PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822664

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822664

Car Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

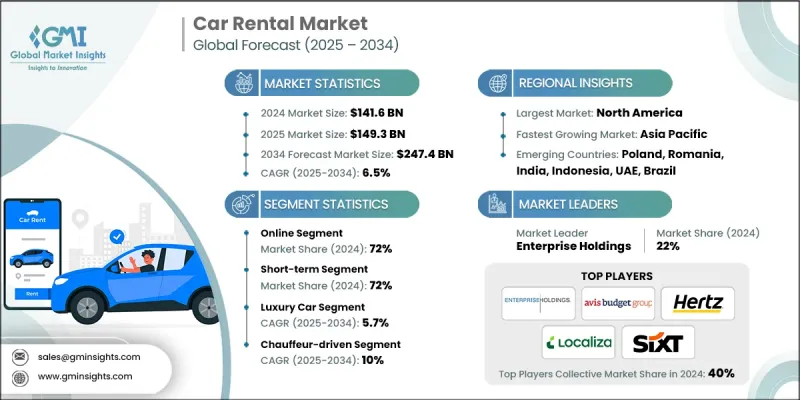

The global car rental market was estimated at USD 141.6 billion in 2024 and is expected to grow from USD 149.3 billion in 2025 to USD 247.4 billion by 2034 at a CAGR of 6.5%, according to the latest report published by Global Market Insights Inc.

The steady growth in domestic and international travel is a significant driver of the car rental market. As more people explore new destinations for leisure or business, the need for flexible and convenient transportation solutions rises. Rental cars offer travelers the freedom to explore at their own pace without relying on public transit schedules or costly taxis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $141.6 Billion |

| Forecast Value | $247.4 Billion |

| CAGR | 6.5% |

Rising Demand in the Online Segment

The online segment held a notable share in 2024, driven by offering customers seamless, convenient booking experiences through websites and mobile apps. This segment benefits from rising internet penetration and smartphone usage, allowing users to compare prices, select vehicles, and manage reservations in real time. Companies are investing heavily in digital platforms to enhance user interface, integrate AI-driven personalization, and provide instant customer support.

Increasing Prevalence of Short-Term Rentals

The short-term car rental segment generated significant revenues in 2024, backed by travelers and urban customers seeking flexible, short-duration vehicle use without the burden of ownership. This segment's growth, driven by increasing tourism and business travel, is supported by rising consumer preference for convenience and affordability. Rentals spanning from a few hours to several days allow users to meet immediate transportation needs efficiently. Market players focus on offering competitive pricing, diverse fleet options, and quick vehicle access to capture this segment.

Increasing Adoption of Luxury Cars

The luxury car rental segment held a sizeable share in 2024, propelled by growing disposable incomes and rising demand for premium experiences among affluent consumers. Luxury rentals offer advanced features, superior comfort, and brand prestige, attracting customers who prioritize status and exclusivity. Rental companies are strengthening their market foothold by partnering with luxury car manufacturers, offering personalized services, and leveraging digital platforms for targeted marketing to upscale clientele.

North America to Emerge as a Lucrative Region

North America car rental market will witness robust growth through 2034, driven by a combination of rising domestic travel, expanding business sectors, and technological innovation. Companies are leveraging data analytics and mobile technology to enhance customer experience, optimize fleet management, and introduce contactless rentals. Strategic collaborations with ride-sharing platforms and the introduction of electric vehicles in rental fleets are further strengthening market positions.

Major players in the car rental market are Movida, Advantage Rent-a-car, Uber, Sixt, Europcar, CAR Inc., Hertz, Localiza, Avis Budget Group, and Enterprise Holdings.

Companies operating in the car rental market are implementing a range of strategic initiatives to strengthen their market position and meet evolving customer expectations. A major focus is on digital transformation, with investments in mobile apps, online booking platforms, and AI-powered customer service tools to enhance convenience and streamline the rental experience. Many firms are expanding their vehicle fleets, offering a wider variety of options-from economy to luxury and electric vehicles-to cater to different customer segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 GMI proprietary AI system

- 1.1.3.1 AI-Powered research enhancement

- 1.1.3.2 Source consistency protocol

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimation

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Booking

- 2.2.3 Rental length

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising tourism & business travel

- 3.2.1.2 Shift from ownership to access

- 3.2.1.3 Digital platforms & contactless rentals

- 3.2.1.4 Sustainability push

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High fleet maintenance & depreciation costs

- 3.2.2.2 Regulatory & competitive pressures

- 3.2.3 Market opportunities

- 3.2.3.1 Subscription & MaaS Integration

- 3.2.3.2 Emerging markets growth

- 3.2.3.3 Corporate partnerships

- 3.2.3.4 Technology differentiation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

