PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871309

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871309

Software Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

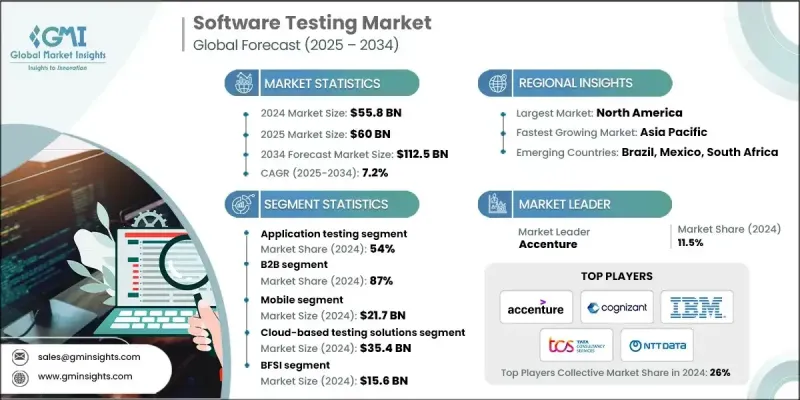

The Global Software Testing Market was valued at USD 55.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 112.5 billion by 2034.

The market is propelled by the growing adoption of Agile, DevOps, and continuous integration/continuous delivery (CI/CD) methodologies, alongside enterprises' increasing focus on digital transformation initiatives. Organizations across industries are prioritizing high-quality, secure, and reliable software, driving demand for advanced testing solutions. Continuous innovations in AI-powered automation, cloud-based testing platforms, and low-code/no-code frameworks are allowing companies to deploy intelligent, scalable, and cost-effective testing operations. These advancements reduce time-to-market, improve operational efficiency, and enhance software quality. The market is witnessing rapid technological evolution, fueled by AI-driven automation, modernized digital infrastructures, and rising expectations for performance, reliability, and cybersecurity. Enterprises are increasingly integrating testing solutions into their DevOps pipelines to maintain seamless operations and superior customer experiences while ensuring compliance with evolving industry regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $55.8 Billion |

| Forecast Value | $112.5 Billion |

| CAGR | 7.2% |

Software testing solutions, including automated testing platforms, performance and load testing systems, security validation frameworks, and AI-driven test management tools, are essential for maintaining software integrity. These solutions enable real-time monitoring, accurate defect detection, and comprehensive application validation while minimizing manual intervention. They ensure seamless coordination between testing teams, cloud infrastructures, and DevOps environments, supporting broader enterprise digitalization strategies. The market is being shaped by AI-powered automation, cloud adoption, modernization of IT infrastructure, and growing regulatory requirements for quality and security.

The application testing segment held a 54% share in 2024 and is expected to grow at a CAGR of 10.1% from 2025 to 2034. Its dominance stems from its critical role in ensuring software functionality, performance, security, and reliability across web, mobile, and enterprise platforms. This segment covers functional testing, performance evaluation, security validation, and user experience assessment, which are essential for software vendors, IT service providers, and enterprises to deliver high-quality applications.

The B2B segment held 87% share in 2024 and is projected to grow at a CAGR of 7.4% through 2034. This leadership is driven by enterprises' growing need for secure, high-performance, and dependable software across sectors such as finance, healthcare, manufacturing, and IT services. Companies are investing in comprehensive testing solutions to ensure compliance, seamless integration, and operational efficiency while enhancing end-user satisfaction.

U.S. Software Testing Market held an 88% share, generating USD 23.3 billion in 2024. The U.S. represents a major opportunity due to its high volume of enterprise IT deployments, rapid adoption of cloud-native and mobile applications, and strict regulatory standards for cybersecurity, data privacy, and industry compliance. The country's mature IT ecosystem enables the swift implementation of AI-driven test management systems, CI/CD pipelines, and next-generation testing solutions.

