PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913318

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913318

Industrial Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

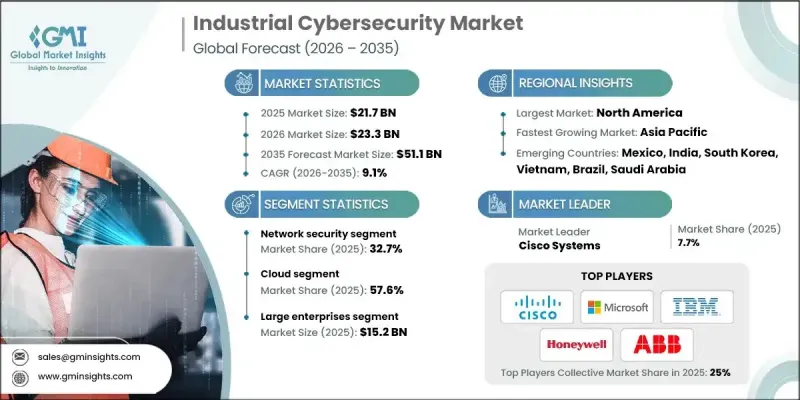

The Global Industrial Cybersecurity Market was valued at USD 21.7 billion in 2025 and is estimated to grow at a CAGR of 9.1% to reach USD 51.1 billion by 2035.

Growth is driven by the rising frequency, sophistication, and potential impact of cyber incidents targeting operational systems. As industrial operations become increasingly interconnected, protecting critical infrastructure has become a top strategic priority. Many industrial environments still face significant security gaps, which has intensified regulatory oversight and increased pressure on organizations to strengthen cyber defenses to avoid large-scale economic and operational disruption. The adoption of artificial intelligence and machine learning is reshaping cybersecurity frameworks by enabling faster threat detection, predictive analysis, and continuous monitoring. These technologies improve visibility across complex workflows and enhance response accuracy. Government mandates and compliance requirements are accelerating cybersecurity implementation across critical industrial operations, making cybersecurity a core element of infrastructure modernization and long-term risk management strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.7 Billion |

| Forecast Value | $51.1 Billion |

| CAGR | 9.1% |

The network security segment held a 32.7% share in 2025. Strong demand is driven by the need to secure communication channels that support real-time data exchange across interconnected systems. As operational continuity depends heavily on reliable networks, protecting data flows has become essential for maintaining safety, productivity, and system stability.

The cloud deployment segment accounted for 57.6% share in 2025 and is expected to grow at a CAGR of 10.2% from 2026 to 2035. Cloud-based cybersecurity solutions enable centralized protection across multiple facilities without requiring extensive upfront investment, making them especially attractive for organizations with distributed operations.

U.S. Industrial Cybersecurity Market reached USD 7.1 billion in 2025. Market leadership is supported by early adoption of connected technologies and strong investment in securing industrial systems, resulting in the highest regional spending on industrial cybersecurity.

Key companies operating in the Global Industrial Cybersecurity Market include Schneider Electric, IBM, Cisco Systems, Honeywell, Palo Alto Networks, ABB, Rockwell Automation, Thales, Microsoft, and Claroty. Companies in the Global Industrial Cybersecurity Market strengthen their competitive position through continuous innovation and integrated security offerings. Firms invest heavily in AI-driven threat detection, real-time monitoring, and predictive analytics to enhance protection capabilities. Strategic partnerships and ecosystem collaborations help expand solution compatibility across industrial platforms. Companies focus on scalable cloud-based architectures to support distributed operations efficiently. Expanding service portfolios to include consulting, risk assessment, and managed security services improves customer retention. Compliance-focused solutions aligned with regulatory requirements further strengthen trust.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Product

- 2.2.4 Deployment Model

- 2.2.5 Enterprise Size

- 2.2.6 Security

- 2.2.7 Industry

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising frequency of cyberattacks on critical infrastructure

- 3.2.1.2 Increasing adoption of industrial IoT (IIoT) and smart manufacturing

- 3.2.1.3 Growing digitalization of industrial control systems (ICS)

