PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699251

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699251

U.S. Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

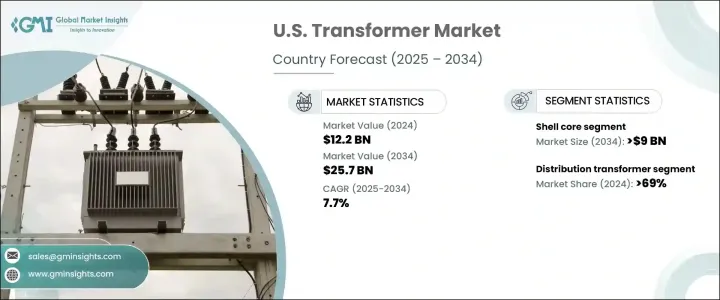

U.S. Transformer Market was valued at USD 12.2 billion in 2024 and is expected to expand at a 7.7% CAGR from 2025 to 2034, driven by increasing electricity demand. Rising energy consumption across industries, infrastructure expansion, and the need for efficient power distribution contribute to market growth. The industrial sector's expansion has resulted in greater electricity consumption, requiring advanced transformers to support higher loads and ensure a stable power supply. The replacement of outdated transformers with modern, energy-efficient models is becoming a priority, as many existing units fail to meet evolving energy standards. Countries are shifting toward advanced transformer solutions that align with long-term energy demands. In the U.S., the electricity generation utilization in 2023 was projected to surpass 4,100 hours, kWh, underscoring the nation's growing energy needs. Urbanization and industrialization continue to boost demand for high-capacity transformers, positioning the market for strong growth over the next decade.

The U.S. transformer industry recorded values of USD 10.3 billion in 2022, USD 11.2 billion in 2023, and USD 12.2 billion in 2024. Market expansion is primarily fueled by increasing power infrastructure investments and the transition toward sustainable energy sources. The shift to renewable energy is a major factor in transformer demand, with renewable energy sources accounting for approximately 43% of total U.S. energy production in 2022. This transition places greater emphasis on modern transformers that can efficiently integrate variable renewable energy into the grid.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $25.7 Billion |

| CAGR | 7.7% |

The shell core segment is expected to exceed USD 9 billion by 2034, experiencing strong growth due to the rising adoption of renewable energy systems. As the energy sector moves toward sustainable solutions, the need for advanced transformers capable of handling fluctuating loads and integrating renewables into the grid becomes critical.

The distribution transformer segment dominated the U.S. market in 2024, capturing over 69% of the total share. The segment is expected to expand further as industrialization and urban development drive electricity demand. The modernization of power distribution networks is accelerating, leading to increased deployment of energy-efficient transformers. Rising urban populations and expanding commercial infrastructure contribute to higher power consumption, requiring reliable and efficient power transmission solutions.

Innovations in transformer technology are reshaping the industry, particularly in the distribution segment. Advanced core materials are replacing traditional silicon steel cores, reducing energy losses caused by hysteresis and eddy currents. The aging infrastructure in the U.S. further accelerates the need for modern replacements. Industry estimates suggest that between 60 to 80 million distribution transformers are currently in use, with a capacity between 2.5 and 3.5 TVA. Notably, approximately 55% of these units have exceeded 33 years of service and are approaching the end of their operational life. Upgrading aging systems with modern, efficient transformers remains a key focus for sustaining grid reliability and optimizing energy use.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.1.1 Vendor matrix

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Core, 2021 – 2034 (USD Million, ‘000 Units)

- 4.1 Key trends

- 4.2 Closed

- 4.3 Shell

- 4.4 Berry

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Distribution transformer

- 5.3 Power transformer

- 5.4 Instrument transformer

- 5.5 Others

Chapter 6 Market Size and Forecast, By Winding, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Two winding

- 6.3 Auto transformer

Chapter 7 Market Size and Forecast, By Cooling, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Dry Type

- 7.2.1 Self-Air

- 7.2.2 Air blast

- 7.3 Oil Immersed

- 7.3.1 Self-cooled

- 7.3.2 Water cooled

- 7.3.3 Forced oil

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Insulation, 2021 – 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Gas

- 8.3 Oil

- 8.4 Solid

- 8.5 Air

- 8.6 Others

Chapter 9 Market Size and Forecast, By Rating, 2021 – 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 ≤ 10 MVA

- 9.3 > 10 MVA to ≤ 100 MVA

- 9.4 > 100 MVA to ≤ 600 MVA

- 9.5 > 600 MVA

Chapter 10 Market Size and Forecast, By Mounting, 2021 – 2034 (USD Million, ‘000 Units)

- 10.1 Key trends

- 10.2 Pad

- 10.3 Pole

- 10.4 Others

Chapter 11 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 11.1 Key trends

- 11.2 Residential

- 11.3 Commercial & industrial

- 11.4 Utility

Chapter 12 Company Profiles

- 12.1 Celme S.r.l.

- 12.2 Daelim Transformer

- 12.3 Eaton Corporation

- 12.4 ELSCO Transformer

- 12.5 Elsewedy Electric

- 12.6 ERMCO

- 12.7 General Electric

- 12.8 Hammond Power Solutions

- 12.9 Hitachi Energy Ltd.

- 12.10 HYOSUNG HEAVY INDUSTRIES

- 12.11 Jordan Transformer

- 12.12 Mitsubishi Electric Corporation

- 12.13 ORMAZABAL

- 12.14 Power Transformers, Inc.

- 12.15 Siemens

- 12.16 Toshiba Energy Systems & Solutions Corporation

- 12.17 Virginia Transformer Corp.

- 12.18 Voltamp