Key players operating in the Global Software Testing Market include Tricentis, IBM, Cognizant, Wipro, EPAM Systems, SmartBear Software, Capgemini, TCS, Accenture, and NTT Data. Companies in the Software Testing Market are employing multiple strategies to expand their market presence and strengthen their position. They are investing heavily in AI-driven test automation and cloud-based platforms to provide scalable, cost-efficient, and intelligent testing solutions. Firms are focusing on partnerships, mergers, and acquisitions to broaden their service offerings and global reach. Product innovation and R&D initiatives allow them to deliver cutting-edge solutions that address evolving enterprise needs. Many companies emphasize end-to-end service integration, including DevOps alignment, CI/CD support, and security compliance. Strategic marketing, thought leadership, and industry-specific solutions help differentiate brands and attract high-value enterprise clients, boosting competitiveness and long-term growth in the software testing market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Business model

- 2.2.4 Platform

- 2.2.5 Deployment model

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of agile and devops

- 3.2.1.2 Growing demand for high-quality software

- 3.2.1.3 Technological advancements in test automation

- 3.2.1.4 Regulatory and compliance requirements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Complex integration with legacy systems

- 3.2.3 Market opportunities

- 3.2.3.1 Rapidly evolving technology landscape

- 3.2.3.2 Data security and privacy concerns

- 3.2.3.3 Ai-driven and predictive testing solutions

- 3.2.3.4 Cloud-based and hybrid testing services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global regulatory landscape overview

- 3.4.2 Industry-specific compliance requirements

- 3.4.3 Data privacy & protection regulations

- 3.4.4 Cybersecurity standards & frameworks

- 3.4.5 Professional certification requirements

- 3.4.6 Quality standards & accreditation

- 3.4.7 Cross-border regulatory harmonization

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 AI & machine learning integration

- 3.7.2 Test automation evolution

- 3.7.3 Cloud-native testing platforms

- 3.7.4 Low-code/no-code testing solutions

- 3.7.5 Quantum computing test preparation

- 3.7.6 Blockchain testing requirements

- 3.7.7 IoT & edge computing testing

- 3.7.8 Augmented & virtual reality testing

- 3.7.9 5g network testing requirements

- 3.8 Price trends

- 3.8.1 Regional Pricing Variations

- 3.8.2 Pricing strategies by player segment

- 3.8.2.1 Service-Based Pricing Models

- 3.8.2.2 Value-Based Pricing Approach

- 3.8.2.3 Volume & Scale Economies

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Risk assessment framework

- 3.13 Best case scenarios

- 3.14 Client Requirements & Selection Criteria Analysis

- 3.14.1 Enterprise client testing requirements

- 3.14.2 SME testing needs & budget constraints

- 3.14.3 Vendor selection decision factors

- 3.14.4 Roi expectations & measurement frameworks

- 3.14.5 Service level agreement requirements

- 3.14.6 Security & compliance mandates

- 3.14.7 Integration & interoperability needs

- 3.14.8 Scalability & flexibility requirements

- 3.15 Industry-Specific Testing Requirements

- 3.15.1 Compliance testing (PCI-DSS, HIPAA, GDPR implications)

- 3.15.2 Domain-specific complexities (fintech, healthcare, autonomous vehicles)

- 3.15.3 Regulatory audit readiness

- 3.15.4 Industry benchmarks and best practices

- 3.16 Quality Metrics & Analytics Framework

- 3.16.1 KPIs for testing effectiveness (defect escape rate, test ROI, cycle time)

- 3.16.2 Data-driven quality insights

- 3.16.3 Real-time monitoring and dashboards

- 3.16.4 Predictive quality analytics

- 3.16.5 Benchmarking against industry standards

- 3.17 Customer Success & Retention Metrics

- 3.17.1 Post-implementation support requirements

- 3.17.2 Client satisfaction trends

- 3.17.3 Churn analysis and loyalty factors

- 3.17.4 Value realization timelines

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Competitive Vulnerabilities & Threats

