PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699397

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699397

Passive and Interconnecting Electronic Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

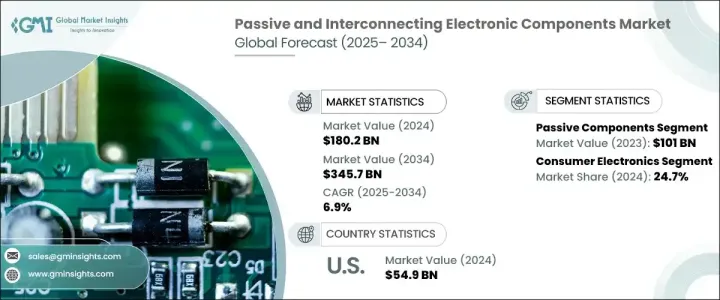

The Global Passive And Interconnecting Electronic Components Market reached USD 180.2 billion in 2024 and is projected to grow at a CAGR of 6.9% between 2025 and 2034. This growth is fueled by the increasing adoption of the Internet of Things (IoT), rapid advancements in automotive electronics, and rising demand for high-performance electronic components across multiple industries. As the world becomes more connected, industries are placing greater emphasis on energy efficiency, automation, and seamless connectivity, driving the need for reliable electronic components.

IoT integration has been a key factor in shaping the market landscape. With smart devices becoming an essential part of everyday life, the demand for high-quality passive and interconnecting components continues to surge. Smart home systems, wearable devices, industrial automation, and smart cities all rely on these electronic components for efficient performance and connectivity. The rise in data-driven technologies, edge computing, and cloud-based applications has further accelerated demand. Additionally, the increasing penetration of 5G networks, artificial intelligence (AI), and advanced telecommunication infrastructure has amplified the need for resilient and high-efficiency electronic components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.2 Billion |

| Forecast Value | $345.7 Billion |

| CAGR | 6.9% |

The automotive sector is also a major contributor to market expansion. Modern vehicles are increasingly dependent on electronic systems, from advanced driver-assistance systems (ADAS) and infotainment to electric vehicle (EV) powertrains and battery management systems. The shift toward electric and autonomous vehicles has created a higher demand for passive and interconnecting components, ensuring performance, safety, and longevity in next-generation automotive technologies. Automakers are integrating more electronic control units (ECUs), sensors, and high-speed connectors to enhance vehicle efficiency, automation, and user experience.

The passive components segment generated USD 101 billion in 2023, comprising essential components such as resistors, capacitors, inductors, and transformers. These components do not require external power to operate but instead store, absorb, or dissipate energy within circuits. Their indispensable role in consumer electronics, industrial applications, telecommunications, and medical devices is fueling steady demand. With manufacturers prioritizing miniaturization and higher energy efficiency, passive components have become critical to ensuring durability, performance, and reliability in modern electronic devices.

The consumer electronics segment in the passive and interconnecting electronic components market accounted for a 24.7% share in 2024. The growing proliferation of smartphones, laptops, home appliances, and wearable devices continues to drive demand for high-quality capacitors, resistors, and connectors. As electronic devices evolve with faster processing speeds, enhanced battery life, and compact designs, manufacturers increasingly depend on passive and interconnecting components to maintain seamless functionality.

The U.S. passive and interconnecting electronic components market reached USD 54.9 billion in 2024, driven by strong technological advancements, increasing automation, and continued investment in digital infrastructure. The country remains at the forefront of innovation in sectors like automotive, telecommunications, and consumer electronics, creating a sustained demand for electronic components. With industries increasingly adopting AI, robotics, and smart manufacturing, the need for reliable, high-performance passive and interconnecting components is expected to rise further in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise of the Internet of Things (IoT)

- 3.6.1.2 Increasing demand for advanced automotive electronics

- 3.6.1.3 Rapid expansion of the consumer electronics industry

- 3.6.1.4 Proliferation of renewable energy solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High raw material costs

- 3.6.2.2 Environmental and sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion & Unit)

- 5.1 Key trends

- 5.2 Passive

- 5.2.1 Resistors

- 5.2.2 Capacitors

- 5.2.3 Inductors

- 5.2.4 Transformers

- 5.2.5 Others

- 5.3 Interconnecting

- 5.3.1 PCB

- 5.3.2 Connectors

- 5.3.3 Switches & relays

- 5.3.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Unit)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.2.1 Smartphones & tablets

- 6.2.2 Laptops & desktops

- 6.2.3 Televisions & home appliances

- 6.2.4 Others

- 6.3 Automotive

- 6.3.1 In-vehicle infotainment

- 6.3.2 Safety & security systems

- 6.3.3 Driver assistance systems

- 6.3.4 Engine control systems

- 6.3.5 Others

- 6.4 Healthcare

- 6.4.1 Imaging systems

- 6.4.2 Patient monitoring systems

- 6.4.3 Therapeutic equipment

- 6.4.4 Others

- 6.5 IT & telecom

- 6.5.1 Telecom equipment

- 6.5.2 Networking devices

- 6.6 Industrial

- 6.6.1 Automation & robotics

- 6.6.2 Power generation

- 6.6.3 Industrial control systems

- 6.6.4 Others

- 6.7 Aerospace & defense

- 6.7.1 Military communications

- 6.7.2 Weaponry systems

- 6.7.3 Aircraft safety systems

- 6.7.4 Others

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Unit)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Fenghua (HK) Electronics Ltd.

- 8.3 Fujitsu Component Limited

- 8.4 Hirose Electric Co. Ltd

- 8.5 Hosiden Corporation

- 8.6 KYOCERA AVX Components Corporation

- 8.7 Molex Incorporated

- 8.8 Murata Manufacturing Co., Ltd.

- 8.9 Nichicon Corporation

- 8.10 Panasonic Corporation

- 8.11 Rohm Co., Ltd.

- 8.12 Samsung Electro-Mechanics Co., Ltd.

- 8.13 Taiyo Yuden Co., Ltd.

- 8.14 TDK Corporation

- 8.15 TE Connectivity Ltd.

- 8.16 TT Electronics PLC

- 8.17 United Chemi-Con

- 8.18 Vishay Intertechnology, Inc.

- 8.19 Walsin Technology Corporation

- 8.20 Yageo Corporation