PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801947

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801947

North America Commercial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

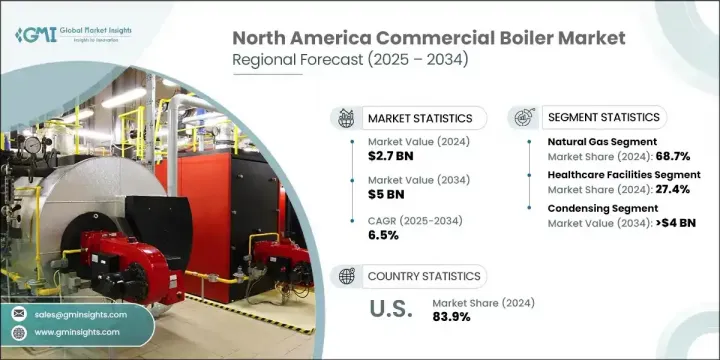

North America Commercial Boiler Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 5 billion by 2034. Market momentum is being driven by the growing shift toward low-carbon heating solutions such as hybrid, electric, and condensing gas boilers, largely influenced by regional decarbonization initiatives. Many municipalities and institutional zones are upgrading and expanding centralized heating networks as part of large-scale energy system retrofits. Commercial boilers are used extensively in facilities like offices, manufacturing sites, educational institutions, and hospitals, where they provide hot water or steam for heating and operational purposes. These systems are designed for durability, efficient performance, and continuous operation under fluctuating loads.

Additionally, financial support in the form of utility programs and government incentives for electric boiler installations is expected to positively influence product uptake. The push for smart building technologies and stricter energy efficiency codes is further accelerating the transition toward advanced boiler systems with enhanced diagnostics and automation. Innovation is being fueled by tightening emissions regulations, especially regarding low-NOx compliance, which is promoting widespread adoption of clean and energy-efficient heating systems across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $5 Billion |

| CAGR | 6.5% |

The natural gas boilers segment held 68.7% share in 2024 and is forecasted to grow at a CAGR of 5.5% through 2034. Their continued adoption is backed by an extensive gas supply infrastructure and the cost-effective, high-efficiency performance they offer. In both new builds and system upgrades, these units remain the system of choice, particularly in markets with deregulated gas services. High efficiency condensing gas boilers are being promoted through rebate and incentive programs, reinforcing their market demand and appeal to commercial operators.

The commercial office segment generated USD 581.2 million in 2024, driven by increasing installations of high-performance boiler systems in new and retrofitted office spaces. Enhanced HVAC system integration and growing demand to meet local building energy codes and sustainability targets are encouraging developers and property managers to opt for condensing boiler solutions. Modern office towers are leveraging automated boiler systems for improved energy management, occupant comfort, and building efficiency, supporting long-term market growth.

United States Commercial Boiler Market heled 83.9% share and generated USD 2.2 billion in 2024. Modernization projects across government facilities and schools are supporting widespread boiler replacements, enabled by public funding and infrastructure upgrade programs. Additionally, with a growing number of states implementing building electrification rules, there's a noticeable shift toward electric boiler systems in cities focused on zero-emission mandates. Integration with intelligent building management solutions is becoming standard in U.S. installations, supporting efficiency goals and advancing the country's commercial boiler market outlook.

Notable companies leading in the North America Commercial Boiler Market across North America include Parker Boiler, HTP, A.O. Smith, Thermal Solutions, P.M. Lattner Manufacturing, Burnham Commercial Boilers, Bosch Thermotechnology, Precision Boilers, Babcock & Wilcox Enterprises, U.S. Boiler Company, Fulton, Columbia Heating Products, Rinnai America, Cleaver-Brooks, Viessmann, NTI Boilers, Lochinvar, WM Technologies, Navien, Energy Kinetics, Rentech Boiler Systems, Miura America, PB Heat, AERCO, Daikin Industries, Bradford White Corporation, Lennox International, Ariston Holding, and Clayton Industries. Companies operating in the North America commercial boiler space are adopting multiple strategies to solidify their market positioning. Leading players are heavily investing in product innovation, especially focusing on low-emission, ultra-efficient systems like condensing and electric boilers to comply with regional environmental mandates. Many are expanding their smart boiler portfolios with built-in controls, remote monitoring, and predictive maintenance features, targeting integration with smart building infrastructures.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of commercial boilers

- 3.8 Price trend analysis

- 3.8.1 By capacity

- 3.8.2 By fuel

- 3.9 Future market outlook & emerging opportunities

- 3.10 Technology trends & innovations

- 3.10.1 Smart boiler integration & IoT connectivity

- 3.10.2 Advanced materials & durability improvements

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic dashboard

- 4.3.1 Major M&A activities

- 4.3.2 Key partnerships and collaborations

- 4.3.3 Product innovations and launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 Offices

- 9.3 Healthcare facilities

- 9.4 Educational institutions

- 9.5 Lodgings

- 9.6 Retail stores

- 9.7 Others

Chapter 10 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

- 10.4 Mexico

Chapter 11 Company Profiles

- 11.1 A.O. Smith

- 11.2 AERCO

- 11.3 Ariston Holding

- 11.4 Babcock & Wilcox Enterprises

- 11.5 Bosch Thermotechnology

- 11.6 Bradford White Corporation

- 11.7 Burnham Commercial Boilers

- 11.8 Clayton Industries

- 11.9 Cleaver-Brooks

- 11.10 Columbia Heating Products

- 11.11 Daikin Industries

- 11.12 Energy Kinetics

- 11.13 Fulton

- 11.14 HTP

- 11.15 Hurst Boiler & Welding

- 11.16 Lennox International

- 11.17 Lochinvar

- 11.18 Miura America

- 11.19 Navien

- 11.20 NTI Boilers

- 11.21 P.M. Lattner Manufacturing

- 11.22 Parker Boiler

- 11.23 PB Heat

- 11.24 Precision Boilers

- 11.25 Rentech Boiler Systems

- 11.26 Rinnai America

- 11.27 Thermal Solutions

- 11.28 U.S. Boiler Company

- 11.29 Viessmann

- 11.30 WM Technologies