PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766349

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766349

Veterinary Assistive Reproduction Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

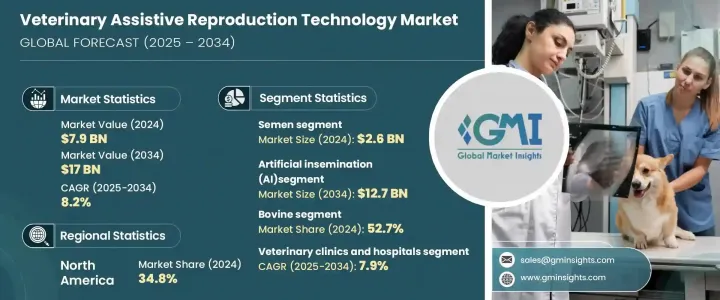

The Global Veterinary Assistive Reproduction Technology Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 17 billion by 2034. This growth is primarily driven by the rising livestock population, an increasing demand for meat and dairy products, and greater investments in the livestock sector. As breeding and genetic improvement in livestock animals become more critical to meeting global food demand, veterinary ART technologies are being adopted to improve reproductive efficiency, herd genetics, and overall productivity. By leveraging superior genetic materials and enhancing breeding cycles, ART helps to boost yields of milk and meat, which in turn supports rising global consumption.

In many countries, governmental support in the form of subsidies and livestock programs further drives the adoption of ART technologies. Additionally, ongoing technological advancements, including cryopreservation, ovum pick-up (OPU), and precision breeding, are improving accessibility to ART, enabling small clinics and large farms alike to benefit from these technologies. Veterinary ART plays an essential role in animal breeding, the conservation of endangered species, and the improvement of livestock health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $17 Billion |

| CAGR | 8.2% |

The semen segment was valued at USD 2.6 billion in 2024. Semen is crucial in artificial insemination (AI) and has become an integral part of selective breeding programs due to its ability to improve herd genetics and avoid diseases associated with natural mating. The adoption of semen-based ART strategies enables farmers and breeders to enhance livestock productivity and profitability. Recent advancements in cryopreservation and semen sexing technologies have made it possible to achieve better breeding results, and innovations in semen quality testing and distribution logistics have bolstered the segment's market position. Furthermore, educational programs, financial incentives, and the growing availability of veterinary services are also supporting the widespread use of semen-based ART in the industry.

Artificial insemination (AI) segment is expected to reach USD 12.7 billion by 2034. AI is widely used in various animal species, particularly in livestock and dairy sectors, for its ability to schedule breeding more effectively, reduce the need for multiple male breeding animals, and extend the reach of genetically superior males to remote locations. The technology has enhanced herd genetics, improved productivity, and increased disease resistance, all of which have led to its widespread acceptance. AI is also considered more cost-effective, and reliable, and carries a lower risk of injury and disease transmission compared to natural breeding, making it a preferred option for farmers and breeders. Government and non-governmental programs designed to boost livestock productivity further accelerate the adoption of AI technologies.

U.S. Veterinary Assistive Reproduction Technology Market was valued at USD 2.5 billion in 2024. The country is a key player in the global veterinary assistive reproduction technology market, driven by a sophisticated veterinary healthcare infrastructure and high adoption of advanced reproductive technologies. Veterinary clinics in the U.S. are equipped with state-of-the-art facilities to perform ART procedures such as AI, embryo transfer, and in vitro fertilization. Commercial breeding operations are increasingly utilizing ART to improve genetic quality and control diseases, leading to better herd health. Additionally, a strong network of suppliers and service providers in the U.S. increases accessibility to ART products and services, propelling market growth.

Key players in the Global Veterinary Assistive Reproduction Technology Market include Minitube Group, IMV Technologies, Genus Plc, CRV Holdings, Bovine Elite, Select Sires, STgenetics, SEMEX, Swine Genetics International, Geno SA, VikingGenetics, and URUS Group. In terms of strategies, companies in the veterinary assistive reproduction technology market focus on expanding their product portfolios and enhancing service offerings to strengthen their market position. Key strategies include developing innovative solutions such as advanced semen cryopreservation techniques, embryo transfer technologies, and precision breeding tools. Partnerships with research institutions and veterinary clinics also play a significant role in increasing the accessibility and effectiveness of ART services, especially in emerging markets. Companies are also investing heavily in educational initiatives, providing training programs for veterinary professionals to improve the overall adoption of these technologies. Furthermore, some companies are focusing on geographical expansion by targeting regions with growing livestock populations and rising demand for meat and dairy products, such as Asia-Pacific and Latin America.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Animal type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for animal breeding

- 3.2.1.2 Advancements in veterinary medicine

- 3.2.1.3 Focus on genetic preservation

- 3.2.1.4 Increasing veterinary healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial setup costs associated with advanced reproductive technologies

- 3.2.2.2 Risk of procedural failures and complications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of genomic selection and precision breeding

- 3.2.3.2 Rising demand for conservation and endangered species breeding

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Artificial insemination (AI)

- 6.3 In vitro fertilization (IVF)

- 6.4 Embryo transfer (MOET)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bovine

- 7.3 Swine

- 7.4 Ovine

- 7.5 Caprine

- 7.6 Equine

- 7.7 Other animal types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Poland

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bovine Elite

- 10.2 CRV Holdings

- 10.3 Geno SA

- 10.4 Genus Plc

- 10.5 IMV Technologies

- 10.6 Minitube Group

- 10.7 SEMEX

- 10.8 Select Sires

- 10.9 Swine Genetics International

- 10.10 STgenetics

- 10.11 URUS Group

- 10.12 VikingGenetics