PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833642

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833642

Data Center Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

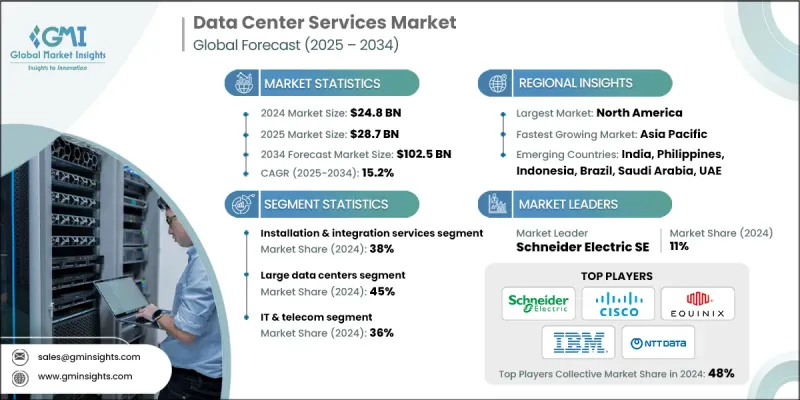

The Global Data Center Services Market was estimated at USD 24.8 billion in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 102.5 billion by 2034.

The growth is driven by the increasing demand for cloud computing and data storage solutions. As companies in diverse sectors increasingly shift to cloud-based platforms to gain scalability, agility, and cost savings, the demand for dependable, high-performing data centers continues to rise. These facilities form the foundation for cloud service providers, allowing them to deliver scalable and resilient digital solutions to their customers. In response to stricter regulatory frameworks and heightened awareness around cyber threats and data breaches, organizations are prioritizing data centers that incorporate robust security protocols, built-in redundancy, and full compliance with industry standards. Additionally, the growing focus on business continuity, disaster recovery, and operational resilience is accelerating the need for data center services that ensure maximum uptime, strong failover capabilities, and secure backup infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.8 Billion |

| Forecast Value | $102.5 Billion |

| CAGR | 15.2% |

The installation and integration services segment held a 38% share in 2024 and is projected to grow at a CAGR of 15% through 2034. This segment remains critical for deploying hyperscale infrastructures, colocation sites, and enterprise-grade IT frameworks. These services enable seamless deployment of servers, power systems, cooling mechanisms, and networking equipment while ensuring compatibility with existing systems. Their growing prominence is attributed to the rising adoption of hybrid cloud environments, AI-driven computing, and high-density workloads, which demand precise configuration and advanced integration techniques.

In 2024, the large data centers segment held a 45% share and is anticipated to grow at a CAGR of 15.3% between 2025 and 2034. These facilities act as the cornerstone for hyperscale and colocation deployments, providing unparalleled capacity, next-gen cooling solutions, and high-level interconnectivity. Their infrastructure is designed to accommodate AI, enterprise workloads, and cloud-native applications with efficiency and flexibility. Rising demand for scalable, high-performance infrastructure that meets multi-tenant requirements is reinforcing the importance of large data centers in global digital transformation strategies.

United States Data Center Services Industry held an 85% share and generated USD 7.7 billion in 2024. This leadership is driven by the widespread presence of hyperscale cloud operators, robust digital infrastructure, and widespread adoption of hybrid IT systems across enterprises. Innovation in artificial intelligence, edge computing, and digital twin technologies is reshaping the way businesses operate, creating new use cases for advanced data centers. The expansion of 5G networks, accelerated migration to cloud platforms, and rising cybersecurity demands are all pushing organizations to invest in secure, scalable, and performance-optimized data center environments.

