PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716521

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716521

Petcoke Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

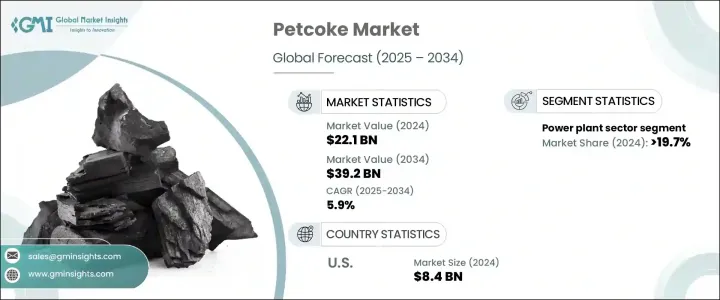

The Global Petcoke Market was valued at USD 22.1 billion in 2024 and is projected to expand at a CAGR of 5.9% from 2025 to 2034. Petcoke, a carbon-rich solid derived from oil refining, remains a key fuel source for industries such as power generation, cement manufacturing, and steel production. Its high calorific value and cost-effectiveness make it a preferred choice over conventional fuels. However, rising environmental concerns and regulatory pressures are prompting industries to explore alternative energy sources. Governments worldwide are implementing stringent policies to curb coal usage due to its adverse environmental impact, particularly high carbon and sulfur emissions. This shift is pushing companies to either adopt cleaner alternatives or implement advanced emission control technologies to continue using petcoke.

The increasing expansion of refinery capacities is a crucial factor contributing to the growing availability of petcoke. As more crude oil is refined, higher volumes of petcoke are produced as a byproduct of processing heavy oil. Additionally, the steady demand from cement and steel industries further propels market growth. These industries rely on petcoke for its affordability and high energy output, ensuring a consistent demand for the material.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.1 Billion |

| Forecast Value | $39.2 Billion |

| CAGR | 5.9% |

The petcoke market is segmented into fuel-grade and calcined petcoke. Fuel-grade petcoke holds a dominant share due to its widespread use in cement plants, power stations, and steel production facilities. It remains a cost-effective alternative to coal despite concerns regarding its high sulfur and metal content.

Market segmentation by application includes power plants, cement, steel, and aluminum industries, among others. In 2024, the power plant sector accounted for over 19.7% of the total petcoke market share, highlighting its critical role in energy production. Thermal power plants continue to rely on petcoke, especially in regions where cleaner fuels are not readily accessible.

The U.S. petcoke market has experienced notable growth, with valuations of USD 8 billion in 2022, USD 8.2 billion in 2023, and USD 8.4 billion in 2024. The expanding steel and power industries drive this demand, capitalizing on petcoke's economic advantages, high energy yield, and role as a carbon source in blast furnaces. In 2024, U.S. consumption reached 54.4 million metric tonnes, primarily for these industrial applications. The cost-efficiency of petcoke compared to natural gas and coal remains a key factor supporting its sustained demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Grade, 2021 - 2034 (MT, USD Million)

- 5.1 Key trends

- 5.2 Fuel grade

- 5.3 Calcined petcoke

Chapter 6 Market Size and Forecast, By Physical Form, 2021 - 2034 (MT, USD Million)

- 6.1 Key trends

- 6.2 Sponge coke

- 6.3 Purge coke

- 6.4 Shot coke

- 6.5 Needle coke

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (MT, USD Million)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Cement industry

- 7.4 Steel industry

- 7.5 Aluminum industry

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (MT, USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Greece

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Turkey

- 8.5.3 Kuwait

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Mexico

Chapter 9 Company Profiles

- 9.1 BP

- 9.2 Chevron Corporation

- 9.3 Exxon Mobil

- 9.4 HF Sinclair Corporation

- 9.5 Husky Energy

- 9.6 Marathon Petroleum Corporation

- 9.7 Oxbow Corporation

- 9.8 Phillips 66 Company

- 9.9 Reliance Industries

- 9.10 Saudi Aramco

- 9.11 Shell plc

- 9.12 Valero Energy Corp

- 9.13 Indian Oil Corporation

- 9.14 Rosneft

- 9.15 TotalEnergies