PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871278

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871278

Artificial Intelligence In Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

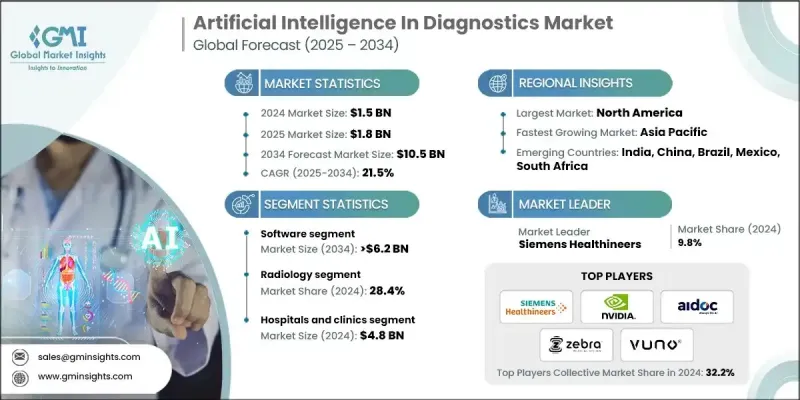

The Global Artificial Intelligence In Diagnostics Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 10.5 billion by 2034.

The market is being propelled by increasing demand for early disease detection, AI integration in medical imaging, precision diagnostics, and regulatory compliance facilitation. AI-powered solutions are enabling healthcare providers, payers, life sciences organizations, and health technology companies to improve patient outcomes, optimize operations, and meet compliance standards. Key solutions include AI-based imaging and diagnostic software, digital pathology platforms, and predictive analytics tools that automate disease identification, assist in accurate treatment planning, and enhance care quality. Advancements in cloud-based AI applications, digital pathology, and predictive modeling are broadening the use of AI across radiology, cardiology, oncology, and pathology. Market adoption is further supported by regulatory approvals and frameworks that encourage the integration of AI into clinical workflows. Increasing research investments and strategic partnerships among healthcare institutions, technology providers, and life sciences firms are driving innovation and accelerating adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $10.5 Billion |

| CAGR | 21.5% |

The diagnostic laboratories segment generated USD 356.1 million in 2024 and is expected to grow at a CAGR of 22.3% through 2034. Laboratories are major users of AI technologies due to their critical role in screening, analyzing, and reporting medical results across a variety of clinical applications. Rising workflow complexity, growing sample volumes, and the need for high-throughput testing are driving the demand for AI-driven automation and decision support systems.

The radiology segment held a 28.4% share in 2024 and is projected to reach USD 3 billion by 2034. Radiology leads the Artificial Intelligence in the diagnostics market because of the urgent need for rapid and precise imaging analysis to detect diseases at early stages. The increasing prevalence of chronic and acute conditions has raised the demand for medical imaging tests. AI-based radiology solutions automate image interpretation, minimize human error, and deliver faster results, enabling timely treatment decisions.

North America Artificial Intelligence In Diagnostics Market held a 40.7% share in 2024. The region's leadership is attributed to advanced healthcare infrastructure, widespread adoption of digital technologies, and significant research and development investments. AI-driven medical imaging, predictive analytics, and digital pathology platforms are widely available across hospitals, clinics, and laboratories. Additionally, the growing prevalence of chronic conditions, including cardiovascular diseases, cancer, and neurological disorders, is driving demand for early and precise diagnostics in the region.

Key players operating in the Global Artificial Intelligence In Diagnostics Market include Aidoc, AliveCor, Digital Diagnostics, Enlitic, HeartFlow, Imagen, NVIDIA, PathAI, Qure.ai, Riverain Technologies, Siemens Healthineers, Sophia Genetics, Tempus, Ultromics, Viz.ai, Vuno, and Zebra Medical Vision. To strengthen their position, companies in the Artificial Intelligence In Diagnostics Market are implementing a variety of strategies. These include expanding research and development capabilities to innovate new AI algorithms and improve predictive accuracy, forming strategic partnerships with healthcare providers, laboratories, and technology firms, and acquiring smaller companies to enhance technological portfolios. Many organizations are focusing on regulatory compliance and obtaining approvals to accelerate market entry. Companies are also prioritizing cloud-based and software-as-a-service solutions to reach broader markets while offering scalable, user-friendly platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Increasing demand for AI tools

- 3.2.1.3 Technological advancements

- 3.2.1.4 Favourable government initiatives and funding

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procurement and maintenance costs

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging economies

- 3.2.3.2 Integration with telemedicine and remote diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 AI-powered radiology and pathology imaging software

- 3.5.1.2 Machine learning algorithms for rapid anomaly detection

- 3.5.1.3 Digital pathology platforms integrated with hospital workflows

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-driven multi-modal imaging for integrated diagnostics

- 3.5.2.2 Deep learning algorithms for early cancer and chronic disease detection

- 3.5.2.3 Cloud-based AI platforms for scalable diagnostics solutions

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of AI diagnostics in emerging markets

- 3.9.2 Integration with telemedicine and remote patient monitoring

- 3.9.3 Adoption of precision and personalized medicine using AI insights

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

- 5.4 Hardware

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Radiology

- 6.3 Oncology

- 6.4 Cardiology

- 6.5 Neurology

- 6.6 Pathology

- 6.7 Infectious diseases

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals & clinics

- 7.3 Diagnostic laboratories

- 7.4 Imaging centers

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aidoc

- 9.2 AliveCor

- 9.3 Digital Diagnostics

- 9.4 Enlitic

- 9.5 HeartFlow

- 9.6 Imagen

- 9.7 NVIDIA

- 9.8 PathAI

- 9.9 Qure.ai

- 9.10 Riverain Technologies

- 9.11 Siemens Healthineers

- 9.12 Sophia Genetics

- 9.13 Tempus

- 9.14 Ultromics

- 9.15 Viz.ai

- 9.16 Vuno

- 9.17 Zebra Medical Vision