PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892833

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892833

Light Duty Truck Steering System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

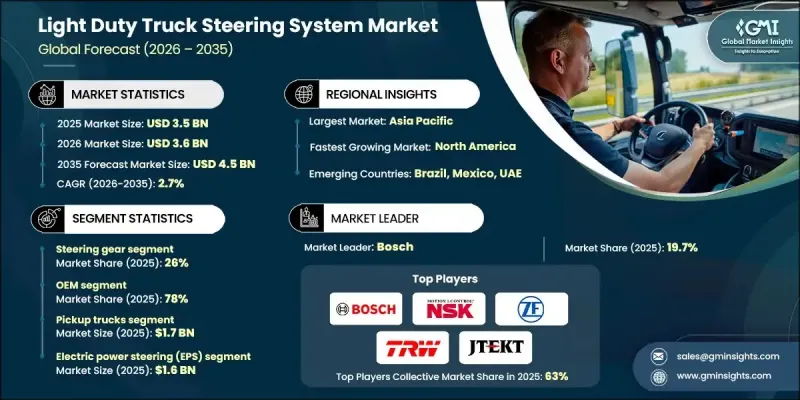

The Global Light Duty Truck Steering System Market was valued at USD 3.5 billion in 2025 and is estimated to grow at a CAGR of 2.7% to reach USD 4.5 billion by 2035.

The market expansion is fueled by increasing demand for advanced, safer, and more efficient steering technologies, alongside the rising adoption of electric and hybrid light-duty trucks and the growth of commercial and logistics operations. Fleet operators and individual buyers are prioritizing driver comfort, vehicle maneuverability, and safety, making modern steering systems essential for reliable handling across diverse road conditions and operational settings. Innovations such as electric power steering (EPS), hydraulic-assisted systems, adaptive steering modules, and lightweight, high-strength components are transforming the functionality of these trucks. High-quality materials, including aluminum alloys, high-strength steel, and corrosion-resistant coatings, ensure durable, long-lasting steering solutions. Expanding urban logistics, last-mile delivery services, ride-sharing fleets, and demand for trucks with enhanced handling and safety features are accelerating market adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.5 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 2.7% |

The steering gear segment held a 26% share in 2025 and is expected to grow at a CAGR of 2.2% from 2026 to 2035. Steering gears are critical for precise vehicle control, stability, and maneuverability across pickups, vans, and light commercial trucks. They offer robustness, compatibility with hydraulic, electric, and electro-hydraulic architectures, and reliability under heavy-duty and variable load conditions, making them a preferred choice for OEMs and fleet operators.

The OEM segment held 78% share in 2025 and is forecasted to grow at a CAGR of 2.3% through 2035. OEM channels integrate steering systems into new trucks, ensuring the use of certified, high-quality components that meet safety and performance standards. These systems offer seamless vehicle compatibility, enhanced driver comfort, durability, and precision. OEM installations are favored for their reliability and alignment with advanced technologies such as EPS, ADAS, and vehicle telematics.

China Light Duty Truck Steering System Market held a 33% share, generating USD 443.5 million in 2025. Growth is driven by strong production of pickups and light commercial vehicles, investments in advanced automotive technologies, and the adoption of EPS, steer-by-wire, and ADAS-integrated steering solutions. Government support for new energy vehicles and stricter safety regulations are further boosting the use of modern steering systems.

Key players operating in the Light Duty Truck Steering System Market include JTEKT, NSK, Thyssenkrupp, ZF Friedrichshafen, Bosch, Hyundai Mobis, Delphi Technologies, TRW Automotive, Denso, and KYB. Companies are focusing on technological innovation to enhance steering system performance, reliability, and fuel efficiency while integrating advanced features like EPS, ADAS, and steer-by-wire capabilities. Strategic partnerships with OEMs and logistics fleet operators enable the adoption of cutting-edge steering solutions in new vehicles and retrofit applications. Firms are investing in lightweight, durable materials to reduce vehicle weight and improve fuel economy. Expanding regional production and supply chain networks ensures timely delivery and cost optimization. Research and development efforts target improved system precision, longevity, and compatibility with hybrid and electric trucks. Companies are also leveraging digital platforms for predictive maintenance, diagnostics, and telematics integration, strengthening their market presence and building long-term relationships with customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced steering technologies

- 3.2.1.2 Growth of light-duty truck fleets

- 3.2.1.3 Focus on driver comfort and safety

- 3.2.1.4 Technological integration and material innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system costs

- 3.2.2.2 Complex maintenance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric and hybrid light-duty trucks

- 3.2.3.2 Aftermarket and retrofit solutions

- 3.2.3.3 ADAS & autonomous vehicle integration

- 3.2.3.4 Lightweight & energy-efficient systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Investment & Funding Analysis

- 3.13.1 OEM R&D investment trends

- 3.13.2 Supplier capex allocation

- 3.13.3 Technology startup funding landscape

- 3.14 Best case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Steering gear

- 5.3 Steering column

- 5.4 Sensors & controllers

- 5.5 Steering pumps

- 5.6 Tie rods

- 5.7 Steering wheel

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Pickup trucks

- 6.3 SUVs & crossovers

- 6.4 Light commercial vehicles (LCV)

- 6.5 Vans

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Electric power steering (EPS)

- 7.3 Hydraulic power steering (HPS)

- 7.4 Electro-hydraulic power steering (EHPS)

- 7.5 Steer-by-wire

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($ Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Bosch

- 10.1.2 Denso

- 10.1.3 Hyundai Mobis

- 10.1.4 JTEKT

- 10.1.5 Magna International

- 10.1.6 Nexteer Automotive

- 10.1.7 NSK

- 10.1.8 Thyssenkrupp

- 10.1.9 TRW Automotive

- 10.1.10 ZF Friedrichshafen

- 10.2 Regional Player

- 10.2.1 Aisin Seiki

- 10.2.2 Calsonic Kansei

- 10.2.3 Hitachi Astemo

- 10.2.4 JMC Steering

- 10.2.5 Kongsberg Automotive

- 10.2.6 Mando

- 10.2.7 Mevotech

- 10.2.8 Mubea

- 10.2.9 Schaeffler

- 10.2.10 KYB

- 10.3 Emerging Players

- 10.3.1 Auto Steering Technologies

- 10.3.2 Eberspacher Steering Solutions

- 10.3.3 Neapco

- 10.3.4 Protean Electric

- 10.3.5 Servotronic Systems