PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721554

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721554

Mining Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

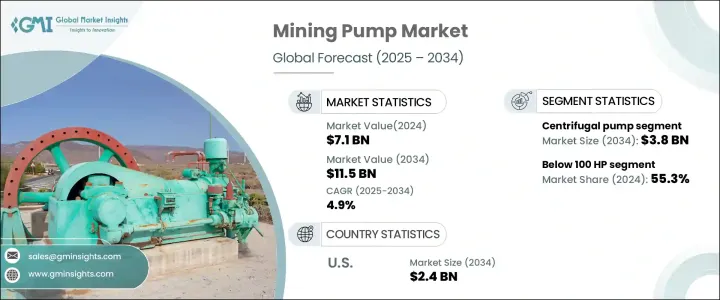

The Global Mining Pump Market was valued at USD 7.1 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 11.5 billion by 2034. This steady growth trajectory reflects a broader industry shift toward sustainable and high-efficiency solutions that support modern mining needs. As governments across the globe push for greener infrastructure and manufacturers seek to optimize productivity while minimizing operational costs, the demand for technologically advanced mining pumps is rising. With growing industrialization, particularly in emerging economies, the global appetite for minerals and metals such as copper, lithium, nickel, and cobalt continues to surge. This demand is further amplified by the expanding electric vehicle (EV) industry, renewable energy projects, and infrastructure development initiatives. The mining industry, responding to this momentum, is ramping up activities to ensure consistent raw material supply, which in turn is creating substantial opportunities for mining pump manufacturers. As mining processes become increasingly automated and digitized, the need for intelligent pumping solutions that offer real-time monitoring and reduced downtime is more critical than ever.

The growth of the mining pump market is primarily driven by increasing mining operations, the need for efficient water handling systems, and the surging global demand for battery materials. Mining companies are investing heavily in advanced machinery to improve productivity, reduce energy consumption, and meet environmental regulations. Effective pumping solutions play a pivotal role in achieving these goals, especially in water extraction, slurry movement, and waste handling operations. The rising need for durable, high-performance, and energy-efficient pumps is compelling manufacturers to integrate cutting-edge technologies into their product lines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 4.9% |

The mining pump market is segmented by pump type, including centrifugal, dewatering, slurry, multi-stage, and diaphragm pumps. Centrifugal pumps emerged as the top revenue-generating category in 2024, accounting for USD 2.2 billion in value. These pumps are widely used in mining for tasks such as dewatering, transporting abrasive slurries, and transferring fluids over long distances. Their demand is fueled by their versatility and cost-efficiency. With operational costs rising in the mining industry, there is a clear preference for energy-saving centrifugal pumps equipped with advanced control systems and better hydraulic designs.

In terms of power rating, the market includes pumps below 100 HP, between 100-500 HP, and above 500 HP. Pumps below 100 HP dominated the landscape in 2024, holding a 55.3% market share. These pumps are commonly used in small-scale operations due to their affordability, adaptability, and ability to operate under challenging site conditions. They serve various applications such as water transfer, dewatering, and slurry management where lower capacity is sufficient but consistent performance is essential.

The U.S. mining pump market generated USD 1.5 billion in 2024, driven by advancements in pump technologies, expanded mining activities, and rising mineral demand. The country's mining sector remains a crucial component of its economy, supplying raw materials to industries such as construction, automotive, and electronics. As demand for critical minerals increases domestically and globally, U.S. mining operations continue to grow, pushing the need for high-performance pumps that align with modern sustainability and efficiency goals.

Key players in the global mining pump market include Sulzer, The Weir Group, Xylem, KSB, Schurco Slurry, Multotec Group, Ebara Corporation, The Gorman-Rupp Company, Flowserve Corporation, Grundfos Holding, Tsurumi Manufacturing, NETZSCH Pumpen & Systeme, JEE Pumps, and Metso Outotec Corporation. These companies are leveraging innovation to strengthen their competitive edge, focusing on energy-efficient pumps and integrating IoT-enabled technologies that support predictive maintenance and real-time performance tracking.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased global demand for minerals and metals

- 3.2.1.2 Technological advancements

- 3.2.1.3 Inclination towards wastewater management

- 3.2.1.4 Expanded mining operations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Frequent maintenance and replacement

- 3.2.2.2 Fluctuating prices

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Centrifugal pump

- 5.3 Dewatering pump

- 5.4 Slurry pump

- 5.5 Multi-Stage pump

- 5.6 Diaphragm pump

- 5.7 Others (Piston Pumps, Peristaltic Pumps, etc.)

Chapter 6 Market Estimates & Forecast, By Power Source, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric & Solar Pumps

- 6.3 Diesel pump

- 6.4 Others (Gasoline Solar, etc.)

Chapter 7 Market Estimates & Forecast, By Flow Rate, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 100 m³/h

- 7.3 100 - 500 m³/h

- 7.4 Above 500 m³/h

Chapter 8 Market Estimates & Forecast, By Horsepower, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 100 HP

- 8.3 100 - 500 HP

- 8.4 Above 500 HP

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Conventional

- 9.3 Smart

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Mine dewatering

- 10.3 Mineral processing

- 10.4 Water & Wastewater Treatment

- 10.5 Dust suppression

- 10.6 Others (Lubrication, etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 Ebara Corporation

- 13.2 Flowserve Corporation

- 13.3 Grundfos Holding

- 13.4 Gorman-Rupp

- 13.5 JEE Pumps

- 13.6 KSB

- 13.7 Metso Outotec Corporation

- 13.8 Multotec Group

- 13.9 NETZSCH Pumps & Systems

- 13.10 Schurco Slurry

- 13.11 Sulzer

- 13.12 The Gorman-Rupp Company

- 13.13 The Weir Group

- 13.14 Tsurumi Manufacturing

- 13.15 Xylem