PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892905

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892905

Image Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

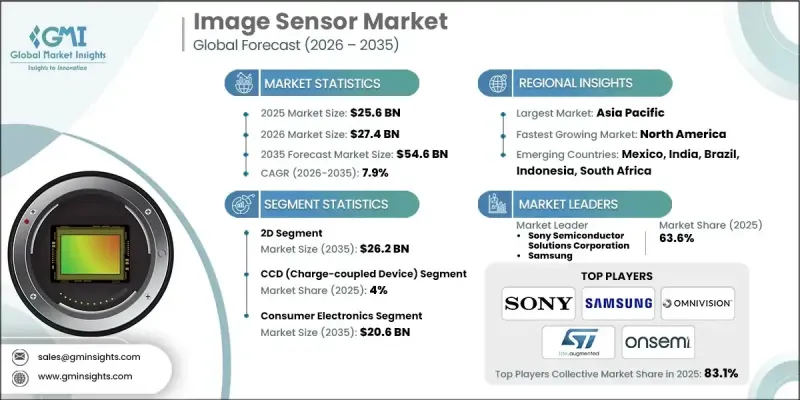

The Global Image Sensor Market was valued at USD 25.6 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 54.6 billion by 2035.

The market's expansion is being fueled by advances in CMOS technology, rising demand for image sensors across automotive applications, consumer electronics, industrial IoT, and healthcare sectors. Medical imaging is driving growth by enabling higher diagnostic accuracy, enhanced imaging, and improved patient care. The integration of artificial intelligence with image sensors is expected to revolutionize computational photography and real-time analytics, enhancing low-light performance, object detection, and overall sensor efficiency. Increasing adoption in automotive ADAS, smart devices, and industrial automation further supports market growth while manufacturers focus on creating smaller, more powerful, and AI-enabled sensors to meet diverse application requirements.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.6 Billion |

| Forecast Value | $54.6 Billion |

| CAGR | 7.9% |

The 2D image sensor segment is anticipated to reach USD 26.2 billion by 2035. Two-dimensional imaging remains prevalent in surveillance systems, smartphones, and automotive cameras due to its cost efficiency, high resolution, and broad compatibility. Integration of HDR, advanced image processing, and low-light capabilities enhances its applicability across multiple industries.

The CCD (charge-coupled device) segment held 4% share in 2025. CCD sensors continue to be preferred in high-precision industrial, medical, and scientific imaging applications due to their superior stability, low noise, and dynamic range. Even as CMOS dominates mainstream applications, CCD remains critical for niche high-accuracy use cases.

U.S. Image Sensor Market generated USD 3.6 billion in 2025. Growth is driven by automotive ADAS systems, AI-enabled cameras, and industrial automation. Significant investments in semiconductor R&D and fabrication support innovation, with manufacturers prioritizing high-resolution, AI-integrated sensors to meet domestic demand across automotive, industrial, and consumer electronics sectors.

Key players in the Global Image Sensor Market include Hamamatsu Photonics K.K., AlpsenTek, CMOS Sensor Inc., Canon Inc., GalaxyCore Shanghai Limited Corporation, Analog Devices, Inc., ams-OSRAM AG, Infineon Technologies AG, and Himax Technologies. Companies in the Image Sensor Market are enhancing their market presence through a combination of strategies focused on technology, partnerships, and innovation. They are investing in R&D to develop AI-enabled, high-resolution sensors for automotive, industrial, and consumer applications. Collaborations with semiconductor manufacturers and OEMs help expand reach and integrate sensors into new devices. Firms are also focusing on optimizing power efficiency, miniaturization, and low-light performance to differentiate products. Geographic expansion, targeted marketing, and after-sales support further strengthen brand presence, while strategic acquisitions and joint ventures allow them to access new technologies and markets, enhancing competitiveness globally.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Sensor type trends

- 2.2.2 Resolution trends

- 2.2.3 Processing technology trends

- 2.2.4 Spectrum trends

- 2.2.5 Application trends

- 2.2.6 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in CMOS technology

- 3.2.1.2 Rising demand for automotive image sensors

- 3.2.1.3 Increasing demand for consumer electronics

- 3.2.1.4 Growth of industrial and IoT applications

- 3.2.1.5 Healthcare and medical imaging applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cost and pricing pressures

- 3.2.2.2 Supply chain disruptions and semiconductor shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in AI and machine vision integration

- 3.2.3.2 Emerging lidar and 3D sensing applications

- 3.2.3.3 Miniaturization and low-power sensor development

- 3.2.3.4 Expansion in AR/VR and metaverse applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Sensor Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 CCD (charge-coupled device)

- 5.3 CMOS (complementary metal-oxide-semiconductor)

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Resolution, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Low resolution (<2 MP)

- 6.3 Medium resolution (2-12 MP)

- 6.4 High resolution (>12 MP)

Chapter 7 Market Estimates and Forecast, By Processing Technology, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 2D

- 7.3 3D

Chapter 8 Market Estimates and Forecast, By Spectrum, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Visible spectrum sensors

- 8.3 Infrared (IR) sensors

- 8.4 Ultraviolet (UV) sensors

- 8.5 Multispectral sensors

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.2.1 Smartphones & tablets

- 9.2.2 Digital cameras & camcorders

- 9.2.3 Wearables

- 9.2.4 Others

- 9.3 Automotive

- 9.3.1 ADAS

- 9.3.2 In-vehicle monitoring systems

- 9.3.3 Lidar

- 9.3.4 Others

- 9.4 Industrial & manufacturing

- 9.4.1 Machine vision systems

- 9.4.2 Robotics & automation

- 9.4.3 Quality control / inspection

- 9.4.4 Others

- 9.5 Healthcare & medical imaging

- 9.5.1 Diagnostic imaging

- 9.5.2 Endoscopy & surgical cameras

- 9.5.3 Others

- 9.6 Security & surveillance

- 9.6.1 CCTV cameras

- 9.6.2 Access control

- 9.6.3 Others

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Samsung

- 11.1.2 Sony Semiconductor Solutions Corporation

- 11.1.3 OMNIVISION

- 11.1.4 Onsemi

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Analog Devices, Inc.

- 11.2.1.2 Teledyne

- 11.2.1.3 Tower Semiconductor

- 11.2.2 Europe

- 11.2.2.1 ams-OSRAM AG

- 11.2.2.2 Infineon Technologies AG

- 11.2.2.3 STMicroelectronics

- 11.2.3 APAC

- 11.2.3.1 Canon Inc.

- 11.2.3.2 Panasonic Corporation

- 11.2.3.3 Sharp Corporation

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 AlpsenTek

- 11.3.2 CMOS Sensor Inc.

- 11.3.3 GalaxyCore Shanghai Limited Corporation

- 11.3.4 Himax Technologies

- 11.3.5 PixArt Imaging Inc.

- 11.3.6 Toshiba Corporation