- 3.13 Revenue optimization and ancillary services

- 3.13.1 Revenue Per Vehicle (RPV) Analysis and Benchmarking

- 3.13.1.1 RPV: vehicle category, location type, and season

- 3.13.1.2 Geographic RPV variations and market dynamics

- 3.13.1.3 Corporate vs. Leisure segment RPV comparison

- 3.13.1.4 Historical RPV trends and future projections

- 3.13.2 Ancillary revenue streams and upselling strategies

- 3.13.2.1 GPS and navigation system revenue contribution

- 3.13.2.2 Insurance and protection product sales

- 3.13.2.3 Fuel service and convenience fees

- 3.13.2.4 Accessories and equipment rental revenue

- 3.13.2.5 Upgrade and premium service revenue

- 3.13.3 Dynamic pricing and revenue management

- 3.13.3.1 AI-powered pricing optimization and performance

- 3.13.3.2 Demand forecasting accuracy and revenue impact

- 3.13.3.3 Competitive pricing intelligence and response strategies

- 3.13.3.4 Seasonal and event-based pricing strategies

- 3.13.4 Cross-selling and customer value enhancement

- 3.13.4.1 Loyalty program revenue and customer retention

- 3.13.4.2 Corporate account expansion and service integration

- 3.13.4.3 Digital platform monetization and commission revenue

- 3.13.4.4 Hotel and travel service partnerships

- 3.13.1 Revenue Per Vehicle (RPV) Analysis and Benchmarking

- 3.14 Customer acquisition and lifetime value analysis

- 3.14.1 Customer acquisition cost (CAC) by channel and segment

- 3.14.1.1 Digital marketing CAC and conversion rates

- 3.14.1.2 Traditional advertising and partnership channel costs

- 3.14.1.3 Corporate account acquisition investment and ROI

- 3.14.1.4 Referral program effectiveness and cost analysis

- 3.14.2 Customer lifetime value (LTV) modeling and segmentation

- 3.14.2.1 LTV by customer type and rental frequency

- 3.14.2.2 Corporate vs. Leisure customer value comparison

- 3.14.2.3 Geographic LTV variations and market characteristics

- 3.14.2.4 Loyalty program impact on LTV enhancement

- 3.14.3 Customer retention and churn analysis

- 3.14.3.1 Retention rate by customer segment and service level

- 3.14.3.2 Churn prediction and prevention strategies

- 3.14.3.3 Service recovery and customer win-back programs

- 3.14.3.4 Net promoter score (NPS) impact on retention and growth

- 3.14.1 Customer acquisition cost (CAC) by channel and segment

- 3.15 Insurance and risk management analysis

- 3.15.1 Insurance cost structure and management strategies

- 3.15.2 Vehicle damage and loss prevention

- 3.15.3 Fraud prevention and security measures

- 3.15.4 Liability management and legal compliance

- 3.16 Fleet lifecycle and asset management

- 3.16.1 Vehicle procurement and acquisition strategy

- 3.16.1.1 OEM partnership and volume negotiation strategies

- 3.16.1.2 Purchase vs. Lease decision framework and financial impact

- 3.16.1.3 Fleet mix optimization and demand alignment

- 3.16.1.4 New vs. Used vehicle integration and cost analysis

- 3.16.2 Fleet utilization and performance optimization

- 3.16.2.1 Geographic fleet allocation and demand balancing

- 3.16.2.2 Seasonal fleet management and capacity planning

- 3.16.2.3 Vehicle rotation and location transfer optimization

- 3.16.3 Vehicle maintenance and lifecycle management

- 3.16.3.1 Preventive maintenance program optimization

- 3.16.3.2 Maintenance cost analysis and vendor management

- 3.16.3.3 Vehicle downtime minimization and service efficiency

- 3.16.3.4 Technology integration for predictive maintenance

- 3.16.4 Residual value management and disposal strategy

- 3.16.4.1 Resale value optimization and market timing

- 3.16.4.2 Wholesale vs. Retail disposal channel performance

- 3.16.4.3 Vehicle condition and refurbishment investment

- 3.16.4.4 Disposal cost management and revenue maximization

- 3.16.1 Vehicle procurement and acquisition strategy

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Service quality and customer satisfaction benchmarking

- 4.8 Location strategy and market coverage analysis

- 4.9 Brand positioning and marketing effectiveness comparison

Chapter 5 Market Estimates & Forecast, By Booking, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Online

- 5.3 Offline

Chapter 6 Market Estimates & Forecast, By Rental length, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Short term

- 6.3 Long term

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Luxury cars

- 7.3 Executive cars

- 7.4 Economy cars

- 7.5 SUVs

- 7.6 MUVs

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Leisure/ Tourism

- 8.3 Business

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Self-driven

- 9.3 Chauffeur-driven

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Alamo Rent-a-Car

- 11.1.2 Avis Budget Group

- 11.1.3 eHi Car Services

- 11.1.4 Enterprise Holdings

- 11.1.5 Europcar

- 11.1.6 Hertz Global Holdings

- 11.1.7 Localiza

- 11.1.8 Sixt

- 11.1.9 Uber Technologies

- 11.1.10 Zipcar

- 11.2 Regional companies

- 11.2.1 Advantage Rent A Car

- 11.2.2 CAR Inc.

- 11.2.3 Fox Rent A Car

- 11.2.4 Green Motion

- 11.2.5 Movida

- 11.2.6 Payless Car Rental

- 11.2.7 Rent-A-Wreck

- 11.2.8 Thrifty Car Rental

- 11.2.9 U-Save Car & Truck Rental

- 11.3 Emerging players

- 11.3.1 Book2wheel

- 11.3.2 Drivezy

- 11.3.3 Fluid Truck

- 11.3.4 Getaround

- 11.3.5 Gett

- 11.3.6 HyreCar

- 11.3.7 Maven

- 11.3.8 Ola Cabs

- 11.3.9 Rent Centric

- 11.3.10 SHARE NOW

- 11.3.11 Turo

- 11.3.12 Zoomcar