PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699368

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699368

North America Carpet and Rug Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

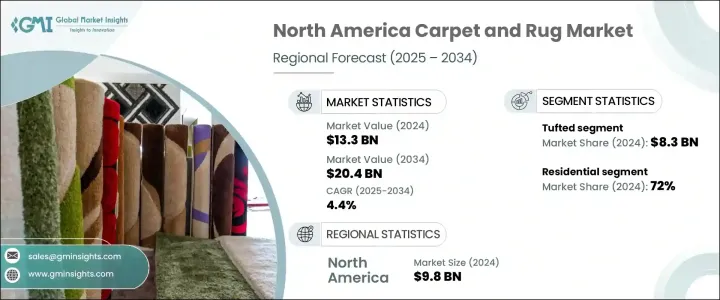

North America Carpet And Rug Market was valued at USD 13.3 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. This steady growth reflects the increasing demand for carpets and rugs as homeowners and businesses prioritize aesthetics, comfort, and sustainability in their interior spaces. Renovation and remodeling projects are on the rise across the region, further fueling market expansion. With urbanization and population growth leading to the development of new residential and commercial properties, the demand for stylish, durable, and eco-friendly flooring solutions continues to surge.

Consumers are shifting their preferences toward sustainable and low-maintenance flooring options, pushing manufacturers to incorporate recycled materials and plant-based fibers in carpet and rug production. The rising emphasis on sustainability aligns with growing environmental concerns, prompting leading brands to introduce eco-friendly product lines without compromising style or durability. Additionally, advancements in textile technology have resulted in innovative designs, stain-resistant fabrics, and water-repellent finishes, making carpets and rugs a preferred choice for modern interiors. As economic conditions improve, higher disposable incomes are also driving purchases of high-end and custom-designed carpets, particularly in the luxury segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 4.4% |

The market is categorized into various product types, including woven, tufted, knotted, needle-punched, flat-weave, and others. Among these, the tufted segment emerged as the largest in 2024, generating USD 8.3 billion in revenue. Known for its affordability, durability, and versatile designs, tufted carpets continue to dominate consumer demand. The knotted segment, recognized for its intricate craftsmanship and aesthetic appeal, is expected to grow at a CAGR of 4.9% between 2025 and 2034, driven by increasing interest in artisanal and handcrafted decor. Manufacturers are leveraging this trend by introducing premium knotted collections that blend traditional techniques with contemporary patterns, appealing to both residential and commercial buyers.

In terms of application, the North American carpet and rug market is divided into residential and commercial segments. Residential applications accounted for 72% of the total market share in 2024, largely due to the growing popularity of home renovation projects. As homeowners look for energy-efficient solutions, wall-to-wall carpeting has gained traction for its insulation properties, helping reduce heating costs while enhancing comfort. Meanwhile, eco-conscious consumers are driving demand for carpets made from natural fibers, recycled polyester, and other sustainable materials. The commercial sector is also witnessing significant growth, with businesses investing in high-quality carpets that complement their brand aesthetics. Offices, hotels, and retail spaces are embracing specialized collections designed to withstand heavy foot traffic while adding a sophisticated touch to interiors.

The United States remains the dominant player in the North American carpet and rug market, holding a substantial 74% share in 2024, equivalent to USD 9.8 billion. This market leadership is attributed to increased consumer spending on home improvements, a strong real estate sector, and rising awareness of sustainable products. Urban expansion and the surge in renovation activities further bolster demand, positioning the U.S. as the epicenter of innovation in carpet and rug manufacturing. Leading companies are continuously enhancing product offerings, integrating advanced materials, and developing eco-friendly alternatives to meet evolving consumer expectations in the competitive flooring industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2018 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising trend of home renovations

- 3.2.1.2 Growing urbanization

- 3.2.1.3 Growing environmental sustainability

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Shifting preference towards hard flooring

- 3.2.2.2 Rising cost of raw materials and transportation

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2032, (USD Billion) (Million Square Meters)

- 5.1 Key trends

- 5.2 Woven

- 5.3 Tufted

- 5.4 Knotted

- 5.5 Needle-punched

- 5.6 Flat-Weave

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2032, (USD Billion) (Million Square Meters)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Wool

- 6.4 Silk

- 6.5 Polyester

- 6.6 Acrylic

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2032, (USD Billion) (Million Square Meters)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2032, (USD Million) (Million Square Meters)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Country, 2021 – 2032, (USD Billion) (Million Square Meters)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Balta Group

- 10.2 Beaulieu International Group

- 10.3 Bentley Mills, Inc.

- 10.4 Engineered Floors LLC

- 10.5 Interface, Inc.

- 10.6 J&J Flooring Group

- 10.7 Mannington Mills, Inc.

- 10.8 Masland Carpets

- 10.9 Milliken & Company

- 10.10 Mohawk Industries, Inc.

- 10.11 Oriental Weavers Group

- 10.12 Shaw Industries Group, Inc.

- 10.13 Stark Carpet Corp.

- 10.14 Tarkett S.A.

- 10.15 The Dixie Group, Inc.