PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750600

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750600

High Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

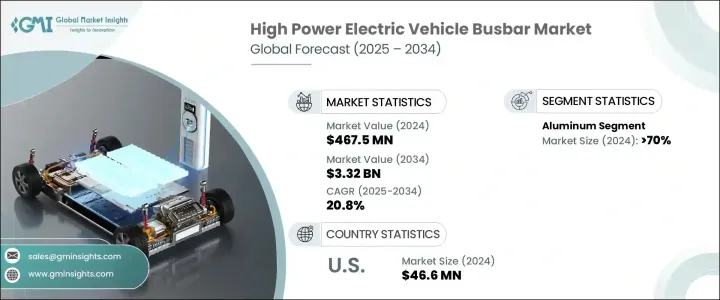

The Global High Power Electric Vehicle Busbar Market was valued at USD 467.5 million in 2024 and is estimated to grow at a CAGR of 20.8% to reach USD 3.32 billion by 2034, driven by the rising adoption of electric vehicles worldwide and the demand for efficient and durable power distribution components, especially high-performance EV busbars. Governments across regions are enforcing strict emission regulations while providing incentives to accelerate EV production and adoption. This regulatory momentum is pushing automakers and suppliers to invest in advanced electric vehicle architecture, with busbars playing a key role in efficient energy transfer within the vehicle's powertrain and battery systems. Urbanization trends and the rise of electric two-wheelers, delivery fleets, and public transit buses expand the market's reach.

High-power EV busbars are essential in managing and directing electric currents between battery cells, drive units, and electronic control systems. Their performance directly impacts the efficiency, safety, and durability of EVs. Innovations in materials-specifically the integration of aluminum and copper-are significantly boosting their reliability and conductivity. Copper is gaining traction due to its superior thermal stability and high electrical conductivity, making it ideal for advanced EV platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $467.5 Million |

| Forecast Value | $3.32 Billion |

| CAGR | 20.8% |

The aluminum segment continues to lead the high-power EV busbar market in volume, accounting for a 70% share in 2024 attributed to its favorable weight, conductivity, and affordability. As automakers prioritize lightweight vehicle designs to improve energy efficiency and range, aluminum emerges as the most practical material for large-scale application in EV power distribution systems. Beyond just its lightness, aluminum offers sufficient thermal and electrical conductivity to meet the performance demands of modern electric vehicles, particularly in commercial and high-volume passenger segments.

United States High Power Electric Vehicle Busbar Market was valued at USD 46.6 million in 2024, driven by the surge in EV sales supported by expansive investments in nationwide charging infrastructure and government-backed incentives aimed at reducing carbon emissions. The increasing integration of fast-charging systems and the growing demand for extended-range EVs drive the need for robust and high-capacity busbar solutions. As North America shifts toward a cleaner transportation ecosystem, advanced electrical components are becoming a priority in consumer and commercial vehicle platforms.

Key players shaping the High Power Electric Vehicle Busbar Market include Weidmuller Interface GmbH & Co. KG, Infineon Technologies AG, Rogers Corporation, EAE Group, Mersen SA, EMS Group, Siemens, Brar Elettromeccanica SpA, TE Connectivity, Amphenol Corporation, Mitsubishi Electric Corporation, Legrand, Schneider Electric, Littelfuse Inc., and EG Electronics. These companies are adopting several strategic approaches to solidify their market position. Efforts include expanding production capabilities, investing in R&D to enhance conductivity and thermal performance, and collaborating with EV manufacturers for integrated design solutions. Many are focusing on lightweight, high-efficiency materials and exploring modular busbar systems to support scalable EV platforms across various vehicle segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1.1 Introduction

- 4.1.2 Strategic dashboard

- 4.1.3 Strategic initiative

- 4.1.4 Company market share

- 4.1.5 Competitive benchmarking

- 4.1.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.3.6 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Singapore

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Israel

- 6.5.4 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 EAE Group

- 7.4 EG Electronics

- 7.5 EMS Group

- 7.6 Infineon Technologies AG

- 7.7 Legrand

- 7.8 Littelfuse, Inc.

- 7.9 Mersen SA

- 7.10 Mitsubishi Electric Corporation

- 7.11 Rogers Corporation

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 TE Connectivity

- 7.15 Weidmuller Interface GmbH & Co. KG