PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858967

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858967

Pharmacogenomics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

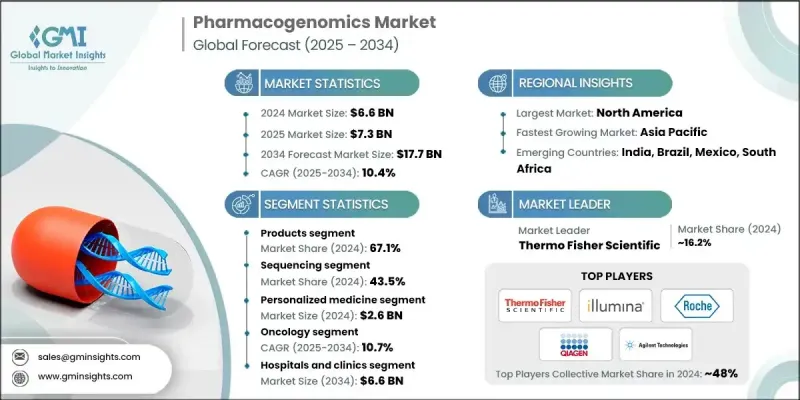

The Global Pharmacogenomics Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 17.7 billion by 2034.

The steady growth is fueled by increasing demand for targeted therapies and the ongoing development of genomic technologies. As healthcare systems worldwide push for more personalized treatment approaches, pharmacogenomic testing is seeing wider adoption across clinical and research settings. The expanding role of genomics in decision-making is further propelled by the burden of chronic diseases such as cancer, cardiovascular diseases, and infectious conditions. Pharmacogenomics focuses on understanding how a person's genetic code influences their drug response, allowing clinicians to fine-tune dosages and treatment options for improved safety and efficacy. The ongoing shift toward digital health solutions, combined with the integration of AI-powered clinical decision tools and real-world data analytics, continues to advance the field. The market's progress is directly tied to the broader move toward personalized medicine and the need to reduce adverse drug reactions while enhancing therapeutic outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 10.4% |

In 2024, the products segment held a 67.1% share, driven by rising demand for tools supporting personalized care. This category includes instruments, consumables, and a wide range of genetic testing kits and reagents, which are essential for clinical and research use. Subsegments such as sequencing kits, PCR-based reagents, microarrays, and other diagnostic tools are widely used across various specialties, including cardiology, oncology, psychiatry, and infectious diseases. The increasing need for precision-driven solutions in therapeutic decision-making continues to boost demand for pharmacogenomic product offerings.

The personalized medicine segment generated USD 2.6 billion in 2024. Its rapid growth is attributed to the expansion of access to advanced genomic tools, improved diagnostics, and the integration of data analytics into routine care. Programs focused on national genomics initiatives are encouraging the inclusion of pharmacogenomic data into everyday clinical practice. Regulatory bodies are supporting this transition by approving relevant biomarkers that enable safer drug use and individualized therapy. Growing use of companion diagnostics and AI-powered technologies has made personalized medicine more scalable and widely accepted.

North America Pharmacogenomics Market held a 48.6% share in 2024. Market expansion in the U.S. and Canada is supported by a strong focus on genomic innovation, high healthcare expenditure, and advanced digital infrastructure. The increased adoption of genomic testing and personalized treatments across hospitals and clinics has been backed by favorable reimbursement policies, contributing to the widespread implementation of pharmacogenomic panels into clinical practice. Ongoing advancements in sequencing tools and AI-enabled diagnostics are enhancing clinical outcomes and driving regional market penetration.

Leading players in the Pharmacogenomics Market are expanding their market presence through strategic R&D investments, partnerships, and product diversification. Companies such as Thermo Fisher Scientific, Agilent Technologies, Illumina, and Qiagen are focused on developing comprehensive kits, reagents, and sequencing platforms that enable faster and more accurate genetic profiling. Collaborations with healthcare providers and research institutions help these firms co-develop custom solutions tailored to clinical needs. Mergers and acquisitions are being pursued to strengthen technological capabilities and widen geographic reach. Additionally, players are emphasizing regulatory approvals and compliance to ensure clinical relevance and market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Offering trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 Disease area trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing research and development investments

- 3.2.1.2 Increasing prevalence of cancer

- 3.2.1.3 Increasing adoption of precision medicine approaches

- 3.2.1.4 Rising burden of adverse drug reactions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cost and reimbursement challenges

- 3.2.2.2 Complexity and interpretation of genetic data

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in microbiome-based and hormone-targeted therapies

- 3.2.3.2 Development of multi-gene panels and companion diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Offerings, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Products

- 5.2.1 Kits and reagents

- 5.2.1.1 Sequencing kits and reagents

- 5.2.1.2 PCR kits and reagents

- 5.2.1.3 Microarray kits and reagents

- 5.2.1.4 Other kits and reagents

- 5.2.2 Instrument and consumables

- 5.2.1 Kits and reagents

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Sequencing

- 6.3 PCR

- 6.4 Microarray

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Personalized medicine

- 7.3 Clinical research

- 7.4 Drug discovery and preclinical development

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Disease Area, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Cardiovascular diseases

- 8.4 Neurological diseases

- 8.5 Infectious diseases

- 8.6 Mental health

- 8.7 Other disease areas

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Academic and research institutions

- 9.4 Pharmaceutical and biotechnology companies

- 9.5 Contract research organization (CROs)

- 9.6 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 23andMe

- 11.2 Admera Health

- 11.3 Agilent Technologies

- 11.4 Becton, Dickinson and Company

- 11.5 Bio-Rad Laboratories

- 11.6 Charles River Laboratories

- 11.7 Danaher

- 11.8 Eurofins Scientific

- 11.9 F. Hoffmann-La Roche

- 11.10 Genelex

- 11.11 Genomind

- 11.12 Illumina

- 11.13 Laboratory Corporation of America Holdings

- 11.14 Novogene

- 11.15 OneOme

- 11.16 Qiagen

- 11.17 Revvity

- 11.18 Takara Bio

- 11.19 Thermo Fisher Scientific