PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822602

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822602

Self-Monitoring Blood Glucose Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

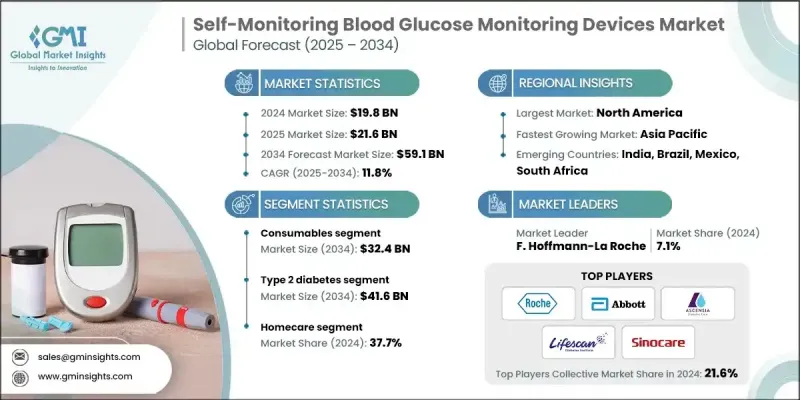

The global self-monitoring blood glucose monitoring devices market was estimated at USD 19.8 billion in 2024 and is expected to grow from USD 21.6 billion in 2025 to USD 59.1 billion in 2034, at a CAGR of 11.8%, according to the latest report published by Global Market Insights Inc.

The global surge in type 1 and type 2 diabetes cases, particularly in emerging markets, is driving demand for convenient and reliable SMBG devices for daily glucose tracking. As sedentary lifestyles, unhealthy diets, and rising obesity rates contribute to a higher incidence of diabetes, more individuals are being diagnosed at younger ages and across wider demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.8 Billion |

| Forecast Value | $59.1 Billion |

| CAGR | 11.8% |

Rising Demand for Consumables

The consumables segment held a notable share in 2024, driven by test strips, lancets, and control solutions. As these items are essential for daily monitoring, their demand remains consistently high, driving steady market growth. Test strips dominate consumables sales due to their frequent replacement cycles. As consumers seek more accurate and convenient testing, companies are innovating to produce strips that require smaller blood samples and deliver faster results. The consumables segment's expansion is critical for maintaining patient adherence, and it continues to attract substantial investment from industry players aiming to secure long-term customer loyalty.

Rising Prevalence of Type 2 Diabetes

The type 2 diabetes segment generated significant revenues in 2024, reflecting the global rise in lifestyle-related diabetes cases. Patients with type 2 diabetes often require regular glucose monitoring to manage their condition effectively alongside diet and medication. This segment is growing rapidly as awareness about disease management improves and healthcare providers emphasize the importance of glycemic control in preventing complications. The affordability and ease of use of SMBG devices for type 2 diabetes patients make them indispensable tools.

Homecare to Gain Traction

The homecare segment held a significant share in 2024, driven by the trend toward patient-centered and remote healthcare management. More individuals prefer monitoring their blood glucose levels from the comfort of their homes, motivated by convenience, privacy, and the ongoing expansion of telehealth services. This segment benefits from technological advancements, including smartphone-compatible devices and digital health platforms that enable real-time data sharing with healthcare professionals. Homecare adoption also aligns with the increasing emphasis on chronic disease management outside clinical settings.

Regional Insights

North America to Emerge as a Lucrative Region

North America self-monitoring blood glucose monitoring devices market generated a notable share in 2024. Strong healthcare infrastructure, high diabetes prevalence, and widespread insurance coverage contribute to robust demand for these devices. Consumers in this region prioritize accuracy, convenience, and integration with digital health ecosystems, which has pushed manufacturers to innovate rapidly. Additionally, the presence of major industry players and a well-established regulatory environment ensures high-quality standards and product reliability.

Major players in the self-monitoring blood glucose monitoring devices market are All Medicus, DarioHealth, B. Braun Melsungen, Ypsomed Holding, Sanofi, Bionime Corporation, AgaMatrix, Nova Biomedical, LifeScan, Arkray, Omnis Health, Sinocare, Abbott Laboratories, F. Hoffmann-La Roche, and Ascensia Diabetes Care Holdings.

To strengthen their market foothold, companies in the self-monitoring blood glucose monitoring devices market are focusing heavily on innovation, partnerships, and patient engagement. Product development emphasizes accuracy, ease of use, and connectivity, with many manufacturers launching app-enabled meters that integrate with broader digital health platforms. Strategic collaborations with healthcare providers and insurance companies are expanding device accessibility through reimbursement schemes and bundled care programs. Companies are also investing in educational initiatives to improve patient literacy and adherence, especially in emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes worldwide

- 3.2.1.2 Government initiatives for increasing awareness among people

- 3.2.1.3 Technological advancements of self-monitoring blood glucose monitoring devices in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and accessories in developing countries

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Self-monitoring blood glucose meters

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital

- 7.3 Ambulatory surgical centers

- 7.4 Diagnostic centers

- 7.5 Homecare

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.3.7 Sweden

- 8.3.8 Belgium

- 8.3.9 Denmark

- 8.3.10 Finland

- 8.3.11 Norway

- 8.3.12 Lithuania

- 8.3.13 Latvia

- 8.3.14 Estonia

- 8.3.15 Russia

- 8.3.16 Poland

- 8.3.17 Switzerland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Taiwan

- 8.4.7 Indonesia

- 8.4.8 Vietnam

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.5.5 Chile

- 8.5.6 Peru

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Turkey

- 8.6.5 Egypt

- 8.6.6 Israel

- 8.6.7 Kuwait

- 8.6.8 Qatar

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AgaMatrix

- 9.3 All Medicus

- 9.4 Arkray

- 9.5 Ascensia Diabetes Care Holdings

- 9.6 B. Braun Melsungen

- 9.7 Bionime Corporation

- 9.8 DarioHealth

- 9.9 F. Hoffmann-La Roche

- 9.10 LifeScan

- 9.11 Nova Biomedical

- 9.12 Omnis Health

- 9.13 Sanofi

- 9.14 Sinocare

- 9.15 Ypsomed Holding