PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773217

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773217

Automated Storage and Retrieval System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

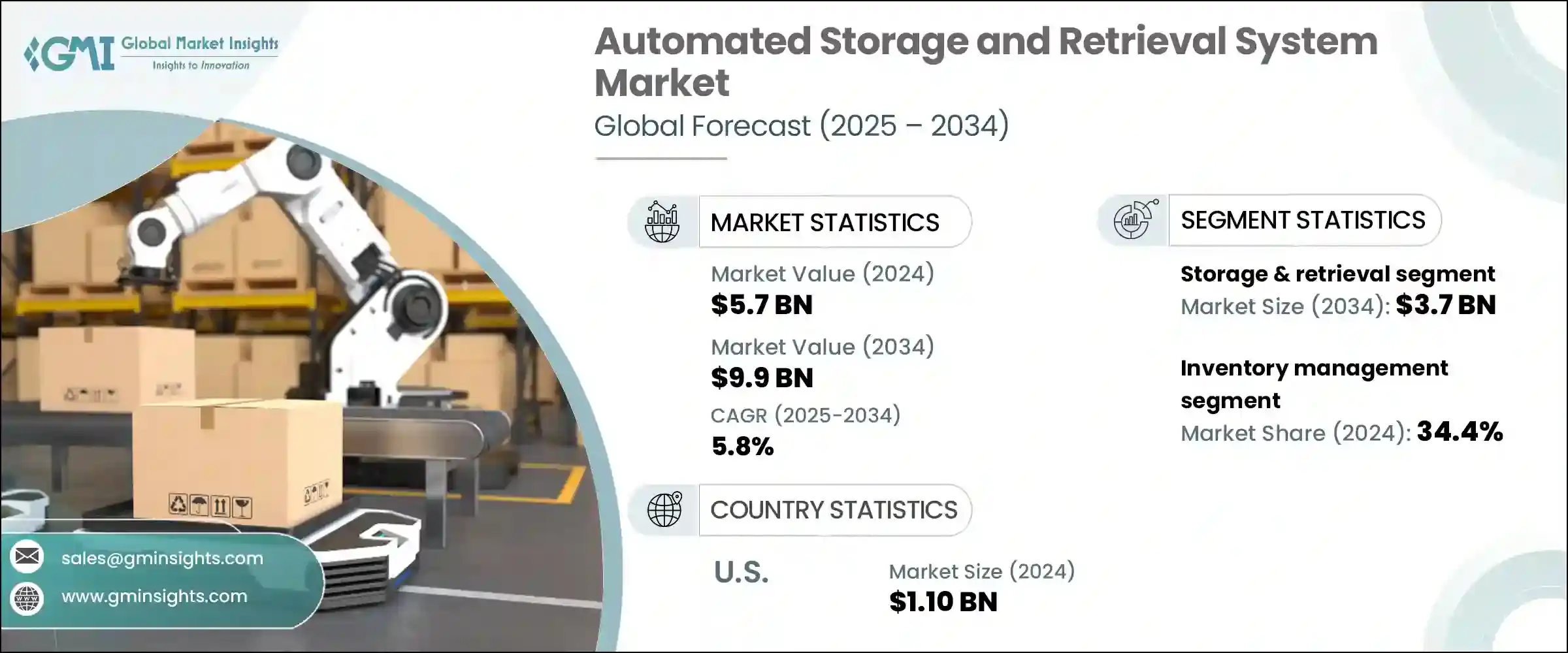

The Global Automated Storage and Retrieval System Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 9.9 billion by 2034. The rapid growth of e-commerce is putting mounting pressure on warehouses to deliver faster, more accurately, and at a lower cost. ASRS systems facilitate a "goods-to-person" model that slashes travel time and boosts picking accuracy. By using vertical storage to maximize cubic space, these systems lower overheads and free up ground-level space for value-added activities like light manufacturing and specialized handling. Labor shortages and rising wages are also pushing distribution centers toward automation. With ASRS capable of replacing up to two-thirds of labor-intensive picking tasks, companies can redirect staff to supervisory and maintenance roles, enhancing efficiency and addressing workforce constraints.

