PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871280

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871280

Automotive TIC Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

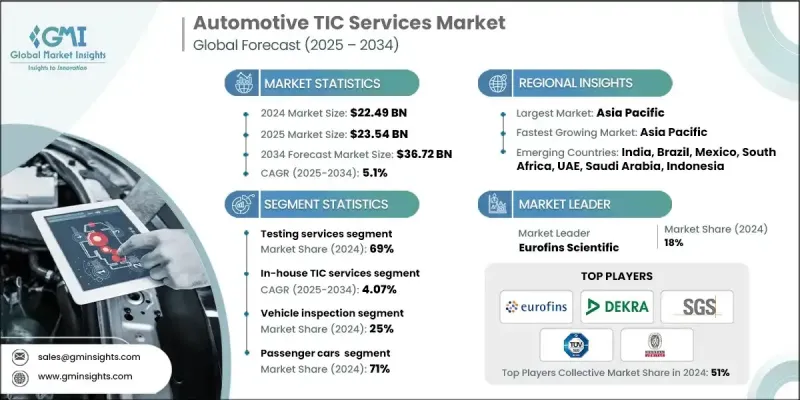

The Global Automotive TIC Services Market was valued at USD 22.49 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 36.72 billion by 2034.

The automotive TIC sector has become a fundamental part of the evolving mobility landscape, ensuring that modern vehicles equipped with electric powertrains, digital systems, and connected technologies meet rigorous safety, performance, and environmental standards. These services validate that every component and process complies with international and regional regulations, supporting the automotive industry's transition toward sustainable and intelligent mobility. The demand for TIC services continues to rise as electric and hybrid vehicles expand globally, requiring more sophisticated validation for battery systems, emissions-free propulsion, and connected software platforms. In addition, the implementation of stringent regulations by governments across major economies is driving the need for independent verification and certification to ensure compliance with carbon neutrality goals and safety mandates. The introduction of new global standards for electric and autonomous vehicles has also intensified testing requirements, fueling steady growth for TIC providers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.49 Billion |

| Forecast Value | $36.72 Billion |

| CAGR | 5.1% |

The testing services segment held a 69% share in 2024 and is projected to grow at a 4.53% CAGR through 2034. The segment's dominance is attributed to evolving regulatory standards and technological complexity that demand continuous validation of vehicle performance and safety. Testing remains the cornerstone of automotive compliance as it assesses durability, emissions, safety mechanisms, and overall functionality before vehicles reach consumers. The rising need for precision and reliability across diverse regional markets continues to propel the testing services segment forward.

The in-house segment held a 59% share in 2024 and is estimated to register a 4.07% CAGR from 2025 to 2034. Companies favor in-house TIC operations to maintain full control over quality assurance, data security, and integration with internal production systems. Large automotive OEMs with dedicated testing infrastructure rely on in-house validation to meet strict regulatory requirements and ensure consistent manufacturing standards. This approach enables faster certification timelines and deeper process optimization, which has strengthened the dominance of this segment in the global market.

Asia Pacific Automotive TIC Services Market held a 38% share and generated USD 8.53 billion in 2024. The region's leadership is due to its vast automotive production capacity, regulatory evolution, and technological progress. Countries across APAC are expanding their vehicle testing frameworks to meet higher safety and emissions standards. The region's continuous industrialization and investment in electric and connected vehicle testing facilities are also propelling market growth.

Prominent players in the Automotive TIC Services Market include TUV Rheinland, Eurofins Scientific, DEKRA, BSI, Bureau Veritas, Intertek, SGS, TUV SUD, and DNV GL. Leading companies in the Automotive TIC Services Market are focusing on strategic expansion, digital transformation, and partnerships to strengthen their market position. Many firms are investing in automated and AI-driven testing solutions to improve efficiency, reduce testing times, and enhance accuracy. Collaborations with automotive OEMs and government bodies help providers align with emerging regulatory frameworks and develop advanced testing capabilities for electric and autonomous vehicles. Companies are also expanding geographically through mergers, acquisitions, and joint ventures to access new markets and diversify service portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Sourcing

