PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797870

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797870

Biomass Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

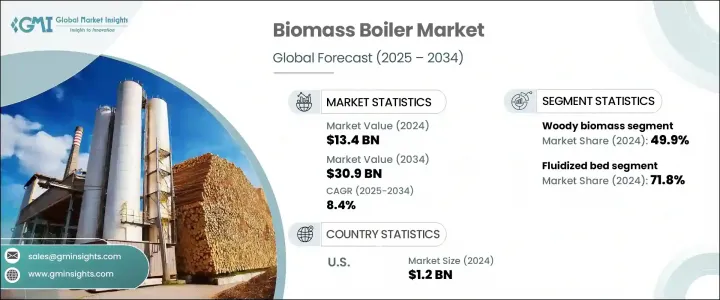

The Global Biomass Boiler Market was valued at USD 13.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 30.9 billion by 2034. Growing concerns over emissions and rising energy security needs are accelerating the transition from fossil fuels to cleaner heating systems. As more countries adopt low-carbon policies and push for decarbonization, biomass heating systems are gaining recognition for their ability to utilize organic materials efficiently. These boilers serve as a renewable alternative to conventional fuel systems, offering the dual benefit of heat generation and waste repurpose. Their increasing deployment across commercial, residential, and industrial sectors is supported by favorable regulations, sustainability mandates, and tax incentives aimed at promoting greener technologies. Heightened awareness of carbon footprints and energy independence is also prompting investments in biomass-based heating solutions, particularly in colder regions and off-grid areas where cost-effective, locally available fuels are essential.

A biomass boiler uses renewable feedstocks like agricultural residue, wood chips, and organic waste to produce hot water and heat, functioning similarly to a conventional system but with a lower environmental impact. Rising support for AI-powered systems, particularly those offering real-time combustion management, is improving fuel conversion efficiency while reducing emissions. Automated fuel feeding, sensor-based adjustments, and adaptive control technologies are becoming standard among premium units. The market is also witnessing growing interest in modular designs and fluidized bed combustion technologies that allow scalable deployment for both small- and large-scale operations. Increasing demand for low-NOx heating units in compliance with stricter environmental laws is further contributing to product innovation. Additionally, government programs, including renewable energy credits, grants, and feed-in tariffs, are directly boosting capital investments in advanced biomass systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.4 Billion |

| Forecast Value | $30.9 Billion |

| CAGR | 8.4% |

The woody biomass segment held a 49.9% share in 2024 and is poised to grow at a CAGR of 8% through 2034. The widespread availability of forestry by-products and wood pellets across several geographies is supporting the dominance of this segment. Locally sourced fuel minimizes transportation costs and enhances regional energy autonomy. These systems are also preferred in regions with prolonged winters due to their consistent heat output and affordability. Policymakers and municipal authorities offering procurement incentives and emissions credits are accelerating the deployment of woody biomass boilers in both public and private facilities.

The stocker-type biomass boiler segment was valued at USD 2.3 billion in 2024. Their increasing incorporation into combined heat and power (CHP) plants allows for simultaneous generation of electricity and thermal energy, making them highly efficient in terms of fuel utilization. Their suitability for continuous operation and adaptability to a wide range of fuel types further enhances their appeal across utilities and industrial setups. Their contribution to distributed energy generation is opening new revenue streams while ensuring operational flexibility and reduced grid dependency.

U.S. Biomass Boiler Market held 86.4% share in 2024, generating USD 1.2 billion. Rising awareness about emissions and growing interest in affordable clean energy solutions are key contributors to the market's momentum in the country. Supportive state-level policies and expansion of green building practices are creating new opportunities for advanced boiler systems, especially in commercial campuses, public infrastructure, and energy-intensive industries. The preference for decentralized heating in off-grid areas and rural regions is also driving further adoption.

Major companies shaping the competitive landscape of the Global Biomass Boiler Market include Hurst Boiler & Welding, Viessmann, DP CleanTech, Babcock & Wilcox Enterprises, and ANDRITZ Group. Top players in the biomass boiler market are leveraging several strategies to expand their footprint and reinforce their market presence. They are consistently developing modular and scalable systems tailored for both small-scale and utility-scale operations. Companies are focusing on upgrading product lines with AI-enabled control systems and low-emission combustion technologies to align with tightening environmental regulations. Investment in R&D is being prioritized to create more fuel-flexible systems and improve efficiency. Strategic collaborations with renewable energy developers and turnkey solution providers are helping to deliver comprehensive installation and maintenance services.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material availability & sourcing analysis

- 3.1.1.2 Manufacturing capacity assessment

- 3.1.1.3 Supply chain resilience & risk factors

- 3.1.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of biomass boiler

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.8.2 By feedstock

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & industry 4.0 integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & financial landscape

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Woody biomass

- 5.3 Agricultural waste

- 5.4 Industrial waste

- 5.5 Urban residue

- 5.6 Others

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Stocker

- 6.3 Fluidized bed

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Argentina

- 8.6.2 Chile

- 8.6.3 Brazil

Chapter 9 Company Profiles

- 9.1 ANDRITZ Group

- 9.2 ARITERM

- 9.3 Babcock & Wilcox Enterprises

- 9.4 Binder Energietechnik

- 9.5 Cheema Boiler

- 9.6 DP Cleantech

- 9.7 Forbes Marshall

- 9.8 Froling Heizkessel

- 9.9 Guntamatic Heiztechnik

- 9.10 Hargassner GesmbH

- 9.11 Hoval

- 9.12 Hurst Boiler & Welding

- 9.13 John Cockerill

- 9.14 John Wood Group

- 9.15 KwB Energiesysteme

- 9.16 Maxtherm Boilers

- 9.17 OkoFEN

- 9.18 Prime Thermals

- 9.19 Schmid Energy Solutions

- 9.20 Sofinter

- 9.21 Sugimat

- 9.22 Transparent Energy Systems

- 9.23 Thermax

- 9.24 Thermodyne Boiler

- 9.25 Treco

- 9.26 VIESSMANN