PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667113

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667113

Circular Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

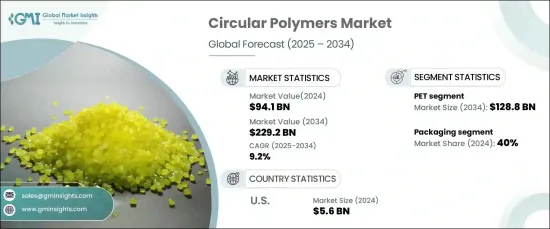

The Global Circular Polymers Market reached USD 94.1 billion in 2024 and is projected to grow at a robust CAGR of 9.2% between 2025 and 2034. As environmental concerns intensify and the availability of natural resources dwindles, industries are increasingly adopting practices that focus on waste reduction and maximizing resource efficiency. This shift toward sustainable resource management spans various sectors, including manufacturing, packaging, and consumer goods, boosting the demand for circular polymers.

Rising awareness among consumers about environmental sustainability has significantly influenced purchasing decisions, driving demand for products packaged in circular polymers. Consumers are becoming more conscious of the detrimental impact of plastic waste and are actively seeking more environmentally friendly alternatives. As a result, manufacturers are turning to circular polymers for packaging solutions to meet the growing demand for durable and sustainable products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $94.1 Billion |

| Forecast Value | $229.2 Billion |

| CAGR | 9.2% |

The market is primarily segmented by polymer type, including PET, polyethylene, polypropylene, PVC, and others. Among these, the PET segment generated USD 50.4 billion in 2024 and is projected to reach USD 128.8 billion by 2034. PET (Polyethylene Terephthalate) is favored in the circular polymer market due to its exceptional recyclability and versatility. Widely used in packaging, especially for bottles and containers, PET benefits from high recovery rates, ensuring a consistent supply for recycling. Its ability to retain its properties through multiple recycling cycles makes it ideal for closed-loop systems. Furthermore, advances in recycling technologies, like chemical depolymerization, are improving PET's quality and enhancing its reuse potential.

Packaging is the dominant application segment in the circular polymers market, accounting for a 40% share in 2024. This growth is driven by the need to combat plastic waste and enhance sustainability efforts across industries. Circular polymers are increasingly used in packaging because they help reduce environmental impact while maintaining performance and efficiency. The shift toward sustainable packaging is noticeable across sectors such as food, beverage, consumer goods, and pharmaceuticals. Brands are increasingly seeking eco-friendly packaging solutions to cater to consumer demand and meet regulatory standards. Circular polymers, particularly recycled PET (r-PET), provide a durable, recyclable, and high-quality alternative for packaging.

U.S. circular polymers market was valued at USD 5.6 billion in 2024. The growth in this market is largely driven by regulations promoting sustainable waste management and a reduction in the use of virgin plastics. The rising consumer preference for eco-friendly products, particularly in packaging, is encouraging manufacturers to adopt recycled polymers. Investment in advanced recycling technologies, such as chemical recycling, is improving the quality of recycled materials, broadening their applications across various industries. Corporate sustainability initiatives and commitments to carbon neutrality by leading companies are also driving the widespread adoption of circular polymers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising awareness among various industries to use recycled materials to reduce their carbon footprints

- 3.6.1.2 Increasing adoption of recyclable materials in the packaging industry is driving the market

- 3.6.1.3 Favorable initiatives to promote recycled plastics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Inclination toward the use of virgin plastics over recycled polymers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Polymer, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 PET

- 5.3 Polyethylene

- 5.4 Polypropylene

- 5.5 PVC

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Packaging

- 6.3 Building & construction

- 6.4 Automotive

- 6.5 Electrical & electronics

- 6.6 Agriculture

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Advanced Circular Polymers

- 8.2 ALBA Group

- 8.3 Banyan

- 8.4 BASF

- 8.5 Borealis

- 8.6 Circular Polymers

- 8.7 Dow

- 8.8 ExxonMobil

- 8.9 KW Plastics

- 8.10 PlastiCycle

- 8.11 Quality Circular Polymers

- 8.12 SABIC

- 8.13 The Shakti Plastic Industries

- 8.14 Total Energies

- 8.15 Veolia