PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716592

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716592

Video Intercom Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

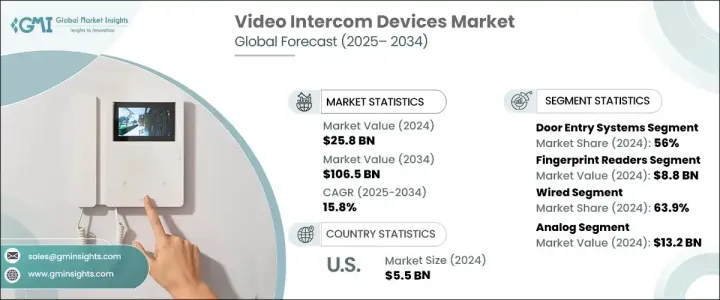

The Global Video Intercom Devices Market was valued at USD 25.8 billion in 2024 and is anticipated to grow at a CAGR of 15.8% from 2025 to 2034. The rapid growth of the market is driven by the increasing demand for advanced home security systems and rising innovations in wireless communication technology. Consumers are more concerned about safety, leading to a higher demand for smart home security solutions. Rising disposable income and growing investments in research and development for home security have further fueled the adoption of these systems globally. The integration of AI with smart home technologies has enabled more efficient, secure, and user-friendly systems, enhancing the appeal of video intercom devices. With the increasing popularity of cloud-based and wireless security systems, consumers are shifting away from conventional solutions to adopt systems that offer real-time notifications and remote control through mobile devices. As urban migration accelerates and dual-income families seek remote surveillance systems, demand for intelligent security solutions continues to rise.

The market is segmented by device type into handheld devices, door entry systems, and video baby monitors. The door entry systems segment captured 56% of the global video intercom devices market in 2024, driven by the increasing need for advanced security features in residential and commercial buildings. Integration of IoT and AI-based access control systems has enhanced security by enabling user identity verification, remote management, and continuous surveillance. The growing focus on smart security solutions to address rising security threats is boosting the adoption of door entry systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.8 Billion |

| Forecast Value | $106.5 Billion |

| CAGR | 15.8% |

By access control, the market is divided into fingerprint readers, password access, proximity cards, and wireless access. The fingerprint readers segment was valued at USD 8.8 billion in 2024, reflecting the increasing preference for biometric security systems. As security concerns grow in residential, commercial, and industrial settings, property owners are opting for biometric-based control systems due to their reliability, ease of use, and ability to prevent unauthorized access. Fingerprint readers offer contactless, fast, and secure authentication, reducing the risk of credential theft or misuse. The integration of AI with fingerprint recognition, cloud-based access, and mobile authentication further enhances the security and convenience of these systems.

The market is bifurcated by system type into wired and wireless. The wired segment held 63.9% of the market share in 2024, as high-security environments favor wired solutions due to their reliability and resilience against cyber threats. Government facilities, military bases, and critical infrastructure sites require maximum security, and wired systems offer better protection against data breaches and system disruptions compared to wireless alternatives.

The technology segment is divided into analog and IP-based systems. The analog segment accounted for USD 13.2 billion in 2024 due to its reliability in low-bandwidth environments. Unlike IP-based systems that rely on internet connectivity, analog systems operate independently, making them ideal for older buildings and rural areas where broadband penetration is limited.

By end use, the market is segmented into automotive, commercial, government, residential, and others. The commercial segment led the market with USD 9.3 billion in 2024, driven by the rising demand for automated access control in smart offices and co-working spaces. Increased adoption of IoT-based office environments has fueled the need for contactless entry, visitor logging, and improved security through video intercom systems. In 2024, the US market accounted for USD 5.5 billion, with growing demand for sophisticated home security solutions that integrate IoT, AI, and cloud-based monitoring systems to improve residential security.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for home security systems

- 3.6.1.2 Advancements in wireless communication technology

- 3.6.1.3 Rising adoption in smart homes

- 3.6.1.4 Growing urbanization and residential complexes

- 3.6.1.5 Integration with IoT and automation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial installation and maintenance costs

- 3.6.2.2 Privacy and data security concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Device Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Door entry systems

- 5.3 Handheld devices

- 5.4 Video baby monitors

Chapter 6 Market Estimates & Forecast, By Access control, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fingerprint readers

- 6.3 Password access

- 6.4 Proximity cards

- 6.5 Wireless access

Chapter 7 Market Estimates & Forecast, By System, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Analog

- 8.3 IP-based

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Commercial

- 9.4 Government

- 9.5 Residential

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB Ltd

- 11.2 Aiphone

- 11.3 Axis Communications AB

- 11.4 ButterflyMX Inc.

- 11.5 Comelit Group

- 11.6 Commend International GmbH

- 11.7 Dahua Technologies Co. Ltd

- 11.8 Doorbird

- 11.9 Fermax

- 11.10 Godrej & Boyce Mfg. Co. Ltd.

- 11.11 Hangzhou Hikvision Digital Technology Co. Ltd

- 11.12 Honeywell

- 11.13 KOCOM Co., Ltd.

- 11.14 Legrand

- 11.15 Mivanta

- 11.16 MOX Group Limited

- 11.17 Panasonic Holdings Corporation

- 11.18 Ring

- 11.19 Siedle & Sohne OHG

- 11.20 Xiamen Leelen Technology Co., Ltd

- 11.21 Zicom

- 11.22 ZKTeco