PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822618

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822618

Iron Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

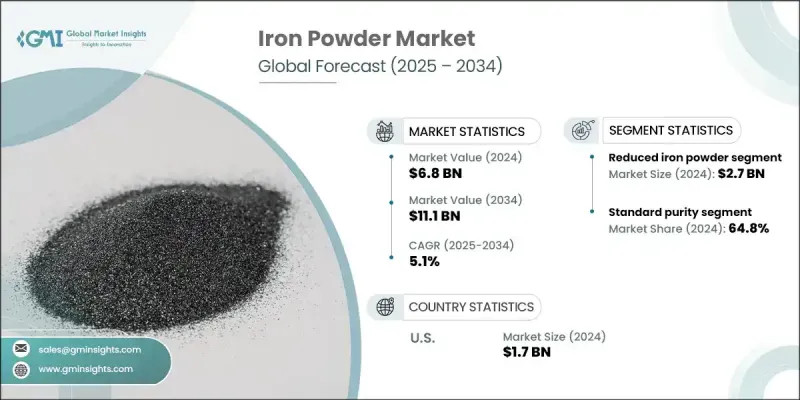

The Global Iron Powder Market was valued at USD 6.8 billion and is estimated to grow at a CAGR of 5.1% to reach USD 11.1 billion by 2034, backed by the technological advancements in production processes. Innovations, including refined powder production techniques and enhanced quality control standards, are advancing the properties of iron powder. These improvements enable its use in a wider array of applications, from automotive to electronics. Additionally, advancements in powder metallurgy and the rise of additive manufacturing are making production more precise and efficient. The construction and electronics sectors, which heavily utilize iron powder, are also contributing to market growth. According to a report by the World Steel Association, the demand for iron powder in construction is expected to rise by 4% annually. Innovations in production methods, such as improved processing techniques and specialized grades, are further driving market dynamics.

The overall iron powder market is sorted based on type, purity, End Use industry, and region. The atomized iron powder segment will register decent CAGR through 2032, driven by its superior properties compared to other types. Atomized iron powder offers excellent uniformity in particle size and shape, which enhances performance in precision applications. Its consistent quality is crucial for industries requiring high levels of accuracy and reliability, such as aerospace and high-tech manufacturing. Additionally, advancements in atomization technology have made the production process more efficient, further boosting the segment revenues. By 2032, the high-purity segment will clutch a noticeable market share, because of its role in advanced manufacturing processes that require minimal contamination. High-purity iron powder is essential for producing components with precise characteristics and superior performance, particularly in high-tech industries such as electronics and pharmaceuticals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 5.1% |

Additionally, stringent industry standards and regulations are catapulting the need for high-purity materials, as they are crucial for achieving optimal performance and safety. North America iron powder market will showcase a strong CAGR from 2024 to 2032, owing to increased industrial activity and technological advancements across various sectors. The region's expanding automotive and aerospace industries are driving the need for high-quality materials in manufacturing processes. Additionally, the focus on infrastructure development and renewable energy projects is creating a higher demand for iron powder in construction and energy applications across the region. The push for innovation and advancements in additive manufacturing also contributes to the rising demand for iron powder, bolstering the market growth in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Purity trends

- 2.2.3 End use industry trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Reduced iron powder

- 5.3 Atomised iron powder

- 5.4 Electrolytic iron powder

Chapter 6 Market Estimates and Forecast, By Purity, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 High purity

- 6.3 Standard purity

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Electronic

- 7.4 General industries

- 7.5 Consumer industries

- 7.6 Construction

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 American Element

- 9.2 BASF SE

- 9.3 Belmont Metals

- 9.4 CNPC Powder

- 9.5 Hoganas

- 9.6 Industrial Metal Powders (India) Pvt. Ltd.

- 9.7 JFE Steel Corporation

- 9.8 Pometon

- 9.9 Reade

- 9.10 Rio Tinto Metal Powder

- 9.11 SAGWELL USA INC.

- 9.12 Serena Nutrition