PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876786

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876786

Ferroelectric Random Access Memory (FeRAM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

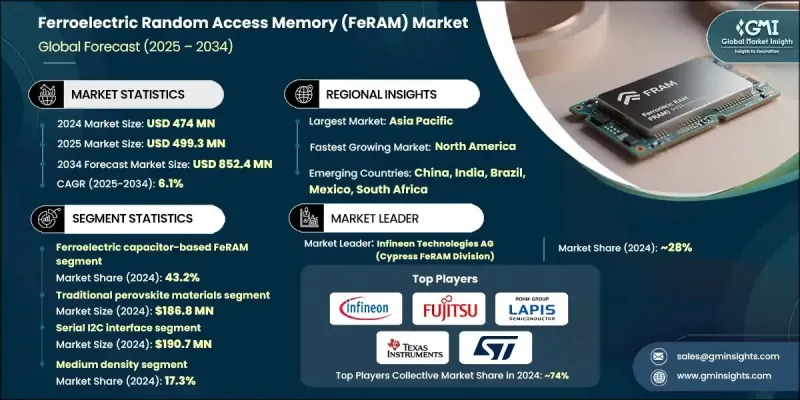

The Global Ferroelectric Random Access Memory (FeRAM) Market was valued at USD 474 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 852.4 million by 2034.

The rising demand for low-power, high-speed, and reliable memory solutions in modern electronics is driving the market forward. As compact devices like IoT sensors, wearable technology, and portable medical instruments become more sophisticated, conventional memory options such as Flash and EEPROM fall short in delivering both efficiency and performance. FeRAM stands out due to its combination of fast read/write cycles, non-volatility, and ultra-low power consumption. Its capability to instantly store data without refresh operations extends battery life and enhances device responsiveness. These advantages have made FeRAM a preferred choice for engineers designing embedded systems that require durability and real-time data processing. Additionally, automotive and industrial applications are adopting FeRAM for use in advanced driver assistance systems, sensor memory, and continuous data logging fields where endurance and reliability under extreme conditions are essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $474 Million |

| Forecast Value | $852.4 Million |

| CAGR | 6.1% |

The ferroelectric capacitor-based FeRAM segment held a 43.2% share in 2024. This segment continues to lead due to its stable performance, superior write speed, and low energy demands. The technology's proven reliability has made it a cornerstone in embedded computing, factory automation, and automotive electronics. Market growth in this area depends on innovations aimed at improving endurance, enhancing data retention, and advancing scalability. Continued investment in fabrication processes and integration with CMOS technology will ensure its relevance as industrial and automotive sectors seek efficient, mission-critical memory solutions.

The traditional perovskite materials segment generated USD 186.8 million in 2024, maintaining its dominance across the market. These materials are widely recognized for their strong ferroelectric properties, process stability, and compatibility with existing FeRAM architectures. Their dependable performance makes them indispensable for applications in automotive, consumer electronics, and industrial systems that demand consistent and durable non-volatile memory. To remain competitive, manufacturers are emphasizing enhanced scalability and improved process integration of perovskite-based technologies for future-generation devices.

North America Ferroelectric Random Access Memory (FeRAM) Market held a 29.4% share in 2024. The region benefits from a favorable regulatory landscape, strong capital investment, and advanced R&D infrastructure. The U.S. serves as a hub for innovation, supported by collaboration between leading academic institutions, research labs, and technology companies. This ecosystem is accelerating product development and fostering advancements in FeRAM design and manufacturing.

Key players operating in the Global Ferroelectric Random Access Memory (FeRAM) Market include Fujitsu Semiconductor Limited, Samsung Electronics Co., Ltd., Ferroelectric Memory Company (FMC), Infineon Technologies AG (Cypress FeRAM Division), Panasonic Holdings Corporation, STMicroelectronics N.V., Nantero, Inc., Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation, Radiant Technologies, Inc., SK Hynix Inc., Advanced Memory Technologies, Micron Technology, Inc., Taiwan Semiconductor Manufacturing Company (TSMC), RAMXEED Limited, and LAPIS Semiconductor Co., Ltd. (ROHM Group). To strengthen their market foothold, companies in the Ferroelectric Random Access Memory (FeRAM) Market are pursuing strategies focused on technological innovation and ecosystem partnerships. Firms are investing heavily in advanced manufacturing processes to enhance performance, scalability, and integration with CMOS and hybrid semiconductor platforms. Collaborative projects with automotive and industrial equipment manufacturers are enabling customized FeRAM solutions for specialized use cases.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Material trends

- 2.2.4 Interface trends

- 2.2.5 Density trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for low-power, high-speed memory solutions

- 3.2.1.2 Rising integration of FeRAM in automotive and industrial systems

- 3.2.1.3 Advancements in ferroelectric material engineering and fabrication processes

- 3.2.1.4 Increasing adoption of non-volatile memory in smart cards and security applications

- 3.2.1.5 Supportive government policies and funding for energy-efficient semiconductor technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and material costs

- 3.2.2.2 Limited storage density compared to emerging NVM

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in IoT and edge computing devices

- 3.2.3.2 Growth of automotive electronics and ADAS systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ferroelectric capacitor-based FeRAM

- 5.3 Ferroelectric field-effect transistor

- 5.4 Ferroelectric tunnel junction

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Traditional perovskite materials

- 6.3 Doped hafnium oxide

- 6.4 Aluminum scandium nitride

Chapter 7 Market Estimates and Forecast, By Interface Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Serial I2C interface

- 7.3 Serial SPI interface

- 7.4 Parallel interface

Chapter 8 Market Estimates and Forecast, By Density Range, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Low density

- 8.3 Medium density

- 8.4 High density

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Industrial automation

- 9.4 Infrastructure & smart grid

- 9.5 Medical & healthcare

- 9.6 Consumer electronics

- 9.7 Networking & communications

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Infineon Technologies AG (Cypress FeRAM Division)

- 11.2 Fujitsu Semiconductor Limited

- 11.3 LAPIS Semiconductor Co., Ltd. (ROHM Group)

- 11.4 Texas Instruments Incorporated

- 11.5 STMicroelectronics N.V.

- 11.6 Taiwan Semiconductor Manufacturing Company (TSMC)

- 11.7 Micron Technology, Inc.

- 11.8 Panasonic Holdings Corporation

- 11.9 Toshiba Electronic Devices & Storage Corporation

- 11.10 RAMXEED Limited

- 11.11 Radiant Technologies, Inc.

- 11.12 Ferroelectric Memory Company (FMC)

- 11.13 Advanced Memory Technologies

- 11.14 SK Hynix Inc.

- 11.15 Samsung Electronics Co., Ltd.

- 11.16 Nantero, Inc.