PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876827

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876827

Swine Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

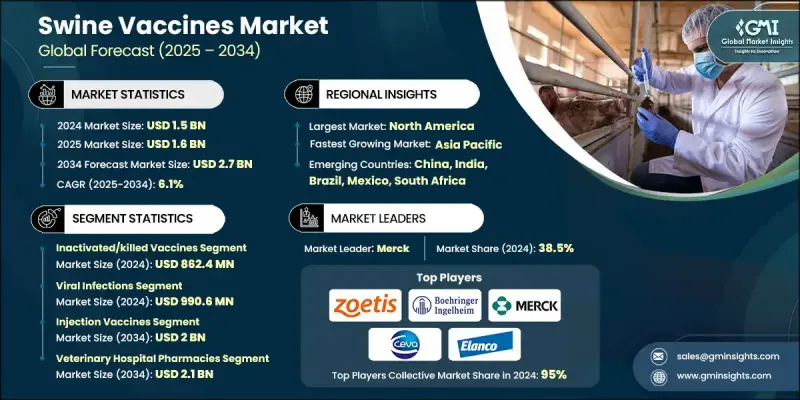

The Global Swine Vaccines Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 2.7 billion by 2034.

Market growth is driven by the rising global consumption and production of pork, one of the most widely consumed meats worldwide. Ensuring the health and productivity of swine herds has become a priority as the livestock industry expands to meet the growing demand for animal protein, fueled by rising populations, urbanization, and shifting dietary preferences. Intensification of swine production for higher efficiency and yield emphasizes preventive healthcare, with vaccines playing a critical role in minimizing disease risks that can impact animal survival and economic returns. Additionally, food security remains a pressing concern in regions heavily reliant on pork, making disease prevention through vaccination crucial to maintain stable supply chains, prevent price spikes, and safeguard the availability of this key protein source.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 6.1% |

The inactivated or killed vaccines segment held a 57.6% share and was valued at USD 862.4 million in 2024. These vaccines are preferred for their proven safety, stability, and long shelf life, making them ideal for large-scale vaccination programs, particularly in areas with established cold chain systems. Their reliability in preventing common swine diseases ensures ongoing demand across global markets.

The viral infections segment generated USD 990.6 million in 2024 and is expected to grow at a CAGR of 6.3% through 2034. This segment's growth is driven by the high prevalence and economic impact of contagious viral diseases that affect swine, including those that cause reproductive failures, growth retardation, and significant financial losses. High transmissibility in densely populated farms makes vaccination the most effective preventive strategy, sustaining this segment's market dominance.

North America Swine Vaccines Market generated USD 650.8 million in 2024 and is expected to reach USD 1.1 billion by 2034, growing at a CAGR of 5.6% between 2025 and 2034. The region's leadership is supported by advanced livestock management practices, robust veterinary healthcare infrastructure, and strong demand for high-quality pork. Major commercial swine operations, frequent outbreaks of contagious diseases, and the presence of leading animal health companies drive vaccine adoption and reinforce North America's dominant market position.

Key players operating in the Global Swine Vaccines Market include Addison Biological Laboratory, Bioveta, a.s., Boehringer Ingelheim, Ceva Sante Animale, Colorado Serum Company, Elanco Animal Health Incorporated, HIPRA S.A., Indian Immunologicals, Merck, biogenesis Bago, Vaxxinova (EW Group), Virbac, and Zoetis. Companies in the Swine Vaccines Market strengthen their presence by investing in research and development to create innovative, high-efficacy vaccines targeting emerging viral and bacterial swine diseases. They expand global reach through strategic partnerships, mergers, and acquisitions, while improving supply chain efficiency to ensure vaccine availability in key regions. Firms focus on educating swine producers about preventive healthcare benefits, optimizing cold chain logistics, and offering value-added services such as herd health monitoring programs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of zoonotic diseases

- 3.2.1.2 Expanding livestock industry and food security concerns

- 3.2.1.3 Advancements in vaccine technology

- 3.2.1.4 Increasing outbreaks of animal diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High R&D costs & long development timelines

- 3.2.2.2 Cold chain infrastructure limitations

- 3.2.2.3 Regulatory complexity & approval delays

- 3.2.3 Market opportunities

- 3.2.3.1 mRNA & next-generation platform adoption

- 3.2.3.2 Thermostable vaccine development

- 3.2.3.3 Combination vaccine innovation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Vaccine technology evolution and innovation

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Live attenuated vaccines

- 5.3 Inactivated/killed vaccines

- 5.4 Viral vector vaccines

- 5.5 mRNA vaccines

- 5.6 Other vaccines

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Bacterial infections

- 6.3 Viral infections

- 6.4 Parasitic infections

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injection vaccines

- 7.3 Oral vaccines

- 7.4 Immersion/spray vaccines

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 UAE

Chapter 10 Company Profiles

- 10.1 Addison Biological Laboratory

- 10.2 Bioveta, a.s.

- 10.3 Boehringer Ingelheim

- 10.4 Ceva Sante Animale

- 10.5 Colorado Serum Company

- 10.6 Elanco Animal Health Incorporated

- 10.7 HIPRA S.A.

- 10.8 Indian Immunologicals

- 10.9 Merck

- 10.10 biogenesis Bago

- 10.11 Vaxxinova (EW Group)

- 10.12 Virbac

- 10.13 Zoetis