PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740970

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740970

Tube Filling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

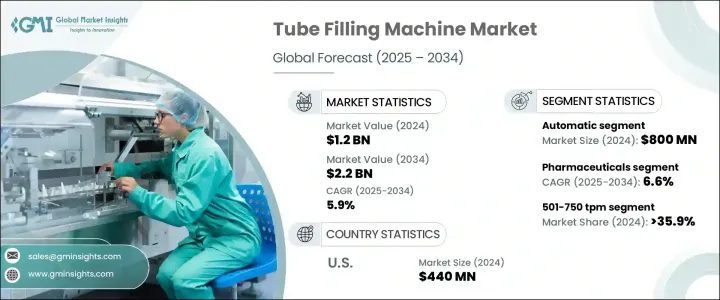

The Global Tube Filling Machine Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 2.2 billion by 2034. This growth is fueled by the increasing demand for automation across industries, as well as advancements in packaging technology. The consumer goods sector, in particular, is driving this shift as businesses seek to adopt more precise, efficient, and scalable manufacturing processes. Tube filling machines are critical in meeting these demands, offering flexibility in packaging a wide range of products, including personal care items, pharmaceuticals, and food products. These machines not only improve production efficiency but also minimize waste by ensuring precise filling, ultimately reducing operational costs over time. Additionally, the rising consumer preference for hygienic, single-dose, and portable packaging solutions is contributing to the growing demand for tube-filling systems. This trend is evident across various sectors, including food and beverages, where portion-controlled dressings and single-serve toothpaste are becoming increasingly popular. As the demand for tube-packaged products grows, the market for tube filling machines is expanding in response.

In 2024, the automatic tube filling machine segment generated a revenue of USD 800 million and is expected to experience a CAGR of 6.2% through 2034. The shift toward automation is gaining momentum, particularly in industries like food, pharmaceuticals, and cosmetics, where high-speed, high-volume production is essential. Automatic tube filling machines play a key role in enhancing production efficiency by minimizing human interaction during processes like filling, sealing, and labeling. This not only ensures a faster production pace but also improves consistency and reduces errors. These machines are equipped with advanced features, such as automatic tube feeding and precise filling control, which help manufacturers achieve higher productivity and lower labor costs. The growing adoption of automated systems is also fueled by innovations that allow these machines to handle a wide range of tube sizes and materials, further boosting their appeal in various sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.9% |

The pharmaceutical sector alone generated USD 500 million in revenue from tube filling machines in 2024, with an expected CAGR of 6.6% through 2034. The demand for tube filling machines is particularly strong in the pharmaceutical industry, where the need for precise and sterile packaging is critical. Tube filling machines ensure that products such as creams, ointments, and gels are filled accurately in sterile environments, which is crucial for maintaining product quality and safety. The adoption of fully automated systems in pharmaceutical manufacturing has streamlined operations, reduced the risk of contamination, and improved overall production efficiency. As the industry continues to prioritize safety and quality, tube filling machines are evolving to meet stricter regulatory standards and consumer expectations.

The 501-750 tubes per minute (tpm) segment accounted for more than 35.9% of the tube filling machine market in 2024 and is expected to grow at a rate of 6.1% until 2034. This segment is favored due to its ability to accommodate a broad range of products, tube sizes, and viscosities, making it ideal for companies that produce various products or are planning to introduce new items to the market. The 501-750 tpm machines strike a balance between production capacity and cost efficiency, offering an attractive option for mid-sized businesses looking to optimize their tube-filling operations. While high-capacity machines offer faster throughput, they come with a significant price tag, which can be prohibitive for some companies. In contrast, the 501-750 tpm machines are economically viable and offer improved production without requiring excessive resources.

North America, particularly the United States, leads the market with a valuation of USD 440 million in 2024 and is expected to grow at a CAGR of 7% from 2025 to 2034. The U.S. has a large and highly automated consumer packaged goods industry, which is heavily reliant on tube filling machines for packaging products like toiletries, cosmetics, and medicines. Automation in manufacturing is a key driver in the region, with companies increasingly investing in robotic tube filling systems that offer automatic loading, filling, sealing, and coding of tubes. These automated systems are integral to increasing production efficiency and reducing labor costs.

Several key players dominate the tube filling machine industry, holding 15-20% of the market share. To maintain a competitive edge, these companies are focusing on research and development and product innovation. There is also a growing trend toward sustainability, with some manufacturers prioritizing eco-friendly machine designs to reduce environmental impact. With the ongoing advancements in automation and sustainability, the tube filling machine market is set to continue expanding, offering businesses the tools they need to meet the growing demand for high-quality, efficiently packaged products across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Pricing analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Manufacturers

- 3.9 Distributors

- 3.10 Retailers

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Automation across industries

- 3.11.1.2 Technological advancement in packaging industry

- 3.11.1.3 The expanding pharmaceutical and cosmetics industries

- 3.11.1.4 Integration of Industry 4.0 technologies

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High-cost investment

- 3.11.2.2 Regular maintenance

- 3.11.1 Growth drivers

- 3.12 Technology & innovation landscape

- 3.13 Growth potential analysis

- 3.14 Regulatory landscape

- 3.15 Pricing analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Semi-automatic

- 5.3 Automatic

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 250 tpm

- 6.3 251-500 tpm

- 6.4 501-750 tpm

- 6.5 Above 750 tpm

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceutical

- 7.3 Cosmetics

- 7.4 Food & beverages

- 7.5 Chemicals

Chapter 8 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Accutek Packaging Equipment Company

- 9.2 Advanced Dynamics

- 9.3 Aligned Machinery

- 9.4 APACKS Packaging

- 9.5 Axomatic

- 9.6 BellatRx

- 9.7 Bischoff & Munneke

- 9.8 Blenzor India

- 9.9 Busch Machinery

- 9.10 Caelsons Industries

- 9.11 GGM Group

- 9.12 Gustav Obermeyer

- 9.13 Harish Pharma Engineering

- 9.14 Makwell Machinery

- 9.15 ProSys Servo Filling Systems