PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928880

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928880

Aerial firefighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

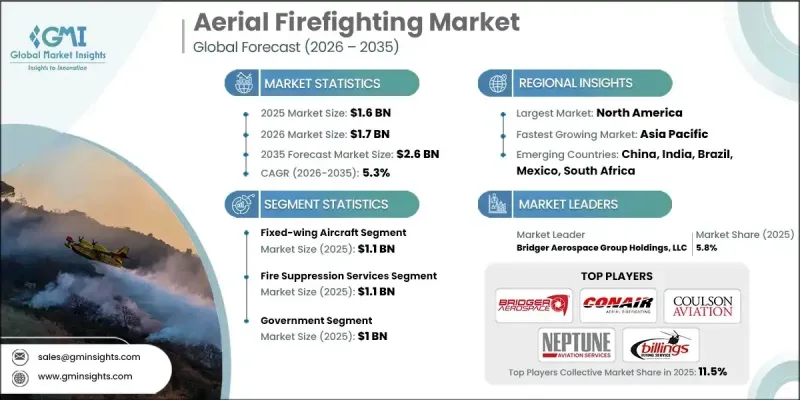

The Global Aerial firefighting Market was valued at USD 1.6 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 2.6 billion by 2035.

Market expansion is driven by the growing severity and frequency of wildfires linked to changing climate conditions, alongside rising public and private investment in emergency response infrastructure. Governments worldwide are prioritizing fleet upgrades and advanced aviation solutions to improve wildfire preparedness and response efficiency. Increased coordination between regions and countries, combined with long-term disaster management strategies, continues to support demand. Aerial firefighting plays a vital role in wildfire containment by enabling rapid deployment of suppression resources and supporting ground operations in hard-to-reach areas. These capabilities help slow fire progression, safeguard communities, and protect vital assets. Continuous innovation in aviation platforms, operational technologies, and mission planning systems further enhances effectiveness. As wildfire risks escalate globally, aerial firefighting remains an essential tool within integrated fire management strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 billion |

| Forecast Value | $2.6 billion |

| CAGR | 5.3% |

The fixed-wing aircraft segment generated USD 1.1 billion in 2025, making this segment the leading contributor to the market. These platforms remain widely deployed due to their ability to cover extensive areas efficiently and deliver high payload volumes during suppression operations. Their operational range and cost efficiency per mission support large-scale wildfire response, particularly in expansive regions. Long-standing use by public agencies and service providers reinforces continued demand for fixed-wing solutions.

The fire suppression services segment recorded USD 1.1 billion in 2025. This segment's strength is tied to its central role in active wildfire response, supported by sustained public funding and multi-year service contracts. Rising wildfire intensity continues to reinforce the need for rapid aerial intervention, supporting long-term growth for suppression-focused operations.

North America Aerial firefighting Market accounted for 44.2% share in 2025. Strong government funding frameworks, advanced aviation infrastructure, and frequent large-scale wildfire events underpin regional leadership. The United States maintains a highly developed aerial firefighting ecosystem that supports rapid deployment, ongoing fleet modernization, and integration of advanced response technologies.

Major companies active in the Global Aerial firefighting Market include Coulson Aviation, Conair Group Inc., Bridger Aerospace Group Holdings, LLC, Neptune Aviation Services, 10 Tanker Air Carrier, Global SuperTanker, Titan-Firefighting, Grayback Forestry, Aero Flite, Inc., Billings Flying Service, Heli-1 Corporation, Dauntless Air, Inc., Air Resources Helicopters Inc., CO Fire Aviation, Airstrike Firefighters LLC, Helicopter Transport Services, SILLER HELICOPTERS INC., Fire Colorado, and Aero Air LLC. Companies operating in the Global Aerial firefighting Market focus on fleet modernization, service diversification, and long-term government partnerships to strengthen their market position. Investment in next-generation aircraft conversions and advanced mission systems improves operational efficiency and response speed. Many players pursue multi-year service contracts to secure stable revenue and long-term deployment opportunities. Geographic expansion supports participation in international firefighting programs and seasonal demand balancing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Vehicle type trends

- 2.2.3 Service type trends

- 2.2.4 End Use Industry trends

- 2.2.5 Regional trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Executive decision points

- 2.3.2 Critical success factors

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising frequency and severity of wildfires

- 3.2.1.2 Investments in fleet modernization and aircraft

- 3.2.1.3 Adoption of multi-role and amphibious aircraft

- 3.2.1.4 Use of advanced avionics and real-time monitoring

- 3.2.1.5 Supportive government policies and initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of advanced packaging technologies

- 3.2.2.2 Recycling and regulatory compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of digital technologies and iot-enabled packaging

- 3.2.3.2 Expansion in pharmaceutical and healthcare packaging applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By Region

- 3.8.2 By Product

- 3.9 Pricing Strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Defense budget analysis

- 3.13 Global defense spending trends

- 3.14 Regional defense budget allocation

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Middle East and Africa

- 3.14.5 Latin America

- 3.15 Key defense modernization programs

- 3.16 Budget Forecast (2025-2034)

- 3.16.1 Impact on industry growth

- 3.16.2 Defense budgets by country

- 3.16.3 Defense budget allocation by segment

- 3.16.3.1 Personnel

- 3.16.3.2 Operations and maintenance

- 3.16.3.3 Procurement

- 3.16.3.4 Research, development, test and evaluation

- 3.16.3.5 Infrastructure and construction

- 3.16.3.6 Technology and innovation

- 3.17 Sustainability initiatives

- 3.18 Supply chain resilience

- 3.19 Geopolitical analysis

- 3.20 Workforce analysis

- 3.21 Digital transformation

- 3.22 Mergers, acquisitions, and strategic partnerships landscape

- 3.23 Risk assessment and management

- 3.24 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 1.1.1 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Vehicle Type, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Fixed-Wing Aircraft (Planes)

- 5.2.1 Very Large Air Tankers (VLAT)

- 5.2.2 Large Air Tankers (LAT)

- 5.2.3 Medium air tankers

- 5.2.4 Single Engine Air Tankers (SEAT)

- 5.2.5 Amphibious scooper aircraft

- 5.2.6 Fixed-wing support & command aircraft

- 5.3 Rotary-wing aircraft (helicopters)

- 5.3.1 Heavy-lift helicopters

- 5.3.2 Medium helicopters

- 5.3.3 Light helicopters

- 5.3.4 Helicopter support & crew operations

- 5.4 Unmanned Aerial Systems (UAS / Drones)

Chapter 6 Market Estimates and Forecast, By Service Type, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Fire suppression services

- 6.3 Aerial reconnaissance & surveillance

- 6.4 Logistics, transport & support

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Government

- 7.2.1 Inter-governmental & cooperative bodies

- 7.2.2 Military & civil defense organizations

- 7.3 Private firefighting contractors

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 10 Tanker Air Carrier

- 9.2 Aero Air LLC

- 9.3 Aero Flite, Inc.

- 9.4 Air Resources Helicopters Inc.

- 9.5 Airstrike Firefighters LLC

- 9.6 Billings Flying Service

- 9.7 Bridger Aerospace Group Holdings, LLC

- 9.8 CO Fire Aviation

- 9.9 Conair Group Inc.

- 9.10 Coulson Aviation

- 9.11 Dauntless Air, Inc.

- 9.12 Fire Colorado

- 9.13 Global SuperTanker

- 9.14 Grayback Forestry

- 9.15 Heli-1 Corporation

- 9.16 Helicopter Transport Services

- 9.17 Neptune Aviation Services

- 9.18 SILLER HELICOPTERS INC.

- 9.19 Titan-Firefighting