PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928952

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928952

Gaming Merchandise Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

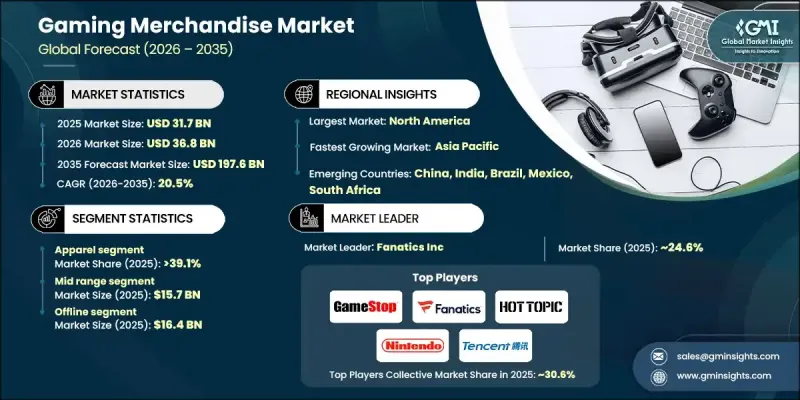

The Global Gaming Merchandise Market was valued at USD 31.7 billion in 2025 and is estimated to grow at a CAGR of 20.5% to reach USD 197.6 billion by 2035.

This sharp growth reflects the steady enlargement of the global gaming audience and the deeper cultural influence of gaming entertainment worldwide. As gaming continues to integrate into everyday lifestyles, consumer engagement increasingly extends beyond interactive experiences into the purchase of branded physical products. Merchandise has become a key channel through which fans express personal identity, brand affinity, and long-term loyalty. The growing acceptance of gaming across age groups and geographies is driving demand for lifestyle-oriented products associated with well-known game brands. As the gaming ecosystem matures, merchandise purchasing behavior is evolving into a mainstream consumer trend rather than a niche activity. Rising fan communities, increased digital exposure, and stronger emotional attachment to game universes are supporting sustained demand. This momentum is transforming gaming merchandise into a high-growth consumer category, supported by continuous innovation, broader distribution, and expanding global reach.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $31.7 Billion |

| Forecast Value | $197.6 Billion |

| CAGR | 20.5% |

The apparel category accounted for 39.1% share in 2025, making it the largest product segment. Demand is being driven by strong interest in branded clothing and lifestyle wear associated with gaming culture. Fashion-forward designs, brand visibility, and wider retail accessibility continue to support adoption, reinforcing apparel's leading position within the market.

The mid-range price segment generated USD 15.7 billion in 2025. This segment benefits from offering an optimal balance between cost and perceived quality, appealing to a broad consumer base. Products in this range align well with mainstream purchasing behavior, supporting consistent sales volumes across multiple merchandise categories.

North America Gaming Merchandise Market represented 35.5% share in 2025, positioning it as the leading regional market. Strong consumer engagement, established digital commerce channels, and high brand awareness are driving demand. The region continues to see strong interest in branded merchandise that reflects gaming-related lifestyle preferences.

Key companies active in the Global Gaming Merchandise Market include Nintendo, Funko, Sony Interactive Entertainment, Microsoft Gaming, Bandai Namco, Fanatics, Inc., Ubisoft, LEGO Group, Activision Blizzard, Hasbro, Inc., Razer, Logitech G, Square Enix Store, NetEase, Electronic Arts, Take-Two Interactive, Tencent Holdings, SteelSeries, GameStop Corp., Hot Topic, Inc., Insert Coin Clothing, Fangamer, Loot Crate, LLC, Numskull Designs, J!NX, LLC, Bioworld Merchandising, Capcom Store, Gamerabilia, Amazon, and independent Etsy sellers. Companies operating in the Global Gaming Merchandise Market are strengthening their positions through brand partnerships, diversified product lines, and direct-to-consumer sales strategies. Many players are focusing on limited-edition releases and exclusive collections to increase brand value and customer engagement. Expanding e-commerce capabilities and leveraging global distribution networks remain central priorities. Collaborations with designers and content creators are used to align merchandise with evolving consumer tastes. Firms are also investing in data-driven marketing to understand fan preferences and optimize product launches.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Products trends

- 2.2.2 Price Range trends

- 2.2.3 Distribution trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2026-2035 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid growth of global gaming communities across PC, console, and mobile platforms.

- 3.2.1.2 Expansion of esports leagues and live gaming events

- 3.2.1.3 Strong fan engagement with game franchises is increasing demand for licensed and limited-edition products.

- 3.2.1.4 Rising influence of streamers and gaming influencers is accelerating merchandise visibility and direct-to-consumer sales.

- 3.2.1.5 Growth of e-commerce and online marketplaces is improving global accessibility to gaming merchandise.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High licensing and royalty costs.

- 3.2.2.2 Limited retail presence in emerging markets restricts offline merchandise sales.

- 3.2.3 Market opportunities

- 3.2.4 Integration of gaming merchandise with fashion and lifestyle brands.

- 3.2.5 Rising demand for sustainable and eco-friendly gaming apparel presents differentiation opportunities.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2022-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2026-2035)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 (USD Billion)

- 5.1 Key trends,

- 5.2 Apparel

- 5.3 Accessories

- 5.4 Collectibles

- 5.5 Gaming Peripherals

- 5.6 Home Decor

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Price Range, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 High-end

- 6.3 Mid-range

- 6.4 Low-cost

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Billion)

- 8.1 Key trends, by region

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Rest of Europe

- 8.4 Asia-Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Rest of Asia-Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.3 Rest of Latin America

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Activision Blizzard

- 9.2 Amazon

- 9.3 Bandai Namco

- 9.4 Bioworld Merchandising

- 9.5 Capcom Store

- 9.6 Electronic Arts (EA)

- 9.7 Etsy Sellers

- 9.8 Fanatics, Inc.

- 9.9 Fangamer

- 9.10 Funko, Inc.

- 9.11 Gamerabilia

- 9.12 GameStop Corp.

- 9.13 Insert Coin Clothing

- 9.14 Hasbro, Inc.

- 9.15 Hot Topic, Inc.

- 9.16 J!NX, LLC

- 9.17 LEGO Group

- 9.18 Logitech G

- 9.19 Loot Crate, LLC

- 9.20 Microsoft Gaming

- 9.21 NetEase

- 9.22 Nintendo

- 9.23 Numskull Designs

- 9.24 Razer

- 9.25 Sony Interactive Entertainment

- 9.26 Square Enix Store

- 9.27 SteelSeries

- 9.28 Take-Two Interactive

- 9.29 Tencent Holdings

- 9.30 Ubisoft