PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797859

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797859

Diesel Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

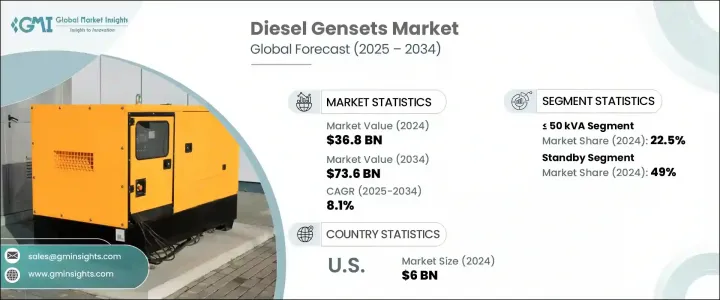

The Global Diesel Gensets Market was valued at USD 36.8 billion in 2024 and is anticipated to grow at a CAGR of 8.1% to reach USD 73.6 billion by 2034. The expansion of this market is driven by an increasing demand for reliable backup power across residential, commercial, and industrial sectors, particularly in regions with unstable or frequently interrupted power grids. Diesel gensets are crucial in these areas, providing immediate power restoration and ensuring the continuity of services in sectors like telecom, healthcare, and infrastructure. As stricter environmental regulations come into play, manufacturers are incorporating automation, remote monitoring, and features aimed at reducing emissions. In response to sustainability concerns, hybrid systems that combine diesel with renewable energy sources, such as solar or battery storage, are gaining traction. This shift is making diesel gensets more viable in environmentally sensitive regions, offering both reliability and lower environmental impact. In the Asia-Pacific region, the diesel genset market is experiencing growth, particularly in urban and rural areas suffering from frequent power outages.

Investments in critical infrastructure like roads, hospitals, and data centers are significantly driving the demand for reliable backup power solutions. As governments and private sectors continue to focus on expanding and modernizing infrastructure, there is an increasing need for a continuous power supply to support these vital operations. Roads and transportation networks require uninterrupted power for traffic management systems, signaling, and emergency services. Hospitals depend on backup power to ensure life-saving equipment remains operational during power outages, especially in critical care units or emergency rooms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.8 Billion |

| Forecast Value | $73.6 Billion |

| CAGR | 8.1% |

The diesel genset market for units between >50 kVA and 125 kVA is expected to grow at a CAGR of 7.5% through 2034. These systems are becoming increasingly popular among small to medium-sized businesses, healthcare institutions, and construction sites. They are particularly valued for their ability to provide uninterrupted power during grid disruptions, ensuring that critical services and operations continue without delay.

The standby diesel genset segment held a 49% share in 2024 and is expected to grow at a 7.5% CAGR until 2034. This segment's rise is attributed to the growing need for reliable backup power in essential sectors such as healthcare, commercial infrastructure, and data centers. As concerns over grid reliability intensify-especially due to extreme weather events and natural disasters-businesses are prioritizing backup systems to mitigate downtime and ensure operational continuity. Standby diesel gensets are the preferred choice in these sectors, providing quick power restoration in times of need.

U.S. Diesel Gensets Market held 85.9% share in 2024, generating USD 6 billion. The demand for backup power solutions is driven by increasing concerns about grid reliability, frequent weather-related disruptions, and aging infrastructure. Industrial and commercial facilities are investing in diesel gensets to ensure business continuity during outages. Moreover, the growing integration of renewable energy sources has spurred interest in hybrid power systems, with diesel gensets serving as reliable supplemental power sources.

Top companies in the Global Diesel Gensets Market include Cummins, Caterpillar, Aggreko, Rolls-Royce, and Generac Power Systems. To solidify their market presence, companies in the diesel genset industry are focusing on several key strategies. Many are investing heavily in technological advancements, such as automation and remote monitoring, which allow users to monitor and control gensets more efficiently, improving operational efficiency. Companies are also prioritizing sustainability by incorporating emissions-reduction features and developing hybrid systems that combine diesel with renewable energy sources like solar and battery storage. This innovation not only reduces carbon footprints but also enhances product appeal in environmentally conscious markets. Additionally, players in the industry are expanding their product portfolios to cater to a broader range of customers, from small businesses to large-scale industrial operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East

- 4.2.5 Africa

- 4.2.6 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Standby

- 7.3 Peak shaving

- 7.4 Prime/continuous

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Aggreko

- 9.2 Ashok Leyland

- 9.3 Atlas Copco

- 9.4 Captiva Energy Solutions Private Limited

- 9.5 Caterpillar

- 9.6 Cooper Corp.

- 9.7 Cummins, Inc.

- 9.8 Deere & Company

- 9.9 FG Wilson

- 9.10 Generac Power Systems, Inc.

- 9.11 Greaves Cotton Limited

- 9.12 HIMOINSA

- 9.13 J C Bamford Excavators Ltd.

- 9.14 Kirloskar

- 9.15 Rehlko

- 9.16 Mahindra POWEROL

- 9.17 Mitsubishi Heavy Industries, Ltd.

- 9.18 Powerica Limited

- 9.19 Rapid Power Generation Ltd.

- 9.20 Rolls-Royce plc

- 9.21 Siemens

- 9.22 Sterling and Wilson Pvt. Ltd.

- 9.23 Sudhir Power Ltd.

- 9.24 Supernova Genset

- 9.25 Wartsila

- 9.26 Yamaha Motor Co., Ltd.