PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721501

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721501

Global Printing Plates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

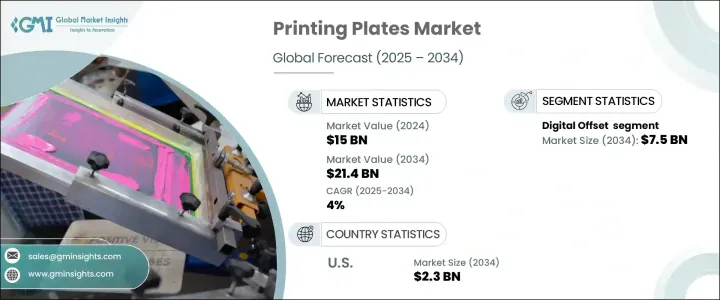

The Global Printing Plates Market was valued at USD 15 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 21.4 billion by 2034. Market expansion is fueled by the ongoing demand for high-quality packaging and promotional printing across industries. As businesses across consumer goods, food and beverage, pharmaceuticals, and publishing continue to emphasize premium packaging and marketing collateral, the need for advanced, cost-effective printing solutions is on the rise. Printing plates play a crucial role in ensuring superior image reproduction, faster processing, and greater production efficiency. Growing volumes of print output in both industrial and commercial segments are pushing manufacturers to adopt technologically advanced plates that deliver consistent quality with minimal waste. With shifting consumer preferences driving product customization and shorter production runs, the industry is rapidly evolving to support high-resolution, short-run, and variable data printing. The transition from analog to digital workflows has gained significant momentum, especially as companies seek to optimize operational workflows and reduce turnaround times. Additionally, sustainability has become a pivotal consideration, with manufacturers increasingly leaning toward eco-conscious solutions that minimize chemical use and align with global environmental standards.

The printing plates market benefits immensely from the rapid innovation in printing technologies, especially automation and digitalization. As companies look to streamline operations and reduce material waste, modern solutions like computer-to-plate (CTP) systems are offering transformative benefits. These systems significantly improve speed, precision, and sustainability in printing workflows. By eliminating several manual steps, CTP technology ensures faster setup, reduced labor requirements, and enhanced print quality. Such advancements are proving vital for businesses aiming to meet dynamic client demands while staying competitive in a fast-paced market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 4% |

Digital offset printing plates held the largest share in 2024, generating USD 5.1 billion, and are expected to reach USD 7.5 billion by 2034. These plates are quickly becoming the industry standard due to their ability to replace traditional film-based processes. Their usage not only cuts down setup time and material consumption but also guarantees high-quality, repeatable image reproduction. The growing need for short-run, high-resolution printing across applications such as commercial printing, packaging, and publishing is further accelerating demand for digital offset plates. Print providers favor these plates for their cost-efficiency, sharp detail output, and ability to minimize delays in production cycles.

Germany Printing Plates Market is forecasted to grow at a CAGR of 4.4% between 2025 and 2034. The country is home to a strong ecosystem of printing equipment manufacturers and plate suppliers who are deeply invested in R&D to develop sustainable and high-performance solutions. With a national emphasis on quality and innovation, premium offset and flexographic plates are gaining prominence in key segments such as food packaging, personal care, and pharmaceuticals. As demand increases for eco-friendly, high-durability prints, German manufacturers are leading the charge in setting industry standards for both performance and environmental responsibility.

Major players in the Global Printing Plates Market include FUJIFILM Holdings Corporation, Trelleborg AB, DuPont de Nemours, Inc., MacDermid Graphics Solutions LLC, Agfa-Gevaert NV, Eastman Kodak Company, Toray Industries, Inc., Plate Crafters LLC, CRON-ECRM LLC, Luscher Technologies AG, Heidelberger Druckmaschinen AG, Asahi Photoproducts Europe NV, Esko-Graphics BVBA, Mitsubishi Chemical Corporation, and Flint Group. These companies are actively investing in R&D to introduce next-generation CTP plates that require minimal processing and deliver enhanced print sharpness. A strong focus is being placed on sustainability, with eco-friendly product lines gaining traction as manufacturers work to reduce chemical use and overall waste. Strategic partnerships with commercial printers and packaging firms are enabling tailored product development, while advancements in digital plate imaging and plate development speed are helping reshape the competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in packaging industries

- 3.2.1.2 Advancements in printing technology

- 3.2.1.3 Rise in promotional and advertising activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Shift toward digital technology

- 3.2.2.2 Competition from alternatives such as inkjet and laser printing

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Flexographic printing plates

- 5.3 Screen printing plates

- 5.4 Gravure printing plates

- 5.5 Rotogravure printing plates

- 5.6 Thermal printing plates

- 5.7 Printing plate cleaning machines

- 5.8 Corrugated flexographic printing plates

- 5.9 Digital flexographic printing plates

- 5.10 Digital offset printing plates

- 5.11 Direct laser engraving to plate printing equipment

- 5.12 Dry offset printing plates

- 5.13 Printing type, blocks, plates, cylinders, and lithographic stones

Chapter 6 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.4.6 Malaysia

- 6.4.7 Indonesia

- 6.5 Latin America

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.6 MEA

- 6.6.1 Saudi Arabia

- 6.6.2 UAE

- 6.6.3 South Africa

Chapter 7 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 7.1 Agfa-Gevaert NV

- 7.2 Asahi Photoproducts Europe NV

- 7.3 CRON-ECRM LLC

- 7.4 DuPont de Nemours, Inc.

- 7.5 Eastman Kodak Company

- 7.6 Esko-Graphics BVBA

- 7.7 Flint Group

- 7.8 FUJIFILM Holdings Corporation

- 7.9 Heidelberger Druckmaschinen AG

- 7.10 Luscher Technologies AG

- 7.11 MacDermid Graphics Solutions LLC

- 7.12 Mitsubishi Chemical Corporation

- 7.13 PlateCrafters LLC

- 7.14 Toray Industries, Inc.

- 7.15 Trelleborg AB