PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699307

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699307

Commercial Voltage Regulator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

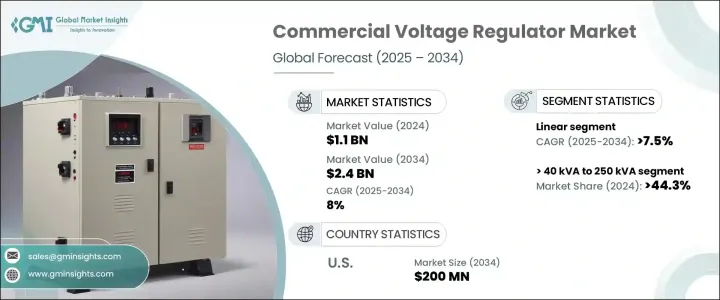

The Global Commercial Voltage Regulator Market reached USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 8% from 2025 to 2034. The growth is driven by the rising emphasis on power quality management and the increasing need to protect precision equipment. Businesses worldwide are investing in advanced power stabilization technologies to prevent disruptions and ensure seamless operations. The growing reliance on AI-driven voltage stabilization is further revolutionizing the industry, offering improved efficiency, automation, and reliability in energy management systems. Governments are also playing a critical role in promoting energy efficiency, encouraging the adoption of voltage regulators to optimize energy consumption and reduce operational costs. The transition toward digital and programmable voltage regulation systems is enhancing power stability across industries, fostering market expansion.

The increasing demand for high-performance voltage regulation solutions is propelling the adoption of both linear and switching regulators. Market segmentation by product highlights the expanding footprint of these advanced power management solutions. Linear voltage regulators, known for their precision and low-noise operation, are gaining traction in industries requiring high accuracy, such as medical technology, telecommunications, and aerospace. This segment is expected to witness a CAGR of 7.5% through 2034, underscoring its critical role in maintaining a stable voltage supply in sensitive applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 8% |

Voltage-based segmentation categorizes the market into three key groups: <= 40 kVA, > 40 kVA to 250 kVA, and > 250 kVA. Among these, the > 40 kVA to 250 kVA segment held a dominant 44.3% market share in 2024, highlighting the increasing reliance on medium-scale power solutions. The expansion of commercial infrastructure, particularly in sectors such as healthcare and data centers, is accelerating demand for these regulators. With businesses prioritizing uninterrupted power supply and efficient energy distribution, investments in power infrastructure continue to rise, strengthening market penetration across commercial applications. The growing digitalization of commercial spaces, coupled with the heightened dependency on electrical systems, is expected to sustain robust growth in this segment.

The U.S. commercial voltage regulator market is also witnessing strong expansion, with market size reaching USD 110.4 million in 2024 and expected to surpass USD 200 million by 2034. The country's rapid development of data centers and healthcare facilities is fueling demand for stable and efficient power distribution solutions. Government initiatives and funding programs aimed at improving energy efficiency are further driving industry advancements. The increasing need for uninterrupted energy supply, along with innovations in AI-driven voltage stabilization, is positioning the U.S. market for sustained growth over the next decade. Businesses across the region are investing in cutting-edge voltage regulation solutions to enhance operational reliability, reduce energy wastage, and ensure long-term sustainability in power management.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Linear

- 5.3 Switching

Chapter 6 Market Size and Forecast, By Phase, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 ≤ 40 kVA

- 7.3 > 40 kVA to 250 kVA

- 7.4 > 250 kVA

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 New Zealand

- 8.4.7 Malaysia

- 8.4.8 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 South Africa

- 8.5.6 Nigeria

- 8.5.7 Kuwait

- 8.5.8 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Analog Devices

- 9.2 Basler Electric Company

- 9.3 Eaton

- 9.4 General Electric

- 9.5 Hindustan Power Control System

- 9.6 Infineon Technologies AG

- 9.7 Legrand

- 9.8 MaxLinear

- 9.9 Microchip Technology Inc.

- 9.10 NXP Semiconductors

- 9.11 Renesas Electronics Corporation

- 9.12 Ricoh USA

- 9.13 Selvon Instruments

- 9.14 SEMTECH

- 9.15 Siemens Energy

- 9.16 Sollatek

- 9.17 STMicroelectronics

- 9.18 TOREX SEMICONDUCTOR

- 9.19 Vicor

- 9.20 Vishay Intertechnology, Inc.