PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666528

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666528

Automated Labeling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

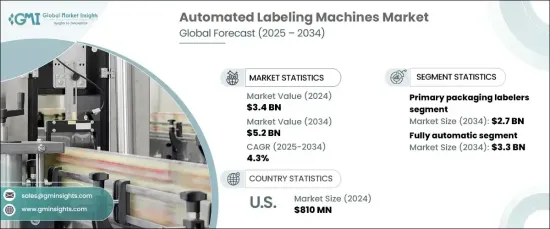

The Global Automated Labeling Machines Market, valued at USD 3.4 billion in 2024, is projected to grow at a steady CAGR of 4.3% between 2025 and 2034. The demand for efficient, high-speed, and precise labeling solutions across industries is propelling the market forward. These machines are widely used in sectors such as pharmaceuticals, food and beverages, cosmetics, and consumer goods, where accuracy and consistency are vital. The growth of e-commerce and the need for optimized production lines are further boosting the adoption of automated labeling systems.

Technological advancements, including robotics, AI, and machine vision, have significantly improved the functionality of these machines. These innovations enable machines to handle diverse label types and packaging formats with enhanced speed and precision, making them ideal for environments requiring high throughput. Additionally, the push for sustainability is influencing manufacturers to develop eco-friendly labeling options, such as biodegradable and recyclable materials, which is reshaping the market. As businesses aim to boost operational efficiency, cut labor costs, and meet strict regulations, the demand for automated labeling machines continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 4.3% |

The market is categorized into primary, secondary, and tertiary packaging labelers. Primary packaging labelers, responsible for labeling product containers like bottles or boxes, dominate the market. Secondary packaging labelers handle outer packaging like cartons and bundles, while tertiary labelers focus on larger units like pallets. Each type plays a crucial role in improving productivity, reducing human error, and ensuring regulatory compliance across the supply chain.

The market also distinguishes between semi-automatic and fully automatic machines. Fully automatic labeling machines hold the largest share, offering high-speed, precision labeling with minimal operator involvement. These machines are favored in large-scale production environments that demand consistent and rapid labeling. In contrast, semi-automatic systems cater to smaller operations, requiring some manual input but still offering significant efficiency improvements over traditional methods.

In North America, the U.S. stands as the leading market for automated labeling machines, valued at USD 810 million in 2024. The country's robust manufacturing infrastructure, widespread use of automation technologies, and stringent regulatory standards are key factors driving this market. Technological innovations, such as AI integration and machine vision, are transforming labeling processes, thus enhancing quality control and maintenance. Furthermore, the demand for sustainable, eco-friendly labeling solutions is pushing the industry toward greener alternatives. As these trends continue, the U.S. market for automated labeling machines is set to maintain steady growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for efficient, high-speed, and accurate labeling solutions across industries

- 3.6.1.2 Growing trend of automation in manufacturing and packaging operations

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost associated with the automated labeling machines

- 3.6.2.2 Interoperability issues associated with the automated labeling machines

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Automated Labeling Machines Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary packaging labelers

- 5.3 Secondary packaging labelers

- 5.4 Tertiary packaging labelers

Chapter 6 Automated Labeling Machines Market Estimates & Forecast, By Labeling Method, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Self-adhesive/pressure-sensitive labeling

- 6.3 Sleeve labeling

- 6.4 Glue-based

- 6.5 Others

Chapter 7 Automated Labeling Machines Market Estimates & Forecast, By Machine Type 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-automatic

- 7.3 Fully automatic

Chapter 8 Automated Labeling Machines Market Estimates & Forecast, By Capacity 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 200 products/min

- 8.3 200 to 500 products/min

- 8.4 500 to 1000 products/min

- 8.5 Above 1000 products/min

Chapter 9 Automated Labeling Machines Market Estimates & Forecast, By Labeling Type 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Top labeling

- 9.3 Bottom labeling

- 9.4 Top & bottom labeling

Chapter 10 Automated Labeling Machines Market Estimates & Forecast, By End Use Industry 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Chemicals

- 10.3 Consumer goods

- 10.4 Electronics

- 10.5 Food & beverages

- 10.6 Pharmaceutical

- 10.7 Consumer goods

- 10.8 Others (logistics and shipping etc.)

Chapter 11 Automated Labeling Machines Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Automated Labeling Machines Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 United States

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Unites kingdom

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 Middle East & Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 United Arab Emirates

Chapter 13 Company Profiles

- 13.1 Accutek

- 13.2 B + B Automations

- 13.3 BellatRx

- 13.4 Brady

- 13.5 CTM Labeling Systems

- 13.6 FoxJet

- 13.7 Herma

- 13.8 KHS

- 13.9 Krones

- 13.10 Marchesini Group

- 13.11 P.E. Labellers

- 13.12 ProMach

- 13.13 Sacmi Imola

- 13.14 SaintyCo

- 13.15 Sidel Group