PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913355

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913355

Arc Welding Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

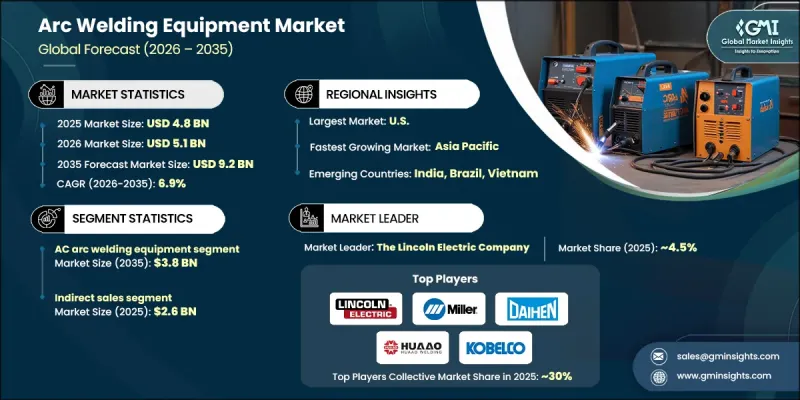

The Global Arc Welding Equipment Market was valued at USD 4.8 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 9.2 billion by 2035.

Regulatory frameworks governing workplace safety and equipment design strongly shape demand across industries that rely on arc welding operations. Strict requirements related to voltage thresholds, electrical insulation, grounding protocols, and airflow standards have increased the adoption of compliant welding systems and supporting safety solutions. Growing recognition of welding-related health risks has further intensified the need for proper ventilation, exhaust management, and respiratory protection. Occupational safety regulations mandate protective equipment with resistance to heat, fire, and electrical exposure, while also specifying performance standards for visibility and facial protection. These rules collectively influence equipment engineering, facility upgrades, and purchasing decisions. As manufacturers and end users prioritize compliance, operational safety, and workforce protection, demand for advanced arc welding equipment continues to rise. The market's growth reflects sustained investment in safer, regulation-aligned technologies that support productivity while reducing long-term occupational risk.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.8 Billion |

| Forecast Value | $9.2 Billion |

| CAGR | 6.9% |

In 2025, the AC arc welding equipment accounted for a 40.3% share and is expected to grow at a CAGR of 7% through 2035. This segment benefits from cost competitiveness and operational characteristics that support stable performance under varying electrical conditions. Regulatory limits on open-circuit voltage levels directly influence product design, prompting manufacturers to align equipment development with established safety thresholds for both manual and automatic applications.

The indirect sales channel generated USD 2.6 billion in 2025, representing a 55% share. This route supports the broad distribution of standardized products, replacement components, and consumables while extending reach into regions and customer groups not served directly by manufacturers. Indirect channels offer scalability, flexibility, and cost efficiency, particularly in secondary markets and smaller operational settings.

North America Arc Welding Equipment Market held a 38.2% share in 2025 and is forecast to grow at a CAGR of 7.1% through 2035. Strong manufacturing capacity, strict enforcement of safety standards, and consistent equipment upgrades support regional dominance. Regulatory mandates establish detailed technical requirements that directly influence purchasing behavior and equipment replacement cycles.

Key companies active in the Global Arc Welding Equipment Market include The Lincoln Electric Company, ESAB, Fronius International, Panasonic Welding Systems, Illinois Tool Works, Miller Electric Mfg., OTC Daihen, Daihen, Denyo, Ador Welding, CLOOS Welding Equipment, Amada Miyachi America, Kobe Steel, Jinan Huaao Electric Welding Machine, and Arcon Welding Equipment. Companies in the Global Arc Welding Equipment Market strengthen their competitive position through continuous product innovation, regulatory compliance, and expansion of distribution networks. Manufacturers invest in safety-focused engineering, energy efficiency, and digital monitoring capabilities to meet evolving industry standards. Strategic partnerships with distributors enhance market reach, while localized manufacturing improves supply reliability. After-sales service, training support, and consumables integration help build long-term customer relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Welding technology trends

- 2.2.3 Power source trends

- 2.2.4 End use industry trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety regulations

- 3.2.1.2 Sustained steel production and infrastructure build-out

- 3.2.1.3 Health risk awareness encouraging safer technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and integration costs

- 3.2.2.2 Technical skills shortage and compliance burden

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of renewable energy and green infrastructure projects

- 3.2.3.2 Development of AI-driven and IoT enabled welding solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Price trend analysis

- 3.5.1 Region and welding technology

- 3.6 Technology and innovation landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Regulatory framework

- 3.7.1 By region

- 3.7.1.1 North America

- 3.7.1.2 Europe

- 3.7.1.3 Asia Pacific

- 3.7.1.4 Latin America

- 3.7.1.5 Middle East and Africa

- 3.7.1 By region

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Welding Technology 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shielded metal arc welding (SMAW)

- 5.3 Gas metal arc welding (GMAW/MIG)

- 5.4 Flux-cored arc welding (FCAW)

- 5.5 Gas tungsten arc welding (GTAW)

- 5.6 Submerged arc welding (SAW)

- 5.7 Others (plasma arc welding (PAW), etc.)

Chapter 6 Market Estimates & Forecast, By Power Source, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 AC arc welding equipment

- 6.3 DC arc welding equipment

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automotive & transportation

- 7.3 Heavy industry & fabrication

- 7.4 Construction & infrastructure

- 7.5 Shipbuilding & marine

- 7.6 Aerospace & defense

- 7.7 Energy and power

- 7.8 Oil and gas

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Ador Welding

- 10.2 Amada Miyachi America

- 10.3 Arcon Welding Equipment

- 10.4 CLOOS Welding Equipment

- 10.5 Daihen

- 10.6 Denyo

- 10.7 ESAB

- 10.8 Fronius International

- 10.9 Illinois Tool Works (ITW Welding)

- 10.10 Jinan Huaao Electric Welding Machine

- 10.11 Kobe Steel (Kobelco)

- 10.12 Miller Electric Mfg. (part of ITW Welding)

- 10.13 OTC Daihen

- 10.14 Panasonic Welding Systems

- 10.15 The Lincoln Electric Company