- 3.2.1.4 Strict government regulations and compliance mandates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled industrial cybersecurity professionals

- 3.2.2.2 Limited cybersecurity awareness among SMEs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for AI-driven threat detection solutions

- 3.2.3.2 Expansion of industrial cybersecurity in emerging economies

- 3.2.3.3 Rising need for managed security services in industries

- 3.2.3.4 Demand for real-time threat intelligence and monitoring solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 NIST Cybersecurity Framework (CSF) 2.0

- 3.4.1.2 NERC CIP

- 3.4.1.3 ISA/IEC 62443

- 3.4.1.4 NIST SP 800-82

- 3.4.2 Europe

- 3.4.2.1 NIS2 Directive

- 3.4.2.2 IEC 62443

- 3.4.2.3 DORA

- 3.4.2.4 Cyber Essentials

- 3.4.3 Asia Pacific

- 3.4.3.1 China's Cybersecurity Law (CSL)

- 3.4.3.2 METI Cybersecurity Management Guidelines

- 3.4.3.3 Singapore Cybersecurity Act

- 3.4.3.4 SOCI Act

- 3.4.4 Latin America

- 3.4.4.1 ANEEL Cybersecurity Norms

- 3.4.4.2 ANATEL Security Regulations

- 3.4.4.3 Chile Framework Law on Cybersecurity

- 3.4.5 Middle East & Africa

- 3.4.5.1 Essential Cybersecurity Controls (ECC)

- 3.4.5.2 Federal Decree-Law No. 5/2012 (UAE)

- 3.4.5.3 Cybercrime Law (Saudi Arabia)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Case studies

- 3.11 IT and OT attacks statistics

- 3.11.1 IT-focused cyberattacks

- 3.11.2 OT-focused cyberattacks

- 3.11.3 IT-OT convergence & hybrid attacks

- 3.11.4 Advanced & emerging industrial threats

- 3.11.5 Impact analysis of IT & OT attacks

- 3.12 Skills & talent landscape

- 3.12.1 Workforce availability and demand

- 3.12.2 Skill gaps in industrial cybersecurity

- 3.12.3 Training and certification programs

- 3.12.4 Government and industry initiatives for skill development

- 3.13 Future outlook & opportunities

- 3.14 Sustainability and Environmental Aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 Services

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Product, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 SCADA

- 6.3 Identity and Access Management (IAM)

- 6.4 Unified Threat Management (UTM)

- 6.5 Data Loss Prevention (DLP)

- 6.6 IDS/IPS

- 6.7 SIEM

- 6.8 DDoS

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 SMEs

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By Security, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Network security

- 9.3 Endpoint security

- 9.4 Application security

- 9.5 Cloud security

- 9.6 Wireless security

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Industry, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Electronics

- 10.4 Food & beverages

- 10.5 Energy & power

- 10.6 Oil & gas

- 10.7 Chemical

- 10.8 IT & Telecommunications

- 10.9 Aerospace & Defense

- 10.10 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 Siemens

- 12.1.2 Honeywell

- 12.1.3 Palo Alto Networks

- 12.1.4 Cisco Systems

- 12.1.5 Microsoft

- 12.1.6 IBM

- 12.1.7 Fortinet

- 12.1.8 Schneider Electric

- 12.1.9 Rockwell Automation

- 12.1.10 Claroty

- 12.1.11 Nozomi Networks

- 12.1.12 Dragos

- 12.1.13 Tenable

- 12.1.14 ABB

- 12.1.15 Thales

- 12.2 Regional companies

- 12.2.1 Armis

- 12.2.2 Darktrace

- 12.2.3 TXOne Networks

- 12.2.4 Waterfall Security

- 12.2.5 Radiflow

- 12.2.6 Industrial Defender

- 12.2.7 Trend Micro

- 12.2.8 ABS Group

- 12.2.9 Check Point

- 12.2.10 Forescout

- 12.3 Emerging companies

- 12.3.1 Fox-IT

- 12.3.2 ONEKEY

- 12.3.3 ACURITY

- 12.3.4 Keeper Security

- 12.3.5 Underwriters Laboratories