- 2.2.4 Application

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent regulatory compliance

- 3.2.1.2 Globalization of the automotive industry

- 3.2.1.3 Rising demand for vehicle performance testing

- 3.2.1.4 Consumer demand for quality assurance

- 3.2.1.5 Technological advancements in automotive systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced TIC equipment

- 3.2.2.2 Complex regulatory environment

- 3.2.3 Market opportunities

- 3.2.3.1 Growth opportunities in emerging markets

- 3.2.3.2 Development of electric and autonomous vehicles

- 3.2.3.3 Expansion of commercial vehicle TIC services

- 3.2.3.4 Outsourcing of TIC services by OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.2 Europe

- 3.9.3 Asia Pacific

- 3.9.4 Latin America

- 3.9.5 Middle East and Africa

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By service

- 3.11 Sustainability & environmental compliance

- 3.11.1 Carbon footprint and emissions testing

- 3.11.2 Lifecycle assessment (LCA) services

- 3.11.3 Circular economy and recyclability testing

- 3.11.4 Environmental sustainability certifications

- 3.11.5 Green vehicle compliance standards

- 3.12 Cost optimization & ROI analysis

- 3.12.1 TIC service investment return analysis

- 3.12.2 Cost-benefit assessment framework

- 3.12.3 Total cost of ownership models

- 3.13 Capacity utilization & resource optimization

- 3.13.1 Laboratory capacity analysis

- 3.13.2 Equipment utilization rates

- 3.13.3 Workforce productivity metrics

- 3.14 Outsourcing vs in-house decision analysis

- 3.14.1 Make vs buy decision framework

- 3.14.2 Core competency assessment

- 3.14.3 Risk-benefit analysis

- 3.15 Service level agreement benchmarking

- 3.15.1 SLA performance standards

- 3.15.2 Quality metrics & KPIs

- 3.15.3 Penalty & incentive structures

- 3.16 Cybersecurity in automotive testing

- 3.16.1 Software security testing and validation

- 3.16.2 Vulnerability assessment and penetration testing

- 3.16.3 ISO/SAE 21434 compliance and standards

- 3.16.4 Connected and autonomous vehicle cybersecurity

- 3.17 Speed to market & agile testing

- 3.17.1 Accelerated testing protocols

- 3.17.2 Parallel testing methodologies

- 3.17.3 Rapid certification pathways

- 3.17.4 Compressed development cycle strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New sourcing launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Testing services

- 5.3 Inspection services

- 5.4 Certification services

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Sourcing, 2021 - 2034 (USD Bn)

- 6.1 Key trends

- 6.2 In-house

- 6.3 Outsourced

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Vehicle inspection

- 7.3 Emission testing

- 7.4 Component testing

- 7.5 Telematics

- 7.6 ADAS

- 7.7 Homologation testing

- 7.8 Fuels, fluids and lubricants

- 7.9 Electric systems and components

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 BSI

- 10.1.2 Bureau Veritas

- 10.1.3 DEKRA

- 10.1.4 DNV GL

- 10.1.5 Eurofins Scientific

- 10.1.6 Intertek

- 10.1.7 Kiwa

- 10.1.8 RINA

- 10.1.9 SGS

- 10.1.10 TUV Rheinland

- 10.1.11 TUV SUD

- 10.1.12 UL Solutions

- 10.2 Regional Players

- 10.2.1 ALS

- 10.2.2 Applus+ Services

- 10.2.3 MISTRAS

- 10.2.4 NSF International

- 10.2.5 SOCOTEC

- 10.2.6 The Smithers

- 10.2.7 TUV NORD

- 10.2.8 UTAC CERAM

- 10.3 Emerging Players / Disruptors

- 10.3.1 AVL

- 10.3.2 Element Materials Technology

- 10.3.3 ESCRYPT

- 10.3.4 ETAS

- 10.3.5 Keysight Technologies