PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721548

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721548

Circuit Protection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

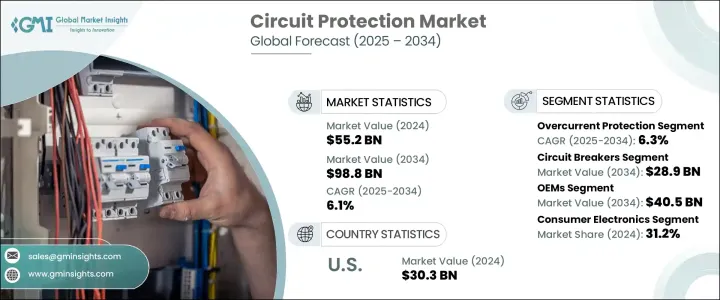

The Global Circuit Protection Market was valued at USD 55.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 98.8 billion by 2034. This momentum is largely driven by increasing reliance on stable and secure electrical systems across multiple industries. As the world shifts toward electrification and smart infrastructure, the demand for advanced circuit protection technologies is seeing a steady rise. The rapid adoption of electric vehicles, the transition to renewable energy, and the expansion of smart cities are all contributing to this trend. At the same time, businesses across the globe are adopting next-generation technologies like artificial intelligence, machine learning, and industrial automation, which require a consistent, high-quality power supply. These technologies are making energy systems more complex, thereby increasing the need for effective circuit protection mechanisms to avoid downtimes, prevent equipment damage, and ensure operational continuity.

From residential buildings to large-scale industrial setups, the role of circuit protection is becoming increasingly critical. In modern infrastructure, where systems are hyperconnected and data-driven, power fluctuations or overloads can severely impact performance and cause significant financial losses. Circuit protection solutions such as breakers, fuses, and surge protectors are being upgraded to handle evolving electrical demands while integrating digital features like predictive diagnostics, remote management, and real-time fault detection. As consumers and enterprises continue to prioritize safety, energy efficiency, and long-term system reliability, the global circuit protection market is positioned for sustained growth over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $55.2 Billion |

| Forecast Value | $98.8 Billion |

| CAGR | 6.1% |

The overcurrent protection segment is gaining significant traction and is expected to grow at a CAGR of 6.3% through 2034. Rising requirements for smart, high-performance systems in homes, commercial buildings, and industrial facilities are compelling manufacturers to deliver more intelligent solutions. Innovations such as remote monitoring, automated diagnostics, and extended durability are pushing these devices into essential infrastructure categories, especially where energy reliability and safety are non-negotiable.

Based on product category, circuit breakers are set to dominate the market and are projected to reach USD 28.9 billion by 2034. The push for digital integration in power infrastructure is driving this demand. Circuit breakers equipped with smart sensors and real-time monitoring tools are becoming vital components in predictive maintenance systems. The increasing deployment of these devices in smart grids, EV charging stations, and automated manufacturing units reflects a broader trend toward intelligent energy systems.

Germany circuit protection market is forecast to expand at a CAGR of 6.8% through 2034. The country's ambitious clean energy goals and widespread implementation of Industry 4.0 are boosting demand for advanced protective systems. Digitized production environments and renewable power facilities are seeking reliable protection to maintain efficiency and minimize disruptions.

Key players driving innovation in the global market include Mitsubishi Electric, Bel Fuse, Siemens, ABB, and Littelfuse. These companies are investing in product development by integrating IoT, AI, and cloud analytics into circuit protection systems. Expansion of manufacturing hubs, partnerships with EV and energy companies, and the launch of compact, high-efficiency products for data centers and smart infrastructure remain top strategies. R&D spending and acquisitions focused on enhancing energy efficiency and meeting global safety standards are also steering long-term growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for consumer electronics

- 3.2.1.2 Growing adoption of electric vehicles (EVs)

- 3.2.1.3 Expansion of industrial automation and smart manufacturing

- 3.2.1.4 Growth in telecommunications and 5G deployment

- 3.2.1.5 Rising demand for data centers and cloud computing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of advanced circuit protection devices

- 3.2.2.2 Complexity in integration with advanced electronic systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Overcurrent protection

- 5.3 Electrostatic discharge (ESD) protection

- 5.4 Overvoltage protection

Chapter 6 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Circuit breakers

- 6.3 Fuses

- 6.4 Overvoltage protection devices

- 6.5 Inrush current limiter

- 6.6 GFCI

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Retail

- 7.4 Wholesale

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Commercial and residential

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Bel Fuse

- 10.3 Eaton

- 10.4 General Electric

- 10.5 Hitachi

- 10.6 Legrand

- 10.7 Littelfuse

- 10.8 Mitsubishi Electric

- 10.9 NXP Semiconductors

- 10.10 ON Semiconductor

- 10.11 Panasonic

- 10.12 Rockwell Automation

- 10.13 Schneider Electric

- 10.14 Siemens

- 10.15 Texas Instruments