PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871292

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871292

Electric Vehicle Communication Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

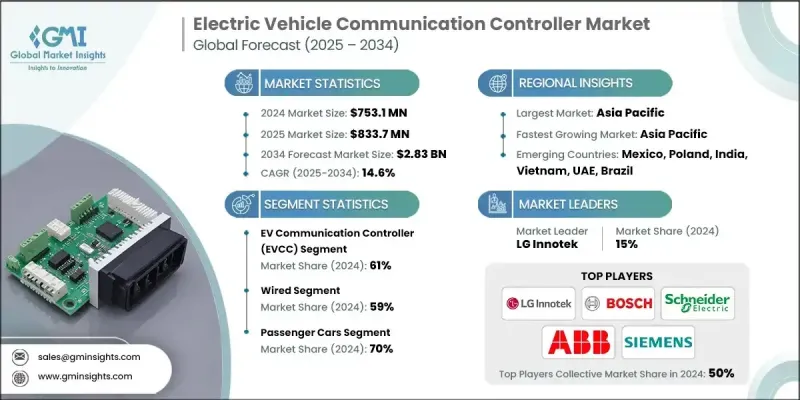

The Global Electric Vehicle Communication Controller Market was valued at USD 753.1 million in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 2.83 billion by 2034.

The expansion of electric mobility worldwide, combined with advances in charging infrastructure, communication protocols, and smart grid integration, is driving the demand for EVCCs. These systems are essential for enabling secure, efficient, and intelligent communication between electric vehicles and charging stations. By ensuring compatibility across EVs, chargers, and backend systems, EVCCs are central to the development of a connected and energy-optimized transportation network. The global transition toward carbon neutrality and the growing deployment of public and private EV charging networks are further accelerating adoption. With the standardization of communication frameworks such as ISO 15118, OCPP, and CHAdeMO, bidirectional energy transfer and smart charging capabilities are becoming mainstream. These technologies improve grid reliability, support dynamic energy management, and create new economic opportunities for EV owners, utilities, and charging operators.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $753.1 Million |

| Forecast Value | $2.83 Billion |

| CAGR | 14.6% |

The EV communication controller segment held a 61% share in 2024, reflecting the growing need for advanced networking devices like switches, routers, and gateways. These systems are vital in enabling vehicle-to-grid operations, allowing electricity to flow both ways between vehicles and power systems. This bidirectional communication enhances energy efficiency, supports grid balancing, and facilitates intelligent load management across residential, commercial, and fleet applications. By improving operational control and optimizing electricity use, these controllers are becoming a cornerstone of the smart transportation ecosystem.

The wired communication segment held a 59% share in 2024, driven by its superior reliability, low latency, and secure data transfer capabilities. Automotive Ethernet is increasingly being adopted in EVs to manage high-capacity data transmission between critical vehicle systems. The availability of greater bandwidth supports real-time diagnostics, precise charging management, and efficient use of vehicle-to-everything (V2X) communication technologies. As a result, wired EVCCs continue to gain prominence as automakers integrate advanced data communication solutions into their electric vehicle architectures.

United States Electric Vehicle Communication Controller Market reached USD 157.8 million in 2024. The U.S. leads the North American market due to strong government incentives, early adoption of electric power technologies, and substantial investment in EV charging networks. The presence of major automotive manufacturers investing in next-generation charging communication systems has reinforced the country's dominant position. These developments are paving the way for improved interoperability and reliability across the national EV infrastructure.

