PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892908

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892908

Rare Sugar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

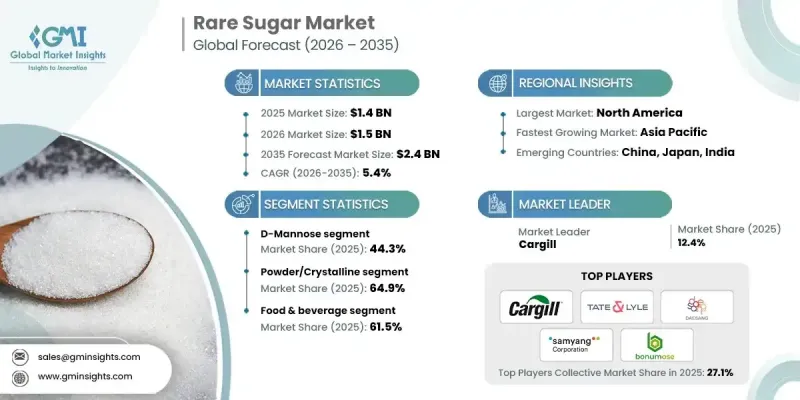

The Global Rare Sugar Market was valued at USD 1.4 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 2.4 billion by 2035.

The market growth is fueled by the rising popularity of low-calorie, low-glycemic, and clean-label sugar alternatives, including allulose, tagatose, D-mannose, and allose. Increasing awareness of the metabolic health benefits of rare sugars, coupled with strengthened regulatory frameworks and robust supply chain infrastructures, is driving adoption in food and beverage products. The APAC region is witnessing the fastest growth, with China, Japan, and India leading due to rising disposable incomes, urbanization, and the growing demand for healthy foods. Emerging markets in Latin America and the Middle East & Africa, particularly Brazil and Saudi Arabia, are also showing promising growth prospects. Overall, rare sugars are becoming mainstream ingredients, with brands reformulating products to meet consumer demand for healthier, clean-label alternatives while maintaining taste and functionality.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 5.4% |

The food & beverage segment held a share of 61.5% share and is projected to grow at a CAGR of 4.8% through 2035. Demand for low-calorie and low-glycemic sweeteners is driving adoption across bakery, confectionery, beverage, and dairy products, replacing conventional sugars without compromising taste, texture, or performance.

The powder/crystalline rare sugars segment held 64.9% share in 2025 and is expected to grow at a CAGR of 4.4% from 2025 to 2034. Powder and crystalline forms offer greater stability and longer shelf-life compared to liquid or syrup alternatives, making them ideal for most food and beverage applications.

North America Rare Sugar Market generated USD 461.7 million in 2025. Growth in the region is supported by strong demand for low-calorie and low-glycemic foods, clean-label products, rising health awareness, increasing diabetes prevalence, and the popularity of functional foods and beverages. Regulatory approvals for rare sugars such as allulose and tagatose are further boosting market expansion in the U.S.

Key players operating in the Global Rare Sugar Market include Cargill, Daesang Corporation, Matsutani Chemical Industry Co., Ltd., Roquette Freres, Anderson Global Group, LLC, Ardilla Technologies, Bonumose, Samyang Corporation, SAVANNA Ingredients GmbH, Shandong Bailong Chuangyuan Bio-tech Co., Ltd., Shandong Fuyang Bio-tech Co., Ltd., and Tate & Lyle PLC. Companies in the Global Rare Sugar Market are strengthening their market position by investing heavily in research and development to innovate new sugar alternatives with better taste, stability, and functional benefits. Strategic partnerships with food and beverage manufacturers help expand distribution and accelerate adoption. Firms are also focusing on scaling production capabilities, securing reliable raw material sources, and obtaining regulatory approvals in multiple regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Rare sugar type

- 2.2.3 Product type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global demand for healthier low-calorie sweeteners replacing conventional sugars

- 3.2.1.2 Increasing prevalence of diabetes and obesity driving functional sugar innovation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and limited large-scale manufacturing capabilities

- 3.2.2.2 Regulatory uncertainties and varying global approvals for emerging rare sugars

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding clean-label and natural ingredient trends across global consumer markets

- 3.2.3.2 Advances in enzymatic and microbial production improving cost-efficient sugar synthesis

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By rare sugar type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Rare Sugar Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 D-Mannose

- 5.3 Allulose

- 5.4 Tagatose

- 5.5 Allose

Chapter 6 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder/Crystalline

- 6.3 Liquid/Syrup

- 6.4 Other Product Types

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.3 Pharmaceuticals

- 7.4 Cosmetics

- 7.5 Nutraceuticals

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Anderson Global Group, LLC

- 9.2 Ardilla Technologies

- 9.3 Bonumose

- 9.4 Cargill

- 9.5 Daesang Corporation

- 9.6 Matsutani Chemical Industry Co., Ltd

- 9.7 Roquette Freres

- 9.8 Samyang Corporation

- 9.9 SAVANNA Ingredients GmbH

- 9.10 Shandong Bailong Chuangyuan Bio-tech Co., Ltd

- 9.11 Shandong Fuyang Bio-tech Co., Ltd

- 9.12 Tate & Lyle PLC