PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699315

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699315

Distribution Panel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

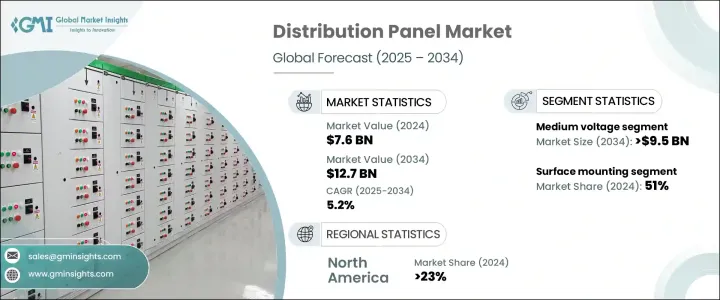

The Global Distribution Panel Market was valued at USD 7.6 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Rising electricity demand, rapid urbanization, and the expansion of social and business infrastructure are fueling this growth. As global energy consumption continues to soar, power distribution networks are under pressure to become more resilient, efficient, and technologically advanced. The increasing adoption of smart grids and renewable energy sources is further transforming power distribution strategies, amplifying the demand for cutting-edge distribution panels. Governments and private entities worldwide are prioritizing grid modernization, reinforcing the need for robust electrical infrastructure.

With industries and commercial establishments shifting toward efficient energy management systems, investments in advanced power distribution solutions are surging. Businesses are implementing automation-driven electrical panels to enhance safety, optimize power flow, and improve operational efficiency. The push for energy conservation and smart monitoring capabilities is prompting manufacturers to design panels that integrate seamlessly with intelligent building management systems. Market players are responding by developing next-generation distribution panels with real-time monitoring, remote accessibility, and predictive maintenance features, ensuring uninterrupted power supply and reduced downtime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 5.2% |

The industry recorded valuations of USD 7.6 billion in 2024. Segmentation by voltage highlights medium-voltage panels as a primary growth driver, with expectations to generate USD 9.5 billion by 2034. The rising deployment of these panels across industrial facilities, utility grids, and data centers is driving demand as businesses seek reliable and scalable power distribution solutions. Industrialization and ongoing grid modernization efforts are reinforcing the necessity for efficient power management, positioning medium-voltage panels as a key component in the energy sector. With automation and digitization reshaping industrial landscapes, investments in high-capacity, technologically advanced panels are steadily increasing.

Market trends point to strong growth in both flush-mounted and surface-mounted distribution panels, influenced by evolving construction practices, spatial considerations, and advancements in electrical technology. The flush-mounted segment is projected to grow at a CAGR of 5.5% by 2034, fueled by the increasing adoption of smart monitoring and control systems. Regulatory mandates emphasizing energy efficiency and automation in building infrastructure are accelerating demand, prompting manufacturers to optimize panel designs for enhanced space utilization and operational effectiveness.

North America distribution panel market accounted for a 23% share in 2024, with expectations for further growth by 2034. The US market alone generated USD 1.5 billion in 2024, driven by advancements in grid technology, the booming construction sector, and the widespread installation of smart electrical infrastructure. Commercial and industrial facilities are making significant investments in IoT-enabled energy-saving panels, enhancing efficiency and automation in power distribution networks. As sustainability and digital transformation initiatives gain traction, the region is poised for continued market expansion, with key players focusing on innovation and strategic collaborations to strengthen their competitive positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Low voltage

- 5.3 Medium voltage

Chapter 6 Market Size and Forecast, By Mounting, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Flush mounting

- 6.3 Surface mounting

Chapter 7 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 College/university

- 7.3.2 Office

- 7.3.3 Government/military

- 7.3.4 Others

- 7.4 Industrial

- 7.4.1 Power generation

- 7.4.2 Chemical

- 7.4.3 Refinery

- 7.4.4 Cement

- 7.4.5 Others

- 7.5 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 Australia

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Abunayyan Holding

- 9.3 AGS

- 9.4 alfanar Group

- 9.5 EAMFCO

- 9.6 Eaton

- 9.7 ESL POWER SYSTEMS, INC.

- 9.8 General Electric

- 9.9 Hager Group

- 9.10 INDUSTRIAL ELECTRIC MFG

- 9.11 Larsen & Toubro Limited

- 9.12 Legrand

- 9.13 Meba Electric Co., Ltd

- 9.14 NHP

- 9.15 Norelco

- 9.16 Schneider Electric

- 9.17 Siemens