The rising emphasis on warehouse efficiency is accelerating the shift toward high-density automated storage and retrieval systems. Companies across industries are under pressure to make the most of every square foot-particularly in urban and high-rent areas-driving strong demand for vertical and modular ASRS configurations. These systems allow businesses to maximize cubic volume while maintaining quick and accurate access to inventory. Additionally, ASRS technologies are increasingly being designed to adapt to varied floor plans and ceiling heights, making them suitable for retrofitting in older facilities and integration into newly constructed smart warehouses. The ability to scale storage without expanding physical footprints not only cuts real estate costs but also supports leaner operations, giving businesses a strategic edge in space-constrained environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 5.8% |

The storage & retrieval functionality segment generated USD 2.2 billion in 2024 and is expected to reach USD 3.7 billion by 2034. This capability lies at the heart of ASRS systems, enabling high-density inventory management and rapid SKU access, making it indispensable across sectors from retail and pharmaceuticals to electronics and automotive. As warehouse space becomes more constrained, these systems' ability to leverage vertical storage, paired with real-time inventory synchronization, helps reduce shrinkage and human error.

The inventory management segment generated USD 2 billion in 2024 and accounted for a 34.4% share. Real-time stock visibility, automated stock rotation (FIFO/LIFO), and prevention of overstocking or stockouts make inventory management a critical component of ASRS adoption. Integration with ERP/WMS platforms, using technologies like RFID and barcode scanning, helps ensure data accuracy and operational efficiency throughout the supply chain.

United States Automated Storage and Retrieval System Market was valued at USD 1.1 billion in 2024 and is forecasted to grow at a CAGR of 5.8% through 2034. The country leads in warehouse automation, supported by strong manufacturing, retail, and logistics sectors. With industry leaders setting benchmarks for supply chain digitization, there's a strong demand for scalable, efficient storage solutions. ASRS technology plays a key role in reducing labor costs, improving accuracy, and increasing throughput, especially in large distribution centers.

Among the major players in this industry are Symbotic LLC, Daifuku Co., Ltd., TGW Logistics Group, Kardex Group, and Kion Group AG, which collectively hold approximately 15% of the market. Industry leaders are strengthening their market positions through a series of strategic initiatives. They are investing in modular ASRS designs and scalable software platforms that support flexible configuration and integration with robotics, AI, and IoT systems.

Partnerships with warehouse operators, e-commerce firms, and logistics integrators are helping them deliver tailored solutions. Expanding global footprints via local manufacturing and service centers allows quicker deployment and support. Companies are also launching subscription-based or managed service models to lower entry barriers for businesses. By offering real-time analytics, predictive maintenance, and remote system monitoring, they differentiate themselves through performance and reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By System Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Unit load cranes

- 5.3 Mini load cranes

- 5.4 Vertical lift module

- 5.5 Robotic shuttle-based

- 5.6 Robotic cube-based

- 5.7 Carousel-based

- 5.7.1 Vertical carousel

- 5.7.2 Horizontal carousel

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Storage & retrieval

- 6.3 Order picking & consolidation

- 6.4 Buffering & sequencing

- 6.5 Kitting & assembly support

- 6.6 Replenishment

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Cold chain storage

- 7.3 Inventory management

- 7.4 Order fulfillment

- 7.5 Production support

- 7.6 Reverse logistics

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.3 Automotive

- 8.4 Electronics & semiconductors

- 8.5 Healthcare

- 8.6 Metals & heavy machinery

- 8.7 Retail & e-commerce

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Automation Logistics Corporation

- 10.2 Bastian Solutions

- 10.3 Beumer Group

- 10.4 Daifuku Co., Ltd.

- 10.5 Dematic

- 10.6 Egemin Automation

- 10.7 Kardex Group

- 10.8 Kion Group AG

- 10.9 Knapp AG

- 10.10 Mecalux, S.A.

- 10.11 Murata Machinery, Ltd.

- 10.12 Schaefer Systems International, Inc.

- 10.13 Swisslog Holding AG

- 10.14 Symbotic LLC

- 10.15 System Logistics Corporation

- 10.16 TGW Logistics Group

- 10.17 Vanderlande Industries

- 10.18 Westfalia Technologies, Inc.

- 10.19 Witron Logistik + Informatik GmbH