Major players operating in the data center services industry include Schneider Electric, Eaton, NTT Data, Digital Realty, IBM, Cisco Systems, Dell Inc., Equinix, Siemens, and ABB. Leading players in the data center services market are embracing sustainability, digital automation, and strategic global expansion to boost market presence. Companies are building energy-efficient and modular facilities to meet environmental regulations and reduce operating costs. Integration of AI-powered monitoring, remote management, and predictive maintenance is enhancing performance and uptime.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Data center size

- 2.2.4 Application

- 2.2.5 Deployment mode

- 2.2.6 Tier

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of cloud computing solutions

- 3.2.1.2 Increasing demand for data storage and processing capacity

- 3.2.1.3 Rising digital transformation initiatives across enterprises

- 3.2.1.4 Growing deployment of edge data centers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial setup costs

- 3.2.2.2 Security and compliance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing focus on green and sustainable data centers

- 3.2.3.2 Increasing integration of AI and automation in data center operations

- 3.2.3.3 Rising adoption of 5G and IoT-driven infrastructure

- 3.2.3.4 Expanding opportunities in emerging economies

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Growth potential analysis

- 3.5 Cost breakdown analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.9.3 Technology innovation and infrastructure evolution

- 3.9.3.1 Next-generation cooling technologies

- 3.9.3.2 Power infrastructure and energy management

- 3.9.3.3 Modular and prefabricated solutions

- 3.9.3.4 Software-defined infrastructure and automation

- 3.10 Cybersecurity and zero trust architecture

- 3.10.1 Data center security threat landscape

- 3.10.2 Zero trust implementation in data centers

- 3.10.3 Compliance and audit framework

- 3.11 Cost optimization and financial intelligence

- 3.11.1 Total cost of ownership (TCO) analysis

- 3.11.2 Power cost intelligence and optimization

- 3.11.3 Real estate and site selection economics

- 3.11.4 Financial models and pricing strategies

- 3.12 Supply chain risk management and resilience

- 3.12.1 Global supply chain vulnerability assessment

- 3.12.2 Supply chain diversification strategies

- 3.12.3 Vendor relationship management

- 3.13 Workforce development and skills gap analysis

- 3.13.1 Skills shortage crisis and impact assessment

- 3.13.2 Workforce development strategies

- 3.13.3 Automation and human-AI collaboration

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Service 2021 - 2032 (USD Billion)

- 5.1 Key trends

- 5.2 Installation & integration services

- 5.3 Training services

- 5.4 Consulting services

- 5.5 Maintenance and support

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Data Center Size, 2021 - 2032 (USD Billion)

- 6.1 Key trends

- 6.2 Small data centers

- 6.3 Medium data centers

- 6.4 Large data centers

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2032 (USD Billion)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Colocation

- 7.4 Energy

- 7.5 Government

- 7.6 Healthcare

- 7.7 Manufacturing

- 7.8 IT & telecom

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Tier, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Tier 1

- 9.3 Tier 2

- 9.4 Tier 3

- 9.5 Tier 4

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB

- 11.1.2 Amazon Web Services

- 11.1.3 Cisco Systems

- 11.1.4 Dell

- 11.1.5 DXC

- 11.1.6 Equinix

- 11.1.7 Eaton

- 11.1.8 Fujitsu

- 11.1.9 Google

- 11.1.10 HCL

- 11.1.11 Hewlett-Packard Enterprise (HPE)

- 11.1.12 Hitachi

- 11.1.13 Huawei Technologies

- 11.1.14 IBM

- 11.1.15 Microsoft

- 11.1.16 NTT

- 11.1.17 Schneider Electric

- 11.1.18 Siemens

- 11.1.19 Vertiv

- 11.2 Regional Players

- 11.2.1 AirTrunk

- 11.2.2 AtlasEdge

- 11.2.3 CoreSite Realty

- 11.2.4 Iron Mountain Data Centers

- 11.2.5 Keppel Data Centre

- 11.2.6 NEXTDC

- 11.2.7 Switch

- 11.3 Emerging Players

- 11.3.1 Applied Digital

- 11.3.2 CoreWeave

- 11.3.3 Crusoe Energy Systems

- 11.3.4 Vapor IO