PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698562

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698562

Satellite Laser Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

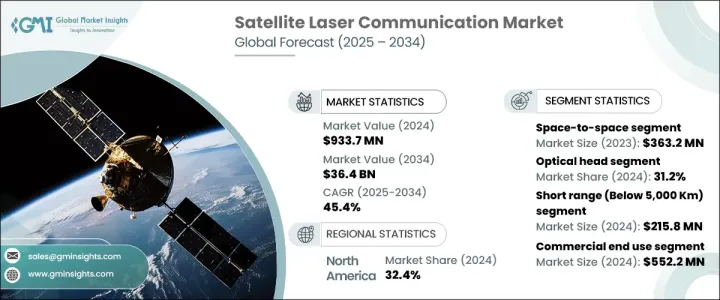

The Global Satellite Laser Communication Market, valued at USD 933.7 million in 2024, is projected to surge at a CAGR of 45.4% from 2025 to 2034. This growth is driven by escalating demand for high-speed data transmission, enhanced bandwidth, and widespread deployment in complex fiber systems. As carrier frequencies evolve, modulation techniques improve, increasing data-carrying capacity for efficient point-to-point transmission. Businesses worldwide are prioritizing fast and reliable connectivity to boost productivity and enhance customer service, driving demand for high-speed data transmission. Satellite laser communication enables superior data rates, minimizing signal loss and ensuring seamless transmission. The technology offers higher bandwidth than radio frequency systems and requires lower weight, volume, and power, making it ideal for satellite constellations and space exploration. With the rising number of low Earth orbit (LEO) satellites, the adoption of satellite laser communication continues to expand. Companies are investing in advanced modulation techniques to optimize data reliability and transmission efficiency.

The market is segmented based on solutions into space-to-space, space-to-ground station, and space-to-other applications. Space-to-space communication, valued at USD 363.2 million in 2023, supports high-speed inter-satellite data transfer, enhancing real-time connectivity. The space-to-ground station segment, worth USD 196 million in 2022, enables efficient data transmission for scientific research, global broadband, and weather forecasting services. Space-to-other applications, which generated USD 46.5 million in 2021, include deep-space exploration and planetary missions, necessitating long-range optical communication with minimal latency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $933.7 Million |

| Forecast Value | $36.4 Billion |

| CAGR | 45.4% |

The market is also classified by components, including optical heads, modems, laser receivers and transmitters, and modulators. The optical head segment is set to account for 31.2% of the market in 2024, crucial for precise laser beam transmission using advanced optics. Laser receivers and transmitters, projected to hold 24.8% of the market, ensure secure, high-speed data exchange. Modems, with a 20.4% share, convert digital data into optical signals for seamless transmission, while modulators, representing 17.2% of the market, enhance spectral efficiency and data throughput.

Segmentation by range includes short, medium, and long-range communication. The short-range segment, valued at USD 215.8 million in 2024, covers LEO satellite links for Earth observation and real-time broadband networks. Medium-range communication, worth USD 123.3 million in 2023, connects satellites in different orbits. The long-range segment, valued at USD 325.9 million in 2022, supports deep-space missions and interplanetary probes.

End-use categories include commercial, government, and military applications. The commercial segment, the largest at USD 552.2 million in 2024, is expanding due to increased demand for global broadband and data relay services. The government sector, valued at USD 200.8 million in 2024, leverages laser communication for climate monitoring, disaster management, and secure data exchange. The military sector, expected to grow at a 46.7% CAGR from 2025 to 2034, invests in secure, high-speed communication for defense and surveillance operations.

North America dominates the market with a 32.4% share in 2024, driven by significant investments in telecommunication infrastructure. The US market, valued at USD 255.8 million in 2024, is advancing rapidly due to strong government and private sector investments in satellite-based communication systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-speed data transmission

- 3.6.1.2 Space exploration and satellite constellations

- 3.6.1.3 Increasing adoption of space-based services

- 3.6.1.4 Advancements in laser communication technology

- 3.6.1.5 Government initiatives and investments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and deployment costs

- 3.6.2.2 Limited availability of space-qualified components

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Space-to-Space

- 5.3 Space-to-Ground station

- 5.4 Space-to-Other applications

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Optical head

- 6.3 Laser receivers and transmitters

- 6.4 Modems

- 6.5 Modulators

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Short range (Below 5,000 Km)

- 7.3 Medium range (5,000-35,000 Km)

- 7.4 Long range (Above 35,000 Km)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government

- 8.4 Military

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus SE

- 10.2 Axelspace Corporation

- 10.3 Ball Aerospace & Technologies Corp.

- 10.4 Blue Canyon Technologies LLC

- 10.5 BridgeComm, Inc.

- 10.6 EnduroSat AD

- 10.7 General Atomics Electromagnetic Systems Inc.

- 10.8 Infostellar Inc.

- 10.9 Kongsberg Satellite Services AS

- 10.10. L3 Harris Technologies, Inc.

- 10.11 Laser Light Communications, LLC

- 10.12 Lockheed Martin Corporation

- 10.13 Mynaric AG

- 10.14 NEC Corporation

- 10.15 Thales Group