PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913327

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913327

Filtration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

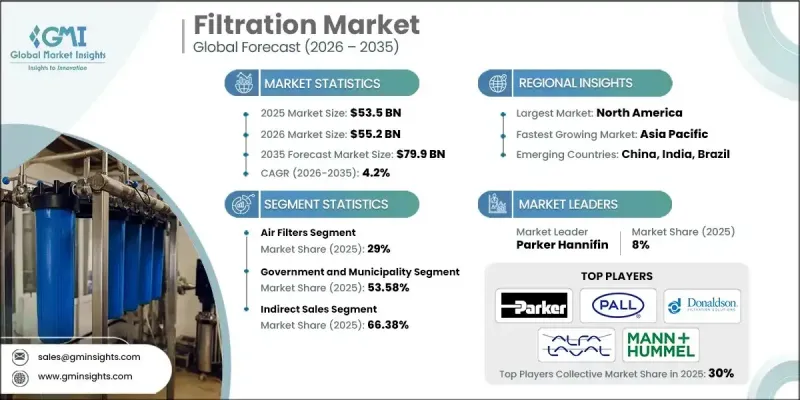

The Global Filtration Market was valued at USD 53.5 billion in 2025 and is estimated to grow at a CAGR of 4.2% to reach USD 79.9 billion by 2035.

Market growth is influenced by rising environmental responsibility and stricter regulatory compliance requirements across industries. Ongoing consolidation activity within the sector is reshaping competition, as strategic mergers and acquisitions enhance innovation capabilities, expand technology offerings, and reinforce global market reach. Traditional approaches to waste management and emission control are gradually being replaced by advanced filtration solutions that deliver improved environmental performance. Modern systems are designed to remove contaminants from air and water through efficient separation processes, enabling industries to reduce their ecological impact while meeting compliance standards. The growing focus on sustainable operations across manufacturing, utilities, and infrastructure development continues to support long-term market expansion. Increased industrial activity and infrastructure investment worldwide further reinforce demand for filtration technologies that improve operational efficiency and environmental outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $53.5 Billion |

| Forecast Value | $79.9 Billion |

| CAGR | 4.2% |

Rising industrial expansion and urban development in North America, along with higher spending on municipal services and environmental protection in Europe and parts of the Asia Pacific region, are strengthening commercial demand. End users increasingly favor automated and efficient purification and treatment solutions, accelerating the transition away from labor-intensive and time-consuming legacy processes.

The air filtration solutions segment held 29% share in 2025. Demand growth is supported by tighter air quality requirements and the need to reduce emissions across industrial and commercial facilities, reinforcing the value of advanced filtration systems.

The indirect sales segment accounted for 66.38% share in 2025 and is expected to maintain the highest growth rate through 2035. This distribution structure remains dominant due to the importance of specialized service networks that provide localized expertise, maintenance support, and long-term servicing agreements.

North America Filtration Market was valued at USD 15.7 billion in 2025 and is forecast to grow at a CAGR of 4.3% from 2026 to 2035. Strong industrial activity, large-scale infrastructure development, and rising demand for high-performance air and water treatment solutions continue to drive regional growth.

Key companies operating in the Global Filtration Market include Donaldson Company, Inc., Pentair, MANN+HUMMEL, Eaton Corporation, 3M Company, Pall Corporation, Camfil Group, Parker Hannifin Corporation, Clarcor, Koch Filter Corporation, Ahlstrom-Munksjo, Porvair Filtration Group, Lydall, Inc., Cummins Filtration, and Parker Bioscience Filtration. Companies in the Filtration Market focus on strategic expansion and technological advancement to strengthen their market position. Leading players invest in product innovation to improve efficiency, durability, and environmental performance. Portfolio diversification allows companies to address a wider range of industrial and municipal applications. Strategic acquisitions and partnerships help expand geographic reach and technical capabilities. Manufacturers also emphasize strengthening distributor networks to improve customer access and service reliability. Investments in automation and advanced materials support cost optimization and performance consistency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Filter

- 2.2.4 Filter Media

- 2.2.5 Application

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Urbanization & Industrial Development

- 3.2.1.2 Growth in Healthcare & Pharmaceuticals

- 3.2.1.3 Stricter Environmental Sustainability & Regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Investment and Replacement Costs

- 3.2.2.2 Operational Complexity and Need for Skilled Labor

- 3.2.3 Opportunities

- 3.2.3.1 Smart Technology & IoT Integration

- 3.2.3.2 Expansion of the Replacement & Aftermarket Media

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Air Filters

- 5.3 Liquid Filters

- 5.4 Gas Filters

- 5.5 Water Filters

- 5.6 Dust Collectors

- 5.7 Others(Magnetic Filters, etc)

Chapter 6 Market Estimates and Forecast, By Filter, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 HEPA Filters

- 6.3 Electrostatic Precipitators

- 6.4 Reverse Osmosis

- 6.5 Ultraviolet

- 6.6 Mechanical Filtration

- 6.7 Membrane Filtration

- 6.8 Media Filtration

- 6.9 Others(Polymeric Filters, etc)

Chapter 7 Market Estimates and Forecast, By Filter Media, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Activated Carbon

- 7.3 Fiberglass

- 7.4 Nonwoven Fabrics

- 7.5 Paper

- 7.6 Metal

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Cement Industry

- 8.2.2 Water & Wastewater Treatment

- 8.2.3 Chemical Processing

- 8.2.4 Food & Beverage Processing

- 8.2.5 Pharmaceutical Manufacturing

- 8.2.6 Automotive

- 8.2.7 Oil & Gas

- 8.2.8 Power Generation

- 8.2.9 Consumer Appliances Manufacturing

- 8.2.10 Others (Mining, Marine, etc)

- 8.3 Government and Municipality

- 8.3.1 Water Treatment Plants

- 8.3.2 Air Quality Management

- 8.3.3 Solid Waste Management Facilities

- 8.3.4 Sewage Treatment Plants

- 8.3.5 Others (Public Swimming Pools, etc.)

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Vermeer

- 11.2 3M Company

- 11.3 Ahlstrom-Munksjo

- 11.4 Camfil Group

- 11.5 Clarcor

- 11.6 Cummins Filtration

- 11.7 Donaldson Company, Inc.

- 11.8 Eaton Corporation

- 11.9 Koch Filter Corporation

- 11.10 Lydall, Inc.

- 11.11 MANN+HUMMEL

- 11.12 Pall Corporation

- 11.13 Parker Bioscience Filtration

- 11.14 Parker Hannifin Corporation

- 11.15 Pentair

- 11.16 Porvair Filtration Group