- 4.7.1 Performance gaps in key areas

- 4.7.2 Technology debt and legacy platform issues

- 4.7.3 Customer churn indicators and at-risk segments

- 4.7.4 Emerging threats from new entrants or adjacent players

- 4.7.5 Underserved market segments

- 4.8 Customer Win/Loss Analysis

- 4.8.1 Deal sizes and contract values by competitor

- 4.8.2 Win rates against specific competitors

- 4.8.3 Key differentiators in competitive deals

- 4.8.4 Customer migration patterns (switching behavior)

- 4.8.5 Market share gains/losses by segment

- 4.9 Technology Stack & Platform Capabilities Matrix

- 4.9.1 AI/ML capabilities comparison across major players

- 4.9.2 Cloud infrastructure preferences and investments

- 4.9.3 Test automation coverage and depth

- 4.9.4 Integration ecosystem breadth (DevOps, monitoring, security tools)

- 4.9.5 Proprietary vs. open-source approach

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Application Testing

- 5.2.1 Functional

- 5.2.1.1 System testing

- 5.2.1.2 Unit testing

- 5.2.1.3 Integration testing

- 5.2.1.4 Smoke Testing

- 5.2.1.5 Regression Testing

- 5.2.1.6 Others

- 5.2.2 Non-Functional

- 5.2.2.1 Security testing

- 5.2.2.2 Performance testing

- 5.2.2.3 Usability testing

- 5.2.2.4 Others

- 5.2.1 Functional

- 5.3 Testing Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 B2B

- 6.2.1 Enterprise application testing

- 6.2.2 B2B platform testing

- 6.2.3 Integration testing services

- 6.2.4 API testing solutions

- 6.3 B2C

- 6.3.1 Consumer application testing

- 6.3.2 User experience testing

- 6.3.3 Mobile app testing

- 6.3.4 E-commerce testing

Chapter 7 Market Estimates & Forecast, By Platform, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Mobile

- 7.2.1 Native mobile app testing

- 7.2.2 Cross-platform mobile testing

- 7.2.3 Mobile device testing

- 7.2.4 Mobile performance testing

- 7.2.5 Mobile security testing

- 7.3 Web-based Testing

- 7.3.1 Web application testing

- 7.3.2 Browser compatibility testing

- 7.3.3 Web performance testing

- 7.3.4 Web security testing

- 7.3.5 Progressive web app testing

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Cloud-based Testing Solutions

- 8.2.1 Software-as-a-Service (SaaS) testing platforms

- 8.2.2 Platform-as-a-Service (PaaS) testing tools

- 8.2.3 Infrastructure-as-a-Service (IaaS) testing

- 8.2.4 Multi-cloud testing strategies

- 8.3 On-premises Testing Solutions

- 8.3.1 Traditional testing infrastructure

- 8.3.2 Enterprise testing platforms

- 8.3.3 Dedicated testing centers

- 8.4 Hybrid Testing Solutions

- 8.4.1 Cloud-on-premises integration

- 8.4.2 Flexible deployment models

- 8.4.3 Hybrid testing orchestration

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 IT

- 9.3 Telecom

- 9.4 BFSI

- 9.5 Manufacturing

- 9.6 Retail

- 9.7 Healthcare

- 9.8 Transportation & Logistics

- 9.9 Government & Public sector

- 9.10 Consumer electronics

- 9.11 Media

- 9.12 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Accenture

- 11.1.2 Atos

- 11.1.3 Capgemini

- 11.1.4 Cognizant Technology Solutions

- 11.1.5 IBM

- 11.1.6 Infosys

- 11.1.7 NTT Data

- 11.1.8 Tata Consultancy Services (TCS)

- 11.1.9 Wipro

- 11.2 Regional Player

- 11.2.1 EPAM Systems

- 11.2.2 Keysight Technologies

- 11.2.3 Micro Focus International

- 11.2.4 Parasoft

- 11.2.5 Ranorex

- 11.2.6 SmartBear Software

- 11.2.7 Tech Mahindra

- 11.2.8 Tricentis

- 11.2.9 Worksoft

- 11.3 Emerging Players

- 11.3.1 Applitools

- 11.3.2 Katalon

- 11.3.3 Mabl

- 11.3.4 Sauce Labs

- 11.3.5 Testim