PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721622

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721622

AC Electric Vehicle Charging Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

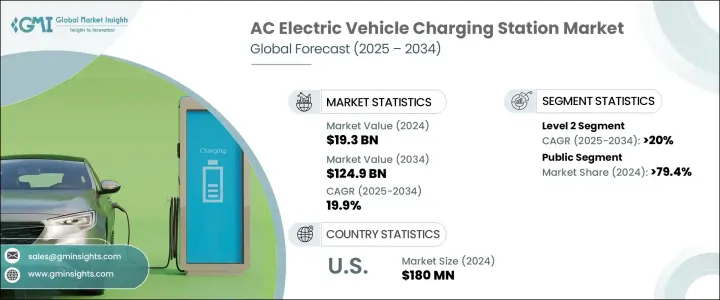

The Global AC Electric Vehicle Charging Station Market was valued at USD 19.3 billion in 2024 and is estimated to grow at a CAGR of 19.9% to reach USD 124.9 billion by 2034. The market is witnessing strong momentum as electric vehicles continue to transition from niche to mainstream. With climate change and sustainability taking center stage, governments and private enterprises alike are prioritizing EV adoption. A critical component of this transition is the availability of robust and reliable charging infrastructure. AC charging stations, known for their compatibility and ease of integration, are becoming central to this shift. The growing push for clean mobility, rising fuel prices, increasing urbanization, and the rapid penetration of electric cars are collectively propelling demand for AC EV charging stations worldwide. Urban areas, in particular, are seeing surging installation rates due to higher population density and increasing vehicle ownership. In addition, rising consumer awareness around eco-friendly transportation and advancements in battery technologies are supporting long-term growth. Companies are aggressively investing in AC charging solutions that blend speed, affordability, and smart functionality to meet evolving consumer needs.

The electric vehicle (EV) charging station market is categorized based on the type of charging stations and their locations. Among the key types, Level 1 and Level 2 chargers are most commonly used. Level 2 chargers, offering faster performance than Level 1, are expected to register a strong CAGR of 20% through 2034. This growth is attributed to the rising preference for more efficient and time-saving charging solutions, particularly in residential complexes, commercial buildings, and workplace settings. While Level 1 chargers remain in demand for single-family homes due to their lower installation costs, their slower charging speed restricts widespread use in high-traffic or commercial locations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.3 Billion |

| Forecast Value | $124.9 Billion |

| CAGR | 19.9% |

In terms of installation site, the public charging station segment accounted for a dominant 79.4% market share in 2024. Public AC chargers are primarily deployed in places like urban centers, commercial parking spaces, and along highways, offering convenient, round-the-clock access for EV users. The growth in public charging networks is further accelerated by supportive government regulations, incentive programs, and public-private partnerships designed to build out EV infrastructure nationwide.

U.S. AC Electric Vehicle Charging Station Market generated USD 180 million in 2024 and is showing remarkable traction. Federal and state governments are rolling out funding initiatives and tax credits to speed up the deployment of EV chargers. Investment in infrastructure along interstate corridors and within cities is helping to bridge accessibility gaps and enhance driver confidence. Both public and private sector players are taking proactive steps to ensure the convenient and widespread availability of charging facilities across the country.

Key players driving the Global AC electric vehicle charging station market include Blink Charging Co., ABB, Bosch, Charge Zone India, Delta Electronics, ChargePoint, Inc., Elli, Enphase Energy, Leviton Industries, NIO, Schneider Electric, EVBox, Siemens, SIGNET EV, Vinfast, Volta Industries Inc., StarCharge, and Zunder. These companies are prioritizing innovation, and integrating smart features like remote monitoring, automated fault detection, and energy load balancing. Through strategic alliances with automakers and government agencies, they're expanding footprints and adapting to growing infrastructure demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Current, 2021 - 2034 (Units, USD Billion)

- 5.1 Key trends

- 5.2 Level 1

- 5.3 Level 2

Chapter 6 Market Size and Forecast, By Charging Site, 2021 - 2034 (Units, USD Billion)

- 6.1 Key trends

- 6.2 Public

- 6.3 Private

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Blink Charging Co.

- 8.3 Bosch

- 8.4 ChargePoint, Inc.

- 8.5 Charge Zone India

- 8.6 Delta Electronics

- 8.7 Elli

- 8.8 Enphase Energy

- 8.9 EVBox

- 8.10 Leviton Industries

- 8.11 NIO

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 SIGNET EV

- 8.15 StarCharge

- 8.16 Vinfast

- 8.17 Volta Industries Inc.

- 8.18 Zunder