PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699272

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699272

Wire and Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

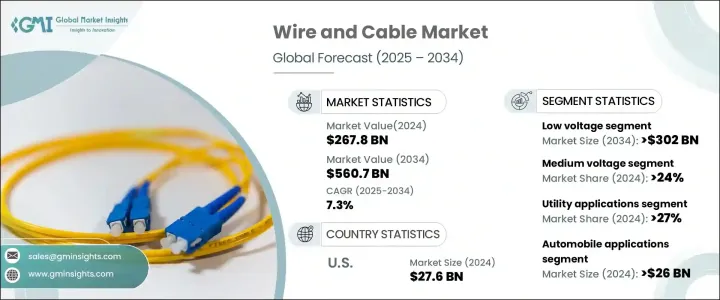

The Global Wire And Cable Market has experienced steady expansion, reaching USD 267.8 billion in 2024, with projections indicating a 7.3% CAGR from 2025 to 2034. This growth is largely driven by the continuous investment in modernizing and expanding transmission and distribution networks to meet the rising electricity demand worldwide. Increasing urbanization and government-led smart city projects are further amplifying the need for reliable electrical infrastructure. The push for renewable energy integration has accelerated the transition to cleaner power sources, requiring advanced cabling solutions to ensure efficient grid connectivity.

Meanwhile, geopolitical challenges and supply chain disruptions have led to a surge in domestic production, reducing reliance on imports and strengthening local manufacturing capabilities. This shift supports infrastructure development by streamlining logistics and addressing raw material supply gaps, ultimately propelling industry growth. Rising demand for fire-retardant, high-performance cables across residential, commercial, and industrial applications has also contributed to market expansion. The industry's valuation stood at USD 216 billion in 2022, USD 240.3 billion in 2023, and USD 267.8 billion in 2024, reflecting strong demand across multiple sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $267.8 Billion |

| Forecast Value | $560.7 Billion |

| CAGR | 7.3% |

The market is categorized by voltage levels, including high, medium, and low voltage segments. The low-voltage wire and cable sector is projected to exceed USD 302 billion by 2034, driven by significant demand from residential and commercial developments. These industries are growing at a rapid pace, fueling the need for safe and efficient wiring solutions. Expanding digital and smart grid initiatives are further boosting demand, as large-scale funding is directed toward improving power distribution networks. Investments in these projects reinforce the necessity for advanced wiring systems, ensuring a stable and efficient electricity supply.

The industry is also segmented based on applications, covering a wide range of sectors, including utilities, material handling, logistics, automotive, railways, consumer electronics, and building infrastructure. Utility applications accounted for over 27% of the market share in 2024 and are expected to see further expansion. The transition towards renewable power generation, particularly through solar and wind energy, has heightened the need for durable and efficient power cables to facilitate seamless grid integration. This shift continues to shape the industry's trajectory, driving long-term demand for specialized wiring solutions.

The U.S. market has demonstrated consistent growth, with valuations of USD 23.9 billion in 2022, USD 25.6 billion in 2023, and USD 27.6 billion in 2024. This trend is supported by increasing investments in the country's construction sector, where monthly expenditures surpassed USD 2 trillion in 2024. The rising adoption of smart electrical systems and sustainable building practices is further influencing the demand for advanced wire and cable products, reinforcing the sector's positive outlook in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Coaxial cables/electronic wires

- 5.3 Fiber optics cables

- 5.4 Power cables

- 5.5 Signal & control cable

- 5.6 Telecom & data cables

Chapter 6 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Automotive

- 7.4 Material handling/logistics

- 7.5 Entertainment/leisure

- 7.6 Utilities

- 7.7 Railways

- 7.8 Consumer electronics

- 7.9 Building infrastructure

- 7.10 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (MWh & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Netherlands

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Sweden

- 8.3.7 Denmark

- 8.3.8 Belgium

- 8.3.9 Germany

- 8.3.10 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Philippines

- 8.4.8 New Zealand

- 8.4.9 Malaysia

- 8.4.10 Thailand

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Iraq

- 8.5.4 Kuwait

- 8.5.5 Qatar

- 8.5.6 South Africa

- 8.5.7 Egypt

- 8.5.8 Nigeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

Chapter 9 Company Profiles

- 9.1 alfanar Group

- 9.2 Bahra Cables

- 9.3 BELDEN

- 9.4 Brugg Kabel AG

- 9.5 Ducab

- 9.6 Elsewedy Electric

- 9.7 Federal Cables

- 9.8 Fujikura

- 9.9 HELUKABEL MiddleEast

- 9.10 Jeddah Cables

- 9.11 KEI Industries

- 9.12 Midal Cables

- 9.13 Naficon

- 9.14 Nexans

- 9.15 NIBE Industrier AB

- 9.16 NKT A/S

- 9.17 Power Plus Cables

- 9.18 Prysmian Group

- 9.19 Riyadh Cables

- 9.20 Saudi Cable Company

- 9.21 Sumitomo Electric Industries

- 9.22 ZTT