected to grow at a robust CAGR of 10.3% from 2025 to 2034. This growth is largely fueled by the rapid adoption of 5G technology and the surging demand for advanced electronic devices across various industries. With the increasing need for high-speed data transmission and enhanced connectivity, manufacturers are relying more on high-performance materials such as high-frequency and high-speed CCLs. These laminates play a crucial role in the production of printed circuit boards, which power modern electronic equipment, telecommunications infrastructure, and high-speed computing systems.

The growing integration of artificial intelligence, the Internet of Things (IoT), and autonomous vehicles is further amplifying the demand for efficient and high-speed electronic components. As data processing needs evolve, industries are focusing on next-generation technologies that require robust and reliable circuit materials. Additionally, the shift toward compact, lightweight, and energy-efficient devices is creating opportunities for manufacturers to innovate in material composition, improving the thermal resistance, signal integrity, and overall performance of copper clad laminates. With significant investments in semiconductor advancements and wireless communication networks, the market for high-frequency and high-speed CCLs is poised for substantial expansion in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $9.6 billion |

| CAGR | 10.3% |

The market is primarily categorized into high-frequency CCL and high-speed CCL, with the high-frequency segment projected to dominate, reaching USD 2.5 billion in 2024. The increasing reliance on advanced telecommunications infrastructure and the growing need for uninterrupted, high-speed data flow are driving the demand for high-frequency CCLs. Industries such as telecommunications and consumer electronics are witnessing an unprecedented shift toward faster, more reliable electronic components, further accelerating the adoption of these laminates.

In terms of resin types, the high frequency high-speed copper clad laminate (CCL) market is segmented into phenolic resin, epoxy resin, polyimide resin, and Bismaleimide-Triazine (BT) resin. The epoxy resin segment held a 36.3% market share in 2024, driven by its superior performance characteristics and ability to enhance the structural integrity of PCBs. Ongoing advancements in epoxy resin formulations are improving the durability, thermal stability, and electrical performance of copper clad laminates, making them a preferred choice among PCB manufacturers.

The U.S. high frequency high-speed copper clad laminate (CCL) market is forecasted to reach USD 1.1 billion in 2024, propelled by the rapid deployment of 5G infrastructure, increased electronics adoption, and the expansion of the automotive industry. As the demand for smarter, more efficient electronic devices continues to rise, the need for high-performance materials like high-frequency and high-speed CCLs is set to grow across multiple sectors, reinforcing their critical role in the future of digital transformation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Demand for 5G technology expansion

- 3.6.1.2 Increasing demand for electronic devices

- 3.6.1.3 Surge in consumer electronics demand

- 3.6.1.4 Advancements in aerospace and defense technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of production processes

- 3.6.2.2 Stringent environmental regulations compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 High frequency CCL

- 5.3 High speed CCL

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Epoxy resin

- 6.3 Phenolic resin

- 6.4 Polyimide resin

- 6.5 Bismaleimide-Triazine (BT) resin

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 5G Base stations

- 7.3 Automotive electronics

- 7.4 Consumer electronics

- 7.4.1 Smartphones

- 7.4.2 Tablets

- 7.4.3 Laptops

- 7.5 Telecommunications

- 7.5.1 Routers

- 7.5.2 Switches

- 7.5.3 Antennas

- 7.6 Aerospace and defense

- 7.6.1 Radar systems

- 7.6.2 Communication systems

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGC Inc. (Asahi Glass Co., Ltd.)

- 9.2 Arlon Electronic Materials

- 9.3 Doosan Corporation Electro-Materials

- 9.4 Elite Material Co., Ltd. (EMC)

- 9.5 Grace Electron

- 9.6 Hanwha Advanced Materials

- 9.7 Hitachi Chemical Co., Ltd.

- 9.8 Isola Group

- 9.9 ITEQ Corporation

- 9.10 Kingboard Laminates Holdings Ltd.

- 9.11 Mitsubishi Gas Chemical Company, Inc.

- 9.12 Nan Ya Plastics Corporation

- 9.13 Nelco Products (Park Electrochemical Corp.)

- 9.14 Nippon Mektron, Ltd.

- 9.15 Panasonic Corporation

- 9.16 Rogers Corporation

- 9.17 Shengyi Technology Co., Ltd.

- 9.18 Shinko Electric Industries Co., Ltd.

- 9.19 Sumitomo Bakelite Co., Ltd.

- 9.20 SYTECH

- 9.21 Taiwan Union Technology Corporation (TUC)

- 9.22 TUC (Taiwan Union Technology Corporation)

- 9.23 Ventec International Group

- 9.24 Wazam New Materials

- 9.25 Zhongying Science & Technology