PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716665

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716665

Engine Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

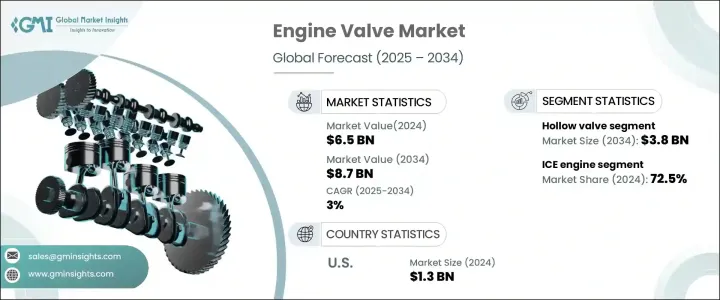

The Global Engine Valve Market, valued at USD 6.5 billion in 2024, is set to experience steady growth, projected to expand at a CAGR of 3% between 2025 and 2034. The increasing global demand for fuel-efficient vehicles is a major factor influencing market expansion. With governments worldwide enforcing stricter fuel economy and emissions regulations, automakers are rapidly adopting advanced engine technologies. This has led to a surge in demand for high-performance engine components, particularly valves, which play a pivotal role in combustion efficiency and emission control. Ongoing innovations in engine design, including turbocharging and variable valve timing, are further boosting the need for precision-engineered valves that optimize fuel combustion and enhance overall vehicle performance. As automakers focus on lightweight and durable engine components to meet stringent regulatory requirements, the engine valve market is witnessing significant advancements in material science and manufacturing processes.

The market is segmented based on valve type into hollow, monometallic, and bimetallic valves. The hollow valve segment accounted for USD 2.9 billion in 2024, gaining traction due to its superior lightweight characteristics. Hollow valves offer a significant advantage over solid valves by enabling faster and more precise valve movement, which enhances engine efficiency. These valves are particularly beneficial in high-performance and racing engines where speed and thermal management are crucial. The ability of hollow valves to improve heat dissipation ensures that engines operate at optimal temperatures, thereby extending the lifespan of engine components subjected to high stress and extreme conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 3% |

In terms of engine type, the market is categorized into internal combustion engines (ICE) and electric engines. ICE engines held a dominant 72.5% share in 2024 and are projected to grow at a CAGR of 2.8% through 2034. While electric vehicles are gradually reshaping the automotive landscape, ICE vehicles continue to lead due to their widespread infrastructure and ongoing technological advancements. Automakers are integrating fuel-efficient technologies such as direct fuel injection and cylinder deactivation to enhance the efficiency of gasoline-powered engines. At the same time, stricter emission norms are driving the development of lightweight, heat-resistant engine valves that minimize emissions without compromising performance.

U.S. Engine Valve Market generated USD 1.3 billion in 2024 and is forecasted to expand at a CAGR of 2.4% from 2025 to 2034. Despite the accelerating shift toward vehicle electrification, the demand for ICE components, including engine valves, remains strong. Automakers in the U.S. are investing in advanced valve materials and coatings that enhance durability and efficiency, ensuring compliance with stringent emission regulations while meeting consumer demand for high-performance gasoline-powered vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Market 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Regional trends

- 2.4 Product type trends

- 2.5 End use trends

- 2.6 Distribution channel trends

Chapter 3 Market Insights

- 3.1 Industry ecosystem analysis

- 3.2 Raw material analysis

- 3.3 Key news and initiatives

- 3.3.1 Partnership/Collaboration

- 3.3.2 Merger/Acquisition

- 3.3.3 Investment

- 3.3.4 Product launch & innovation

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Increase production of vehicles

- 3.5.1.2 Increase innovation in valve technology

- 3.5.1.3 Rise in stringent emission regulations

- 3.5.1 Growth drivers

- 3.6 Industry pitfalls & challenges

- 3.6.1.1 Manufacturing process of automotive valves involves environmental concerns

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Trade analysis

- 3.10.1 Export data

- 3.10.2 Import data

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share, 2024

- 4.3 Competitive analysis of major market players, 2024

- 4.4 Competitive positioning matrix, 2024

- 4.5 Strategic outlook matrix, 2024

Chapter 5 Market Estimates & Forecast, By Valve Type 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Hollow

- 5.3 Monometallic

- 5.4 Bimetallic

Chapter 6 Market Estimates & Forecast, By Purpose 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Intake valves

- 6.3 Exhaust valves

Chapter 7 Market Estimates & Forecast, By Engine type 2021 - 2034, (USD Billion)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

Chapter 8 Market Estimates & Forecast, By Material 2021 - 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Nickel alloy

- 8.3 Chrome plated

- 8.4 Stainless steel

- 8.5 Others (Nitrate, Stellite Alloy, etc.)

Chapter 9 Market Estimates & Forecast, By Technology 2021 - 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Pneumatic

- 9.3 Hydraulic

- 9.4 Electric

Chapter 10 Market Estimates & Forecast, By Application 2021 - 2034, (USD Billion)

- 10.1 Key trends

- 10.2 Automotive

- 10.2.1 Commercial vehicle

- 10.2.2 Passenger vehicle

- 10.2.3 Two wheelers

- 10.3 Marine applications

- 10.4 Natural gas engines

- 10.5 Military & defense applications

- 10.6 Agricultural & earth moving machinery

- 10.7 Railway & locomotive applications

- 10.8 Generators & industrial engines

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel 2021 - 2034, (USD Billion)

- 11.1 Key trends

- 11.2 OEM

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region 2021 - 2034, (USD Billion)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Malaysia

- 12.4.7 Indonesia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 AVR (Vikram) Valves

- 13.2 Bosch

- 13.3 Continental AG

- 13.4 Denso

- 13.5 Eaton Corporation

- 13.6 Federal-Mogul

- 13.7 Fuji Oozx

- 13.8 Grindtech

- 13.9 Hitachi Ltd

- 13.10 Rane