PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822623

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822623

North America Residential Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

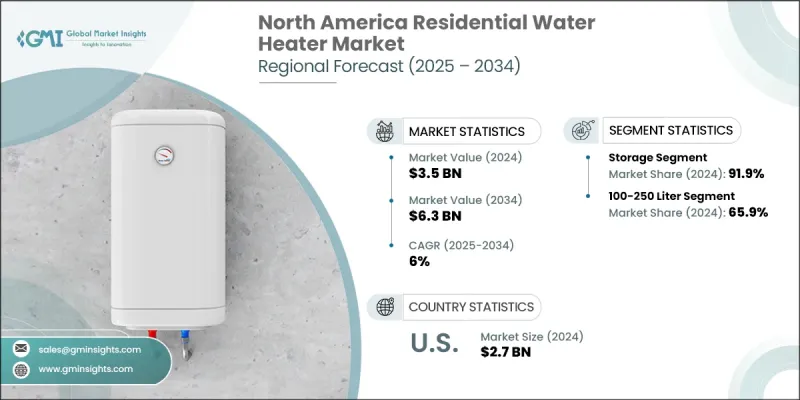

North America Residential Water Heater Market was valued at USD 3.5 billion and is estimated to grow at a CAGR of 6% to reach USD 6.3 billion by 2034, owing to the growing demand for energy-efficient and environmentally friendly water heating solutions. Consumers are adopting advanced technologies, such as tankless and solar water heaters, to reduce energy consumption and lower utility bills. Against this backdrop, in 2024, Bradford White launched the "Brute(TM) Elite" series of tankless water heaters, focusing on enhanced energy efficiency and reduced operational costs. This new line meets the rising consumer demand for high-performance, cost-effective water heating solutions. Additionally, government incentives and rebates for energy-efficient home upgrades are further propelling the market growth. The upsurge in home renovation and construction activities is boosting the product demand, as homeowners seek to improve comfort and efficiency in their residences.

North America residential water heater market is sorted based on product, capacity, energy source, and country. The instant segment will exhibit a prominent CAGR between 2024 and 2032, due to its convenience and energy efficiency. Instant water heaters provide hot water instantly without the need for a storage tank, which eliminates standby heat loss and reduces energy consumption. This aligns with the growing consumer preference for energy-efficient solutions that lower utility bills and support environmental sustainability. Additionally, the compact size makes instant units ideal for modern homes spurring their adoption in the residential sector. The 30-100 liters segment will garner a noteworthy residential water heater market share by 2032, owing to an optimal balance between size and functionality, offering sufficient hot water for medium-sized homes and small to mid-sized families.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.3 Billion |

| CAGR | 6% |

The increasing preference for compact yet efficient water heaters in residential settings is thrusting demand for units within this capacity range. Moreover, advancements in technology have improved the energy efficiency of these units, making them a popular choice among homeowners seeking cost-effective water heating solutions. Canada residential water heater market will record a strong CAGR through 2032, because of the focus on improving home energy efficiency and meeting stringent environmental regulations. With escalating focus on reducing carbon footprints, Canadian homeowners are investing in modern solutions that offer better performance and lower energy consumption. Additionally, the growing real estate sector and rising renovation activities, combined with government incentives and rebates are aiding market expansion across Canada.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Capacity trends

- 2.5 Energy source trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Price trend analysis, 2021-2034 (USD/Unit)

- 3.2.1 By capacity

- 3.2.2 By region

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 <30 Liters

- 6.3 30 - 100 Liters

- 6.4 100 - 250 Liters

- 6.5 250 - 400 Liters

- 6.6 >400 Liters

Chapter 7 Market Size and Forecast, By Energy Source, 2021 - 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Electric

- 7.3 Gas

- 7.3.1 Natural Gas

- 7.3.2 LPG

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 Ariston Thermo

- 9.3 American Standard Water Heaters

- 9.4 Bradford White Corporation

- 9.5 EcoSmart Green Energy Products

- 9.6 GE Appliances

- 9.7 Giant Factories

- 9.8 HTP Comfort Solutions

- 9.9 Hubbell Water Heaters

- 9.10 John Wood

- 9.11 Lennox International

- 9.12 Noritz America

- 9.13 Navien

- 9.14 Racold

- 9.15 Rheem Manufacturing Company

- 9.16 Rinnai America Corporation

- 9.17 State Industries

- 9.18 State Water Heaters

- 9.19 Whirlpool Corporation

- 9.20 Westinghouse Electric Corporation