PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716452

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716452

Bending Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

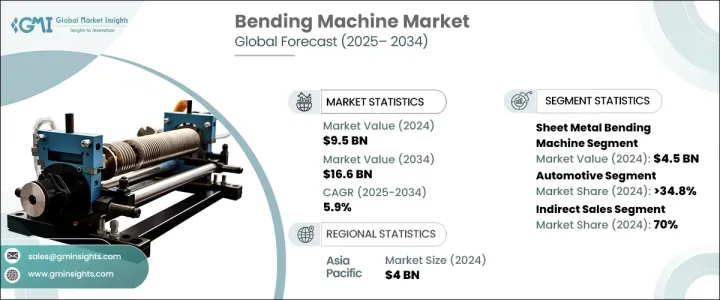

The Global Bending Machine Market was valued at USD 9.5 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2034. Bending machines play an integral role across multiple industries, including manufacturing, construction, automotive, and aerospace. These machines are used to shape sheet metal, pipes, tubes, and profiles, making them indispensable in producing complex components and structures. As global industrialization accelerates, the demand for bending machines is increasing, especially in emerging economies where infrastructure and construction projects are expanding rapidly. The rising adoption of automation and precision engineering in various sectors further boosts market growth, driving demand for advanced bending machines that can handle intricate designs with high accuracy.

Technological advancements are transforming the bending machine landscape, with CNC and robotic models offering superior efficiency and precision. However, the high acquisition and maintenance costs of these advanced machines can be a significant challenge, particularly for smaller manufacturers in emerging economies. Additionally, these machines require skilled operators proficient in programming and managing complex systems, posing a barrier for companies with limited technical expertise. Despite these challenges, the growing emphasis on automated processes and customized component production is fueling the adoption of advanced bending machines across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $16.6 Billion |

| CAGR | 5.9% |

The sheet metal bending machine segment generated USD 4.5 billion in 2024 and is projected to grow at a CAGR of 6.6% through 2034. Sheet metal is extensively used across industries such as construction, automotive, aerospace, electronics, and manufacturing, making these machines highly valuable. They excel in bending intricate shapes and angles, enabling manufacturers to meet specific design requirements with high precision. Compared to pipe or tube bending machines, sheet metal bending machines offer cost advantages when processing larger sheets, making them economically viable for large-scale component production. The growing adoption of lightweight materials and the need for customized parts further enhance the demand for sheet metal bending machines.

The market is segmented by end-use into aerospace & defense, automotive, general machinery & equipment, electrical & electronics, and others, including healthcare and marine applications. The automotive segment accounted for 34.8% of the market share in 2024 and is expected to grow at a CAGR of 5.6% through 2034. Bending machines are essential in automotive manufacturing, where they create precise and customized components such as exhaust systems, roll cages, and chassis elements. As automakers increasingly incorporate lightweight materials like aluminum and advanced alloys to improve fuel efficiency and performance, the demand for bending machines continues to rise.

Asia Pacific generated USD 4 billion in revenue from the bending machine market in 2024. The region hosts major manufacturing hubs, particularly in the automotive, aerospace, construction, and electronics sectors. Rapid industrial expansion and infrastructure development in countries like China, India, and South Korea are driving the demand for bending machines to produce a wide range of components, including automotive parts, structural elements, and consumer electronics. The region's emphasis on technological innovation and precision manufacturing is expected to propel market growth, making the Asia Pacific a dominant player in the global bending machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact on forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing industrialization and infrastructure development

- 3.9.1.2 Rapid growth in the manufacturing sector

- 3.9.1.3 Advancements in manufacturing technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investment

- 3.9.2.2 Shortage of skilled labor

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Sheet metal bending machine

- 5.3 Pipe/tube bending machine

- 5.4 Others (press brake, roll forming, bar bending)

Chapter 6 Market Estimates & Forecast, By Driving Mechanism, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Hydraulic

- 6.4 Pneumatic

- 6.5 Mechanical

Chapter 7 Market Estimates & Forecast, By Operating Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Computer numerically controlled (CNC)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.3 Automotive

- 8.4 General machinery & equipment

- 8.5 Building & construction

- 8.6 Others (mining, marine, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amada

- 11.2 Amob

- 11.3 Baileigh Industrial

- 11.4 BLM Group

- 11.5 Bystronic Group

- 11.6 Euromac

- 11.7 Horn Machine Tools

- 11.8 Murata Machinery

- 11.9 Pedax

- 11.10 Prima Industrie

- 11.11 Sahinler Metal Makina Industry

- 11.12 Shuz Tung Machinery Industrial

- 11.13 Transfluid

- 11.14 Trumpf

- 11.15 Wafios