PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716673

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716673

U.S. Cryogenic Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

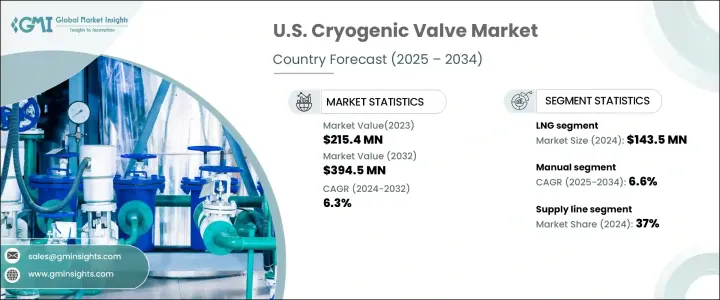

U.S. Cryogenic Valve Market, valued at USD 215.4 million in 2024, is projected to grow at a CAGR of 6.3% from 2025 to 2034, driven by the increasing demand for liquefied natural gas (LNG) and the expansion of LNG infrastructure. Cryogenic valves are vital components for handling fluids at extremely low temperatures, making them indispensable in LNG operations, including storage, transportation, and processing. As the U.S. continues to increase its LNG export capabilities and expand domestic energy consumption, the need for highly reliable and efficient cryogenic valves is escalating. Ongoing investments in storage facilities, LNG terminals, and transportation systems are boosting market growth, while rising interest in hydrogen-based energy solutions is adding further momentum. In addition, technological advancements, such as automation and smart valve technologies, are enhancing system performance and operational efficiency, making advanced cryogenic valves a cornerstone of U.S. LNG infrastructure. The increasing adoption of floating LNG (FLNG) units and the rise of small-scale LNG distribution networks are also contributing to the growing demand for durable and advanced cryogenic valve solutions.

The market is segmented by application, with the LNG segment generating USD 143.5 million in 2024 and expected to grow at a CAGR of 6.1% through 2034. The surge in demand for LNG, fueled by its reputation as a cleaner and more sustainable energy source, is driving significant investments in infrastructure. LNG operations require cryogenic valves to maintain extremely low temperatures and ensure safe, efficient flow control during storage, transportation, and processing. As the U.S. strengthens its position as a leading LNG exporter, the demand for advanced cryogenic valve technologies is expected to increase substantially.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $215.4 Million |

| Forecast Value | $394.5 Million |

| CAGR | 6.3% |

Based on function, the market is divided into manual and pneumatic/electric control valves. The manual segment dominated with a 65% market share in 2024 and is projected to grow at a CAGR of 6.6% through 2034. Manual cryogenic valves remain a preferred choice in the U.S. due to their reliability, cost-effectiveness, and simplicity in operation across various industries, including industrial gas, aerospace, and LNG. These valves perform well in extremely cold conditions, where automated systems may encounter challenges, making them a dependable solution for critical applications.

The U.S. Cryogenic Valve Market is poised for steady growth, supported by the ongoing expansion of LNG infrastructure, rising demand for industrial gases, and increasing investments in the hydrogen economy. As the U.S. accelerates its transition toward cleaner energy sources and enhances its LNG export infrastructure, the need for high-performance cryogenic valves is set to grow. These valves play a pivotal role in maintaining safety and efficiency in LNG export terminals, pipelines, liquefaction plants, and bunkering operations. Furthermore, the growing push for green hydrogen production and storage solutions is amplifying demand for cryogenic valves capable of handling extremely low temperatures, further solidifying their importance in the evolving U.S. energy landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact on forces

- 3.9.1 Growth drivers

- 3.9.1.1 Expansion of LNG infrastructure

- 3.9.1.2 The expansion of industrial gas facilities and distribution networks

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Operational Safety and Reliability

- 3.9.2.2 Price volatility of raw materials

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Valve Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 LNG

- 5.2.1 Ball valve

- 5.2.1.1 Floating ball valves

- 5.2.1.2 Trunnion-mounted ball valves

- 5.2.1.3 3-way ball valves

- 5.2.1.4 Fully welded ball valves

- 5.2.1.5 Others (screw end ball valves, flanged end ball valves, multi-port, etc.)

- 5.2.2 Butterfly valve

- 5.2.2.1 Double offset butterfly valves

- 5.2.2.2 Triple offset butterfly valves

- 5.2.2.3 High-performance butterfly valves

- 5.2.2.4 Others (actuated butterfly valves, lug butterfly valves, etc.)

- 5.2.1 Ball valve

- 5.3 Hydrogen

- 5.3.1 Ball valve

- 5.3.1.1 Floating ball valves

- 5.3.1.2 Trunnion-mounted ball valves

- 5.3.1.3 3-way ball valves

- 5.3.1.4 Fully welded ball valves

- 5.3.1.5 Others (screw end ball valves, flanged end ball valves, multi-port, etc.)

- 5.3.2 Butterfly valve

- 5.3.2.1 Double offset butterfly valves

- 5.3.2.2 Triple offset butterfly valves

- 5.3.2.3 High-performance butterfly valves

- 5.3.2.4 Others (actuated butterfly valves, lug butterfly valves, etc.)

- 5.3.1 Ball valve

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Pneumatic/Electric/Hydraulic Control

Chapter 7 Market Estimates & Forecast, By Size, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 1”

- 7.3 1” to 6"

- 7.4 7” to 25”

- 7.5 26” to 50”

- 7.6 >50"

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Gas Pipeline and transportation

- 8.3 Supplying line

- 8.4 Filling device

- 8.5 Bulk storage tank

- 8.6 Others (Storage Tank & Piping, etc.)

Chapter 9 Market Estimates & Forecast, By Industry, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Upstream

- 9.3 Midstream

- 9.4 Downstream

Chapter 10 Company Profiles

- 10.1 Alloy Valves and Control (AVCO)

- 10.2 Bray International

- 10.3 Crane Company

- 10.4 Emerson Electric Co

- 10.5 Flowserve Corporation

- 10.6 FZV-Canada (Fangzheng Valve Group Co., Ltd.)

- 10.7 HEROES GmbH

- 10.8 KITZ Corporation

- 10.9 Ladish Valves

- 10.10 Parker Hannifin

- 10.11 Richards Industrials

- 10.12 Sesto Valves

- 10.13 SWI Valve

- 10.14 Valves Only

- 10.15 Velan