PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928978

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928978

Welding Equipment and Consumables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

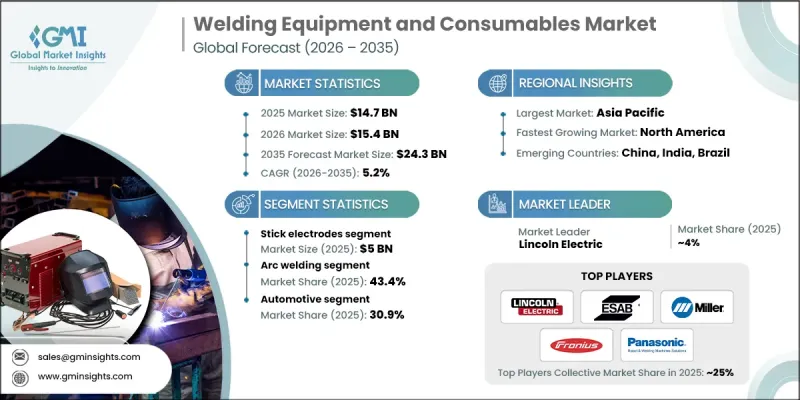

The Global Welding Equipment and Consumables Market was valued at USD 14.7 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 24.3 billion by 2035.

The industry's expansion is fueled by rapid urbanization and large-scale infrastructure developments that demand reliable and high-strength welding solutions. Modern infrastructure projects require advanced welding techniques to ensure durability and structural integrity across bridges, railways, highways, and industrial facilities. Beyond construction, the shift toward sustainable building practices has increased the need for innovative welding technologies that improve efficiency and minimize environmental impact. Investments from both public and private sectors in infrastructure are creating consistent growth opportunities. At the same time, the automotive and transportation industries are undergoing transformation due to the adoption of electric vehicles and lightweight materials, further driving demand for specialized welding equipment and consumables capable of handling new alloys and composites.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $14.7 Billion |

| Forecast Value | $24.3 Billion |

| CAGR | 5.2% |

The stick electrodes segment accounted for USD 5 billion in 2025 and is expected to grow at a CAGR of 4.6% through 2035. These electrodes remain popular due to their cost-effectiveness, versatility, and ability to perform reliably in outdoor and challenging conditions, making them indispensable for construction, repair, and maintenance applications. Their robust design allows welders to work efficiently in environments with wind, rain, or extreme temperatures, where other consumables might fail. Stick electrodes also offer compatibility with a wide range of metals and alloys, providing consistent weld quality across diverse projects.

The arc welding segment held a 43.4% share in 2025. Arc welding's adaptability and efficiency make it central to industries requiring high-quality welds, including automotive, construction, and heavy engineering. Techniques such as shielded metal arc welding (SMAW), gas metal arc welding (GMAW), and submerged arc welding (SAW) are widely employed to achieve durable and precise welds across various metals and alloys.

U.S. Welding Equipment and Consumables Market generated USD 2.7 billion in 2025 and is projected to grow at a CAGR of 5.7% from 2026 to 2035. The U.S. market benefits from a robust industrial base and a highly developed manufacturing sector, where widespread adoption of automated and robotic welding systems in automotive, aerospace, and energy industries is driving demand for high-precision equipment. The focus on meeting stringent safety and quality standards has accelerated investments in cutting-edge welding technologies and consumables to support advanced industrial processes.

Major players in the Global Welding Equipment and Consumables Market include Ador Welding Ltd., Air Liquide Welding, Arcon Welding Equipment, Bohler Welding, Denyo Co., Ltd., ESAB, Fronius International GmbH, Hyundai Welding Co., Ltd., Illinois Tool Works Inc. (ITW), Jasic Technology Co., Ltd., Kemppi Oy, Lincoln Electric, Miller Electric, Panasonic Welding Systems, and Tianjin Golden Bridge Welding Materials Group. Companies in the Global Welding Equipment and Consumables Market are pursuing multiple strategies to strengthen their market presence and expand their foothold. They are investing in research and development to introduce advanced, high-efficiency welding solutions tailored for industrial, construction, and automotive applications. Partnerships and collaborations with infrastructure and automotive companies allow them to offer integrated solutions and secure long-term contracts. Many are focusing on expanding their geographic reach, particularly in emerging markets where infrastructure growth is rapid. The adoption of automation, robotic welding systems, and smart welding technologies helps enhance operational efficiency for clients, increasing brand loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Market estimates & forecasts parameters

- 1.4 Forecast Model

- 1.4.1 Key trends for market estimates

- 1.4.2 Quantified market impact analysis

- 1.4.2.1 Mathematical impact of growth parameters on forecast

- 1.4.3 Scenario analysis framework

- 1.5 Primary research and validation

- 1.5.1 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Paid Sources

- 1.7 Primary research and validation

- 1.7.1 Primary sources

- 1.8 Research Trail & confidence scoring

- 1.8.1 Research trail components

- 1.8.2 Scoring components

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Distribution channels

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and industrialization

- 3.2.1.2 Automotive and transportation sector expansion

- 3.2.1.3 Technological advancements in welding processes

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Shortage of skilled workforce

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of automation and industry 4.0

- 3.2.3.2 Growing demand in renewable energy sector

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.7.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.7.2 Europe

- 3.7.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.7.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.7.2.3 France: European Norm (EN) ISO 4210

- 3.7.3 Asia Pacific

- 3.7.3.1 China: Guobiao (GB) 3565

- 3.7.3.2 India: Indian Standard (IS) 10613

- 3.7.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.7.4 Latin America

- 3.7.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.7.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.7.5 Middle East & Africa

- 3.7.5.1 South Africa: South African National Standard (SANS) 311

- 3.7.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.7.1 North America

- 3.8 Trade statistics (HS Code - 8501)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Stick electrodes

- 5.3 Solid wires

- 5.4 Flux coiled wires

- 5.5 Saw wires

- 5.6 Others (rod electrodes, shielding gas, etc.)

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Arc welding

- 6.3 Resistance welding

- 6.4 Oxy-fuel welding

- 6.5 Solid state welding

- 6.6 Others (electron beam, etc.)

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Building and construction

- 7.4 Marine

- 7.5 Aerospace & defense

- 7.6 Oil & gas

- 7.7 Others (metal, mining, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Ador Welding Ltd.

- 10.2 Air Liquide Welding

- 10.3 Arcon Welding Equipment

- 10.4 Bohler Welding

- 10.5 Denyo Co., Ltd.

- 10.6 ESAB

- 10.7 Fronius International GmbH

- 10.8 Hyundai Welding Co., Ltd.

- 10.9 Illinois Tool Works Inc. (ITW)

- 10.10 Jasic Technology Co., Ltd.

- 10.11 Kemppi Oy

- 10.12 Lincoln Electric

- 10.13 Miller Electric

- 10.14 Panasonic Welding Systems

- 10.15 Tianjin Golden Bridge Welding Materials Group