Key players active in the Global Electric Vehicle Communication Controller Market include Schneider Electric, ABB, BYD, Mitsubishi Electric, Vector Informatik, Robert Bosch, Tesla, Ficosa Internacional, LG Innotek, and Efacec Power Solutions. Companies in the Electric Vehicle Communication Controller Market are implementing strategies focused on innovation, standardization, and global expansion. Major players are heavily investing in R&D to enhance interoperability, cybersecurity, and real-time communication performance of EVCCs. Collaborations with automotive OEMs, energy providers, and charging infrastructure developers are key to strengthening integration across the EV ecosystem. Firms are also aligning their solutions with international standards like ISO 15118 and OCPP to ensure compatibility across global markets. Mergers and partnerships are being leveraged to scale production, reduce costs, and expand technology portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Charging

- 2.2.4 Vehicle

- 2.2.5 Current

- 2.2.6 End use

- 2.2.7 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption and expansion of charging infrastructure

- 3.2.1.2 Integration of standardized communication protocols and V2G capabilities

- 3.2.1.3 Technological advancements in intelligent and secure EVCC solutions

- 3.2.1.4 Government policies and regional investments driving e-mobility ecosystems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of advanced EVCC integration

- 3.2.2.2 Cybersecurity and data privacy risks

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of vehicle-to-grid (V2G) and smart charging ecosystems

- 3.2.3.2 Growth of fast and ultra-fast charging networks

- 3.2.3.3 Integration with smart cities and IoT infrastructure

- 3.2.3.4 Software-defined and cloud-based EVCC solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 Cybersecurity regulations (ISO/SAE 21434)

- 3.4.1.2 V2X deployment policies across regions

- 3.4.1.3 Charging infrastructure standards (ISO 15118)

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Migration from CAN to automotive Ethernet for high-speed data transfer

- 3.7.1.2 V2X communication technology roadmap enabling vehicle-to-vehicle and vehicle-to-infrastructure connectivity

- 3.7.2 Emerging technologies

- 3.7.2.1 Wireless charging communication protocols development

- 3.7.2.2 Edge computing integration trends for real-time analytics and control

- 3.7.3 Technology adoption lifecycle analysis

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 Controller unit economics

- 3.8.2 Integration and certification costs

- 3.8.3 Total cost of ownership analysis

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 Venture capital and private equity activity in EVCC solutions

- 3.13.2 Government funding and incentives for EV adoption

- 3.13.3 Corporate R&D investment trends in EV communication technologies

- 3.14 Market maturity & penetration analysis

- 3.15 Customer behavior & decision-making analysis

- 3.16 Distribution channel & go-to-market analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

- 4.8 Competitive response strategies

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 EV communication controller (EVCC)

- 5.3 Supply equipment communication controller (SECC)

Chapter 6 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 BEV

- 7.2.2 PHEV

- 7.2.3 FCEV

- 7.3 Commercial vehicles

- 7.3.1 BEV

- 7.3.2 PHEV

- 7.3.3 FCEV

Chapter 8 Market Estimates & Forecast, By Current, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Alternating current (AC)

- 8.3 Direct current (DC)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Electric vehicle manufacturers (OEM)

- 9.3 Charging station operators

- 9.4 Utility providers

- 9.5 Fleet operators

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Residential charging

- 10.3 Commercial charging

- 10.4 Public charging

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.3.8 Poland

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Vietnam

- 11.4.7 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 ABB

- 12.1.2 Analog Devices

- 12.1.3 Infineon Technologies

- 12.1.4 LG Innotek

- 12.1.5 Mitsubishi Electric

- 12.1.6 NXP Semiconductors

- 12.1.7 Qualcomm Technologies

- 12.1.8 Schneider Electric

- 12.1.9 STMicroelectronics

- 12.1.10 Tesla

- 12.1.11 Texas Instruments

- 12.2 Regional companies

- 12.2.1 Aptiv

- 12.2.2 BYD

- 12.2.3 Continental

- 12.2.4 Denso

- 12.2.5 Ficosa Internacional

- 12.2.6 Hyundai Mobis

- 12.2.7 Magna International

- 12.2.8 Robert Bosch

- 12.2.9 Valeo

- 12.2.10 ZF Friedrichshafen

- 12.3 Emerging players

- 12.3.1 Cohda Wireless

- 12.3.2 Elektrobit Automotive

- 12.3.3 Efacec Power Solutions (or Efacec)

- 12.3.4